In the last few hours, the GBP/USD is rallying a little higher having recently fallen strongly to a three week low at 1.52. This just continues the slide from last week, almost touching 1.52, a level that proved itself to be one of significance last month. Prior to last week, the pound has enjoyed a strong couple of weeks and moved to new highs above 1.56. It experienced all sorts of bother at 1.56 as it made several pushes to this significant level however it was turned away with excessive supply. For about a week it ran into a wall of resistance right around the 1.56 level, which is very evident in the four-hourl chart below. This showed how much buying pressure there was on the 1.56 level but equally how well that level provided resistance to any movement higher. The pound had enjoyed a very solid couple of weeks moving from the support level at 1.52 to reach new highs at 1.56, a new 10-week high.

It was only a few weeks ago, it found solid support at 1.52 for about a week, which greatly assisted the recent surge higher, and now this level is being called upon again to offer some support and a soft landing. The last week has seen the pound fall strongly and return almost all of its gains from the last few weeks. About a month ago the 1.54 level provided a little piece of resistance and this level has since been broken as it offered limited support. Now that the pound has drifted back down below 1.54, it may provide some resistance again. During its push to 1.56, the pound was able to find some support at 1.55, although this level has also been broken last week. Over the last month or so, the GBP/USD has been experiencing a variety of different levels, which have played a role on the price action.

Toward the end of March the GBP/USD was trading within a range roughly between 1.51 and 1.5250 and now on a couple of occasions it has been able to move outside that range and push higher. A few weeks ago, the 1.5350 level was one of significance as it offered resistance before the GBP/USD was able to move higher through to 1.56. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD had completely turned around its fortunes from earlier in the year, however it is starting to ease off and return most of the good work.

Toward the end of March the GBP/USD was trading within a range roughly between 1.51 and 1.5250 and now on a couple of occasions it has been able to move outside that range and push higher. A few weeks ago, the 1.5350 level was one of significance as it offered resistance before the GBP/USD was able to move higher through to 1.56. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD had completely turned around its fortunes from earlier in the year, however it is starting to ease off and return most of the good work.

The UK has plunged down an economic wellbeing league, falling from fifth place to 12th over six years, according to a new report that underlines the pressure on Britons’ finances amid rising unemployment. The Office for National Statistics ranked OECD countries in terms of disposable household income from 2005 to 2011, but on a separate ONS labour-market ranking Britain dropped even further, falling 12 places over the six years. The ONS looked at various economic factors that might affect wellbeing across the OECD club of mostly rich nations as part of its scheme to measure national wellbeing. It ranked the United States top in terms of disposable household income, followed by Luxembourg. Chile was ranked bottom out of 30 countries.

The UK has plunged down an economic wellbeing league, falling from fifth place to 12th over six years, according to a new report that underlines the pressure on Britons’ finances amid rising unemployment. The Office for National Statistics ranked OECD countries in terms of disposable household income from 2005 to 2011, but on a separate ONS labour-market ranking Britain dropped even further, falling 12 places over the six years. The ONS looked at various economic factors that might affect wellbeing across the OECD club of mostly rich nations as part of its scheme to measure national wellbeing. It ranked the United States top in terms of disposable household income, followed by Luxembourg. Chile was ranked bottom out of 30 countries.

GBP/USD: Four-Hour Chart" title="Daily 4 Hours Chart" width="568" height="571">

GBP/USD: Four-Hour Chart" title="Daily 4 Hours Chart" width="568" height="571">

GBP/USD May 15 at 02:30 GMT 1.52285 H: 1.5326 L: 1.5207 GBP/USD Technicals" title="GBP/USD Technical" width="599" height="81">

GBP/USD Technicals" title="GBP/USD Technical" width="599" height="81">

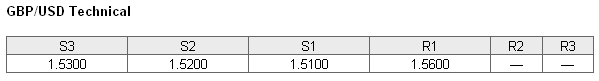

During the early hours of the Asian trading session on Wednesday, the GBP/USD is rallying a little higher moving up away from 1.52, after having recently fallen strongly down to a three week low at 1.52 in the last few hours. Throughout the first part of this year, the Cable fell very strongly from the key resistance level at 1.63 level down to levels not seen in two and a half years and has done well the last month to rally well and move back up above 1.56. Current range: Right around 1.5350.

Further levels in both directions:

- Below: 1.5200 and 1.5100.

- Above: 1.5600.

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back up above 50% after the GBP/USD has fallen down to the three week low near 1.52. Trader sentiment has shifted to in favour of long positions.

Economic Releases

- 01:30 AU New motor vehicle sales (Apr)

- 01:30 AU Wage Price Index (WPI) (Q1)

- 05:00 JP Consumer Confidence (Apr)

- 08:30 UK Average Earnings (incl. bonus) (Mar)

- 08:30 UK Claimant Count Change (Apr)

- 08:30 UK Claimant Count Rate (Apr)

- 08:30 UK ILO Unemployment Rate (Mar)

- 09:00 EU GDP (1st Est.) (Q1)

- 09:30 UK BoE Releases Quarterly Inflation Report

- 12:30 CA Manufacturing sales (Mar)

- 12:30 US Empire State Survey (May)

- 12:30 US PPI (Apr)

- 13:00 US Net Long-term TICS Flows (Mar)

- 13:15 US Capacity utilisation (Apr)

- 13:15 US Industrial production (Apr)

- 14:00 US NAHB Builders survey (May)