Weekly Large Trader COT Report: Currencies

US dollar net speculator positions edged up last week to +$7.45 billion

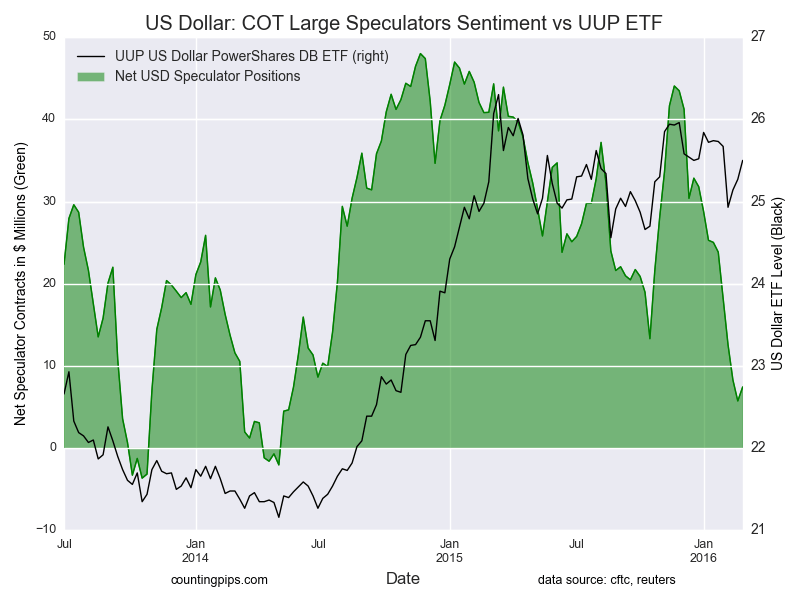

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators increased their overall net bullish positions in the US dollar last week for the first time in ten weeks.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $7.45 billion as of Tuesday March 1st, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of +$1.70 billion from the $5.75 billion total long position that was registered on February 23rd, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

Last week’s data was the first rise in the aggregate US dollar speculative level since December 22nd when net positions stood at $32.84 billion.

Weekly Speculator Contract Changes:

