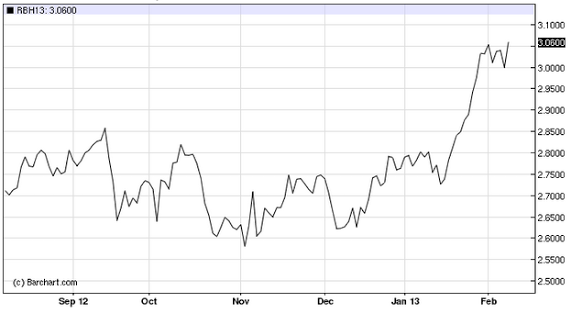

As the winter storm pounded the Northeastern United States today, gasoline futures hit another high. The March delivery contract broke $3.06, indicating that retail prices for fuel will be going up.

Already prices at the pump are the highest for this time of year.

CNBC: - Nationally, retail gasoline prices have soared 11 cents in a week and nearly 30 cents in a month to $3.57 a gallon on Friday, according to AAA. Pump prices are the highest on record for early February, and are rising the fastest along the coasts.

The state-wide average price of gasoline in New York is $3.92 a gallon and California gas prices on average have now surpassed the $4-a-gallon mark.

Increased demand from abroad, stronger crude prices, and some refinery shutdowns are all contributing to higher prices.

MarketWatch: - Consumers haven’t even seen the worst, with a perfect storm of factors driving higher prices.

Many of the issues lifting fuel prices higher are common, but they “seem to have combined at the right time,” said Matt Tormollen, president and chief executive officer at FuelQuest, a Houston-based fuel management software provider.

Typically at this time of year, refineries begin their switch to the more environmentally-friendly summer-blend gasoline and perform maintenance, which “temporarily restricts supply and drives up prices,” he said.

Some refineries have also announced unexpected shutdowns or closings, leading to even tighter refining capacity, said Jeff Lenard, a spokesman at the National Association of Convenience Stores (NACS), a trade group for an industry that sells 80% of the nation’s gasoline.

Late last month, Hess Corp. HES +1.23% said it would close its Port Reading, N.J., refinery by the end of February, completing its exit from the refining business. See Jan. 28 story on the rally in Hess shares.

And of course the Fed's recent activities are not helping the situation either (discussed here). Ultimately this trend of rising fuel prices, combined with the possibility of higher taxes in the future, constitutes the biggest risk to US consumer sentiment and spending.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gasoline Prices On The Rise; May Pose Risk To Consumer Sentiment

Published 02/10/2013, 02:03 AM

Updated 07/09/2023, 06:31 AM

Gasoline Prices On The Rise; May Pose Risk To Consumer Sentiment

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.