- Energy giants Exxon Mobil and Chevron report earnings tomorrow.

- Exxon boasts a strong financial position, potentially mitigating risks from rising interest rates.

- Analysts are cautious on Chevron, but a positive surprise could unlock significant upside.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

With the earnings season in full swing, eyes are on the energy sector as two behemoths, Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX), set to unveil their quarterly results tomorrow before the market opens.

Recent months have seen the industry riding high on the back of soaring oil prices, fueled by escalating tensions in the Middle East, incidents targeting merchant ships in the Red Sea basin, and ongoing production cuts orchestrated by the OPEC+ coalition.

This also translates into positive year-to-date returns for both companies: ExxonMobil boasts a 21.7% increase, while Chevron follows with a respectable 9.66%. These gains have the potential to continue climbing.

Oil Prices: Upward Trend Remains Intact

Oil prices, a key benchmark for energy companies like ExxonMobil and Chevron, are currently enjoying a medium-term uptrend fueled by the factors mentioned earlier (rising tensions, and production cuts). Both Brent and WTI crude are benefiting from this trend.

A critical development to watch is the simmering conflict between Israel and Iran. Recent weeks have seen a clear escalation, with Iran launching an airstrike against Israeli targets. While Tel Aviv's response has been limited so far, it doesn't necessarily signal a definitive end to the conflict. This temporary easing of tensions has led to a local correction in oil prices, but it's unlikely to derail the overall upward trend driven by fundamental factors.

Therefore, barring a major escalation in the conflict, oil prices are expected to remain stable around current levels. This stability, coupled with existing high prices, should translate positively into the stock valuations of ExxonMobil and Chevron.

Chevron Earnings Loom: Analyst Skepticism Meets Potential Upside

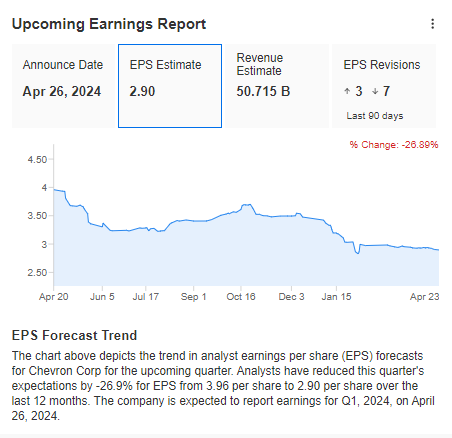

Analysts are bracing for Chevron's earnings report with a dose of caution. Downward revisions outnumber upward ones, painting a moderately pessimistic picture of their expectations.

Source: InvestingPro

