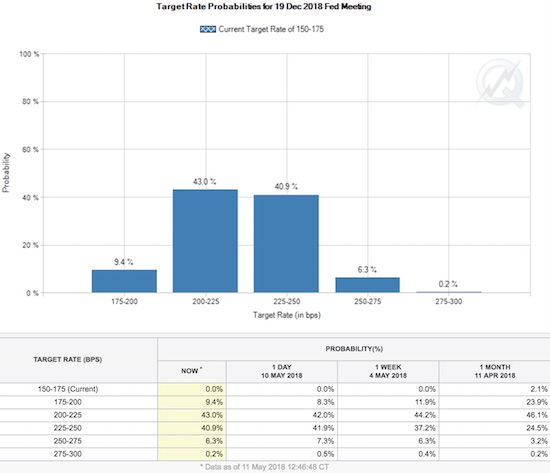

To-date, I have been extremely skeptical of the meme of four rate hikes in 2018. I thought that Thursday’s “weaker than expected” increase in the April consumer price index (CPI) would further confirm my skepticism. Instead, I discovered that the 30-day Fed Fund Futures are pricing in a 47.4% chance of a fourth rate hike in December (assuming the Fed hikes 25 basis points at a time).

Adding from left to right, starting from the 225-250bps target range, the market tells us that it thinks there is a 47.4% chance that December will deliver at least the 4th rate cut.

These odds are essentially 50/50. Because I defer to the market for assessing the outlook for Fed rate hikes, I now have to take a four rate hike scenario a lot more seriously. Perhaps even more importantly, these increasing odds help explain the slow strengthening in the dollar: the market is pricing in a change of expectations.

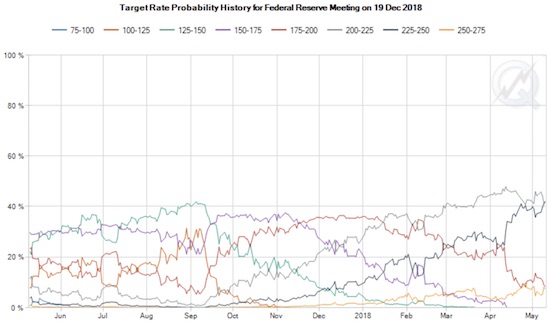

The dark gray line rising in April represents most of the increase in odds for a fourth rate hike in December.

The odds of a fourth rate hike soared through most of the month of April. After a brief dip going into the first few days of May, the odds have risen to their highest levels yet. Compare this action to the recent rise in the U.S. dollar index (DXY).

The U.S. dollar index (DXY) stopped going down in February and broke out in April.

I do not think the close relationship is an accident. With the dollar in sync with the rising odds, I give even more credence to the potential for a 4th rate hike in December. This view also firms up my bullishness on the U.S. dollar. I failed to mention in earlier posts about the dollar than my dollar bullishness also reflects the END of my bullishness on the euro. In fact, I am more and more looking to carry trades going short the euro as rates look set to stay negative for quite a lot more time.

The U.S. dollar index pulled back a bit on the CPI report. While one data point is enough to stall the momentum, the upward push is likely not over unless subsequent data points overwhelmingly confirm an end to inflationary pressures in the U.S. economy (not likely). Regardless, going forward, I will be checking in on the changing odds for rate hikes more often.

Be careful out there!

Full disclosure: net long the U.S. dollar, short EUR/AUD