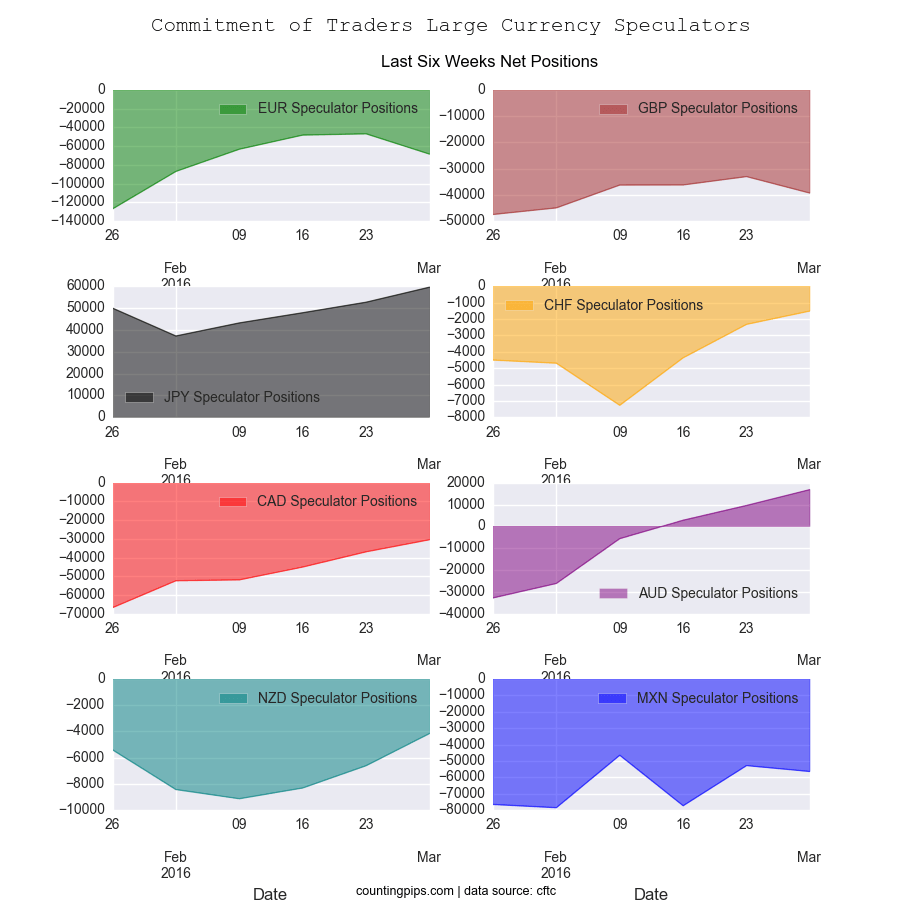

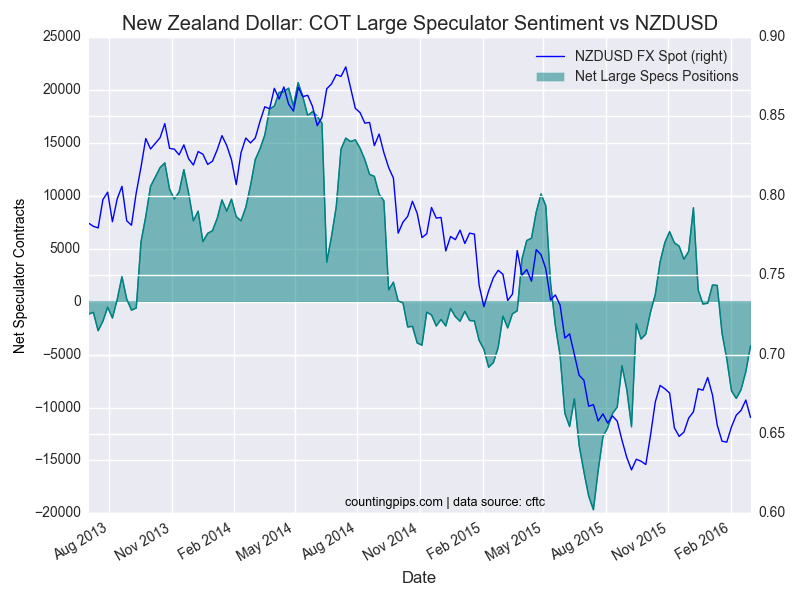

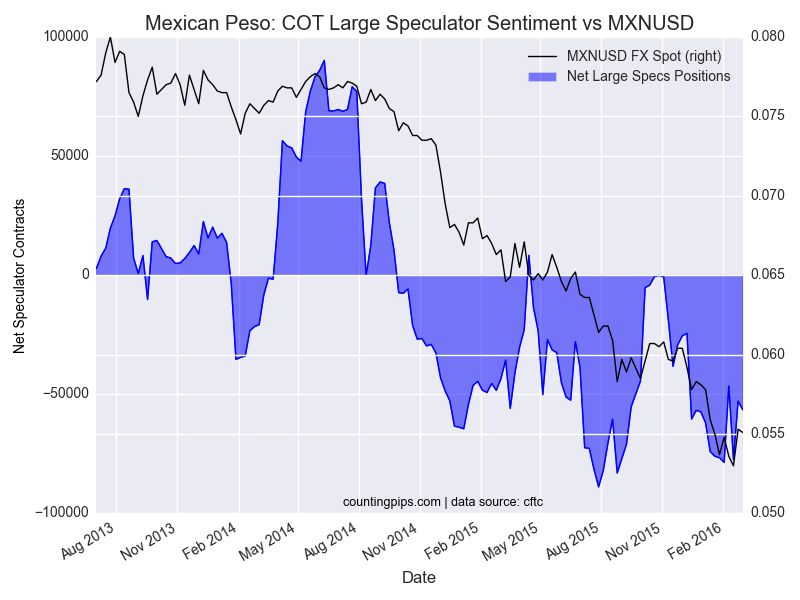

Weekly changes for the major currencies showed that large speculators raised their bets in favor of the Japanese yen, Swiss franc, Canadian dollar, Australian dollar and the New Zealand dollar while decreasing weekly bets for the euro, British pound sterling and the Mexican Peso.

This latest COT data is through Tuesday March 1stand shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below. (Click on Charts to Enlarge)

Weekly Charts: Large Trader Weekly Positions vs Price

Last 6 Weeks of Large Trader Positions

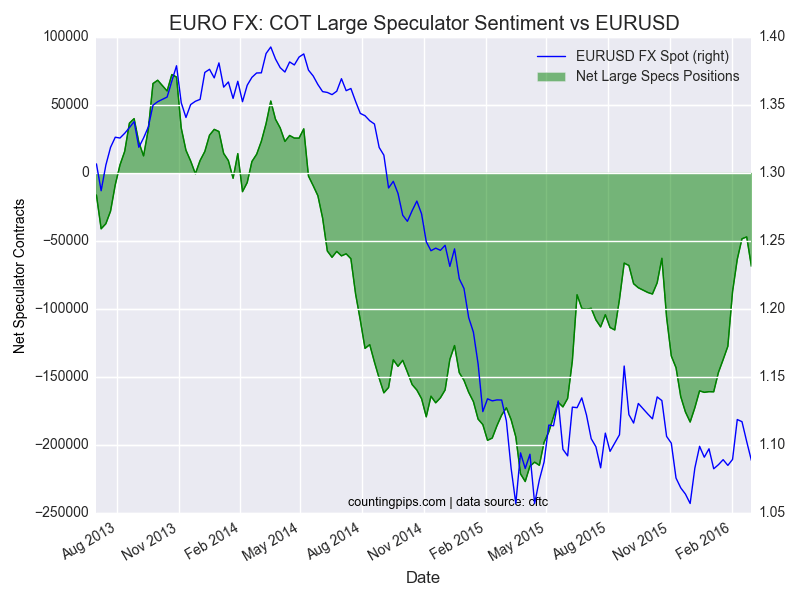

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 402227 | 1865 | 142818 | -4649 | -127215 | 9800 |

| 20160202 | 403939 | 1712 | 111997 | -30821 | -87073 | 40142 |

| 20160209 | 441228 | 37289 | 74024 | -37973 | -63314 | 23759 |

| 20160216 | 429997 | -11231 | 53764 | -20260 | -48205 | 15109 |

| 20160223 | 422624 | -7373 | 53527 | -237 | -46857 | 1348 |

| 20160301 | 417624 | -5000 | 86498 | 32971 | -68541 | -21684 |

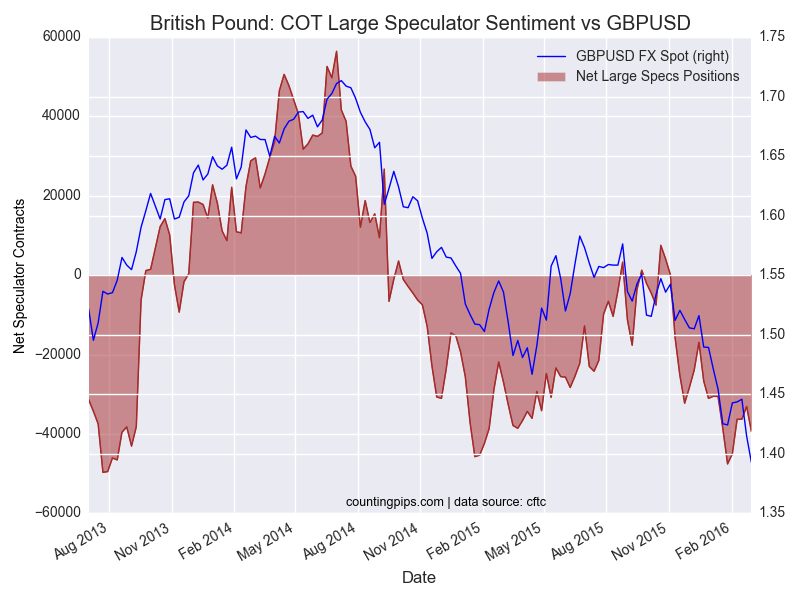

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 272798 | 13209 | 72297 | 7502 | -47537 | -8958 |

| 20160202 | 270680 | -2118 | 71746 | -551 | -45018 | 2519 |

| 20160209 | 255866 | -14814 | 54709 | -17037 | -36300 | 8718 |

| 20160216 | 260649 | 4783 | 57559 | 2850 | -36255 | 45 |

| 20160223 | 257214 | -3435 | 52788 | -4771 | -33068 | 3187 |

| 20160301 | 275825 | 18611 | 62384 | 9596 | -39378 | -6310 |

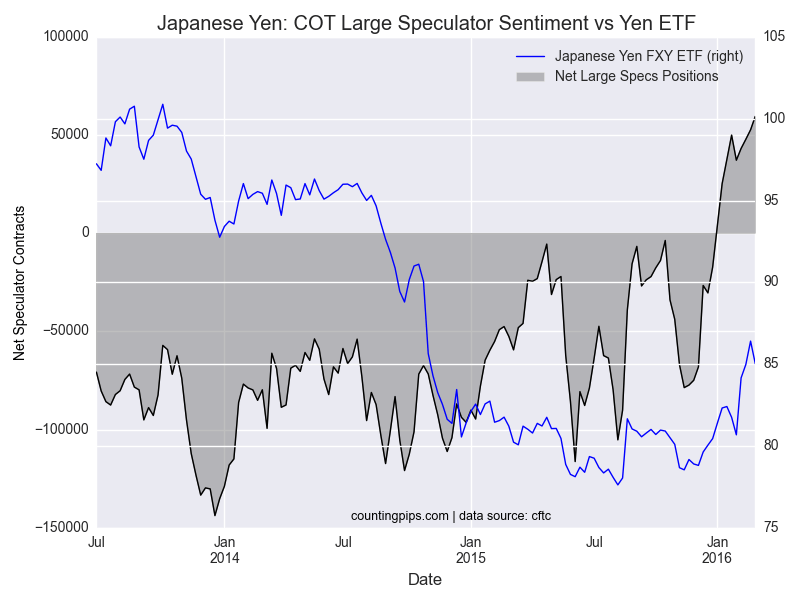

Japanese yen (via NYSE:FXY):

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 250711 | 3097 | -54641 | -14224 | 50026 | 12373 |

| 20160202 | 237289 | -13422 | -27090 | 27551 | 37245 | -12781 |

| 20160209 | 237081 | -208 | -40801 | -13711 | 43232 | 5987 |

| 20160216 | 248985 | 11904 | -51459 | -10658 | 47901 | 4669 |

| 20160223 | 257064 | 8079 | -57242 | -5783 | 52734 | 4833 |

| 20160301 | 261679 | 4615 | -58622 | -1380 | 59625 | 6891 |

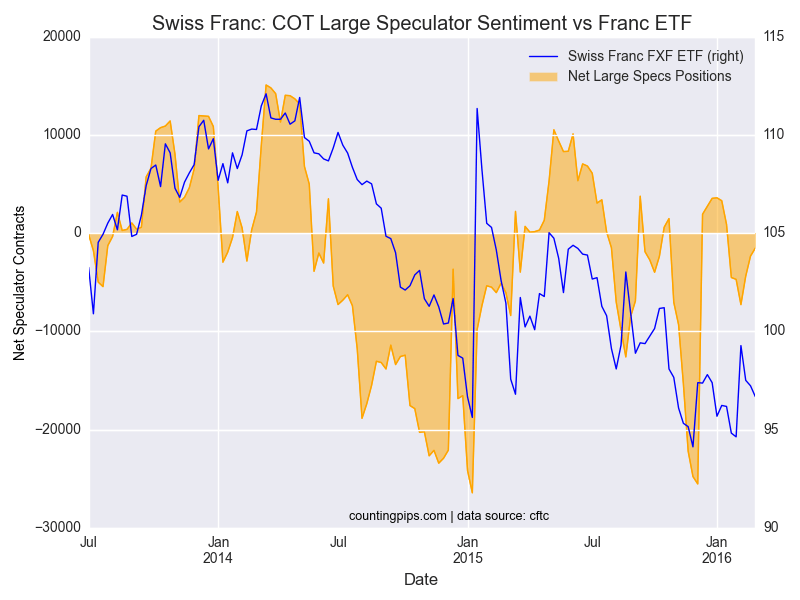

Swiss franc (via NYSE:FXF):

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 55694 | 6404 | 22174 | 7371 | -4503 | -5409 |

| 20160202 | 59370 | 3676 | 22956 | 782 | -4695 | -192 |

| 20160209 | 52701 | -6669 | 17846 | -5110 | -7268 | -2573 |

| 20160216 | 48564 | -4137 | 12058 | -5788 | -4366 | 2902 |

| 20160223 | 47838 | -726 | 13874 | 1816 | -2321 | 2045 |

| 20160301 | 47634 | -204 | 14501 | 627 | -1507 | 814 |

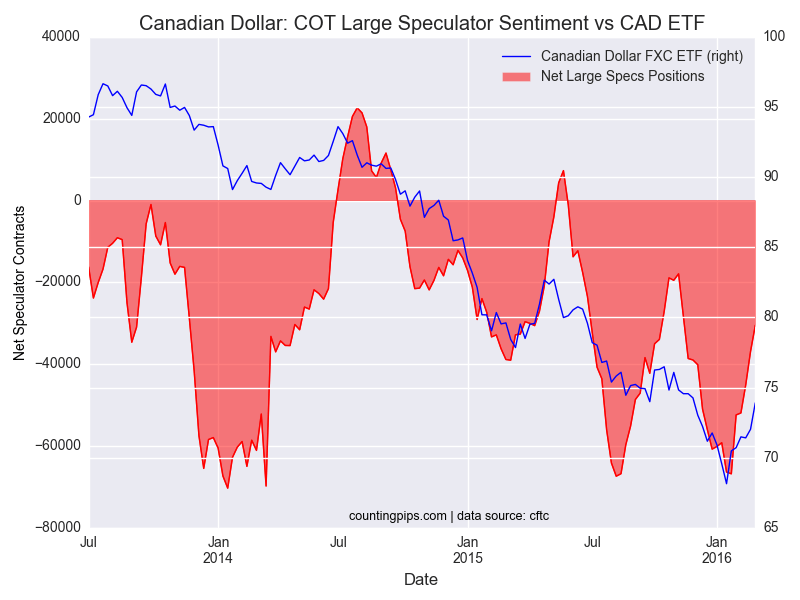

Canadian dollar (via NYSE:FXC):

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 165240 | -104 | 81197 | -1284 | -66819 | -433 |

| 20160202 | 157362 | -7878 | 70420 | -10777 | -52420 | 14399 |

| 20160209 | 157150 | -212 | 59638 | -10782 | -51935 | 485 |

| 20160216 | 158608 | 1458 | 52387 | -7251 | -45085 | 6850 |

| 20160223 | 157921 | -687 | 43501 | -8886 | -36940 | 8145 |

| 20160301 | 159107 | 1186 | 37575 | -5926 | -30478 | 6462 |

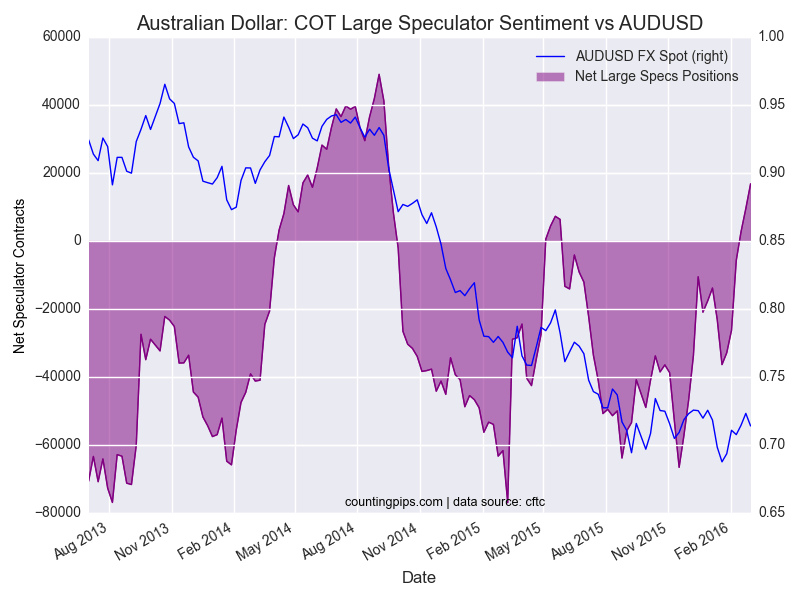

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 125451 | -7363 | 50874 | -9028 | -32798 | 3469 |

| 20160202 | 122056 | -3395 | 41630 | -9244 | -26168 | 6630 |

| 20160209 | 113354 | -8702 | 14479 | -27151 | -5626 | 20542 |

| 20160216 | 111447 | -1907 | 5308 | -9171 | 2807 | 8433 |

| 20160223 | 119526 | 8079 | -4593 | -9901 | 9575 | 6768 |

| 20160301 | 122911 | 3385 | -10617 | -6024 | 16861 | 7286 |

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 30437 | 2323 | 8331 | 2328 | -5400 | -2446 |

| 20160202 | 30979 | 542 | 10539 | 2208 | -8436 | -3036 |

| 20160209 | 33544 | 2565 | 9999 | -540 | -9139 | -703 |

| 20160216 | 33596 | 52 | 9866 | -133 | -8317 | 822 |

| 20160223 | 32618 | -978 | 7595 | -2271 | -6615 | 1702 |

| 20160301 | 31473 | -1145 | 5886 | -1709 | -4157 | 2458 |

Last 6 Weeks of Large Trader Positions

| Date | Open Interest | Change OI | Net Commercial Positions | Weekly Com Changes | Net Large Specs Positions | Weekly Spec Changes |

| 20160126 | 167763 | -4208 | 81087 | 724 | -76607 | -604 |

| 20160202 | 166295 | -1468 | 83364 | 2277 | -78594 | -1987 |

| 20160209 | 155692 | -10603 | 51203 | -32161 | -46522 | 32072 |

| 20160216 | 161403 | 5711 | 82595 | 31392 | -77385 | -30863 |

| 20160223 | 145631 | -15772 | 57318 | -25277 | -52859 | 24526 |

| 20160301 | 141104 | -4527 | 59837 | 2519 | -56473 | -3614 |

*COT Report:The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The charts overlay the forex closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

All information contained in this article cannot be guaranteed to be accurate and is used at your own risk. All information and opinions on this website are for general informational purposes only and do not in any way constitute investment advice.

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts. All information and opinions on this website are for general informational purposes only and do not constitute investment advice.