- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gold Speculators Cut Net Bullish Positions For 4th Week

Weekly Large Trader COT Report: Gold

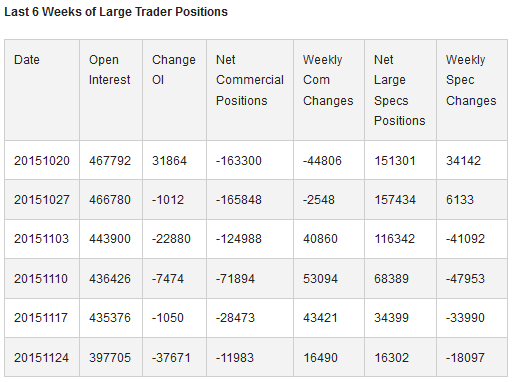

Gold speculative positions dropped last week to +16,302 contracts

GOLD Non-Commercial Positions:

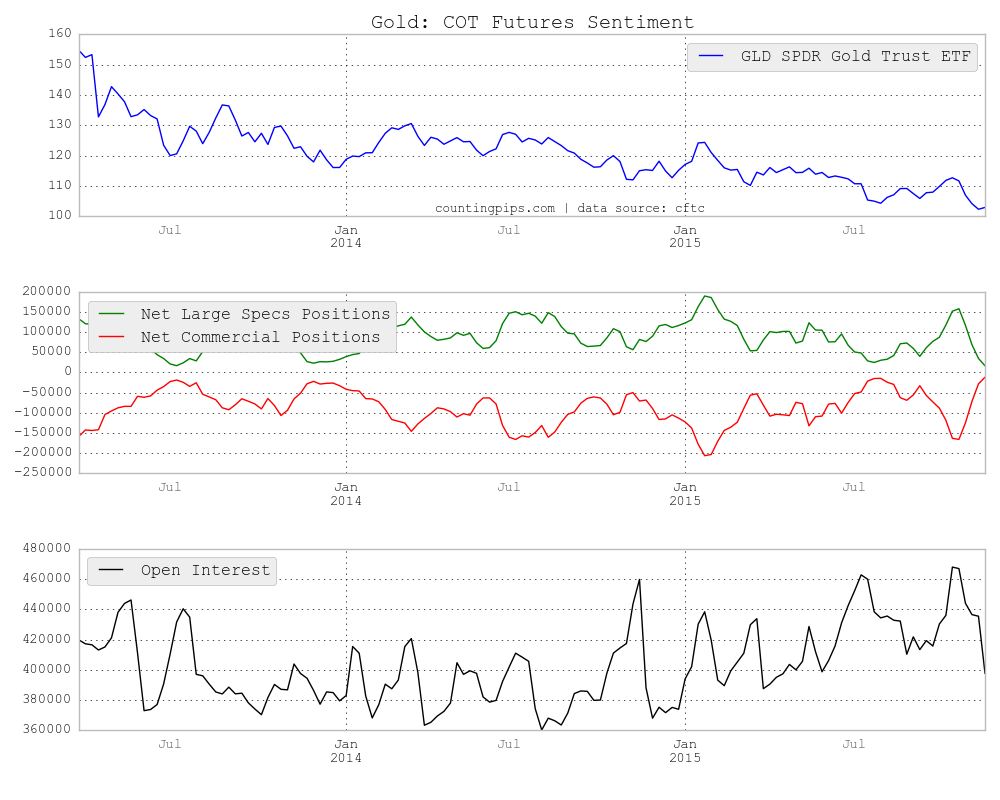

Gold speculator and large futures traders cut their gold bullish positions last week for a fourth consecutive week and to the lowest level of the year, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to the Thanksgiving holiday schedule.

The non-commercial futures contracts of Comex gold futures, traded by large speculators and hedge funds, totaled a net position of +16,302 contracts in the data reported through November 24th. This was a weekly change of -18,097 contracts from the previous week’s total of +34,399 net contracts that was registered on November 17th.

The fall in the weekly net speculator positions (-18,097 net contracts) was due to a decline in the weekly bullish positions by -13,955 contracts that combined with a gain in the weekly bearish positions by 4,142 contracts.

Gold Commercial Positions:

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) reduced their overall bearish positions for a fourth straight week to a net total position of -11,983 contracts through November 24th. This was a weekly change of +16,490 contracts from the total net position of -28,473 contracts on November 17th.

GLD ETF:

Over the weekly reporting time-frame, from Tuesday November 17th to Tuesday November 24th, the price of the (N:GLD) Gold ETF , which tracks the gold spot price, edged a little higher from approximately $102.34 to $102.94, according to ETF price data of the SPDR Gold Trust ETF (GLD).

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts.

Related Articles

Brent crude prices continue to face downside pressure as technical indicators and fundamentals hint at further downside. Markets are digesting a host of factors at present and...

Gold Gold (XAU/USD) continues to hit heavy selling pressure on every rally, as we established a week ago. Yesterday we collapsed to support at 2904/00 but longs were stopped...

Energy prices are under pressure amid demand concerns and improving prospects for a Russia-Ukraine peace deal. But tariff risks continue to hit metal markets Energy-WTI Below...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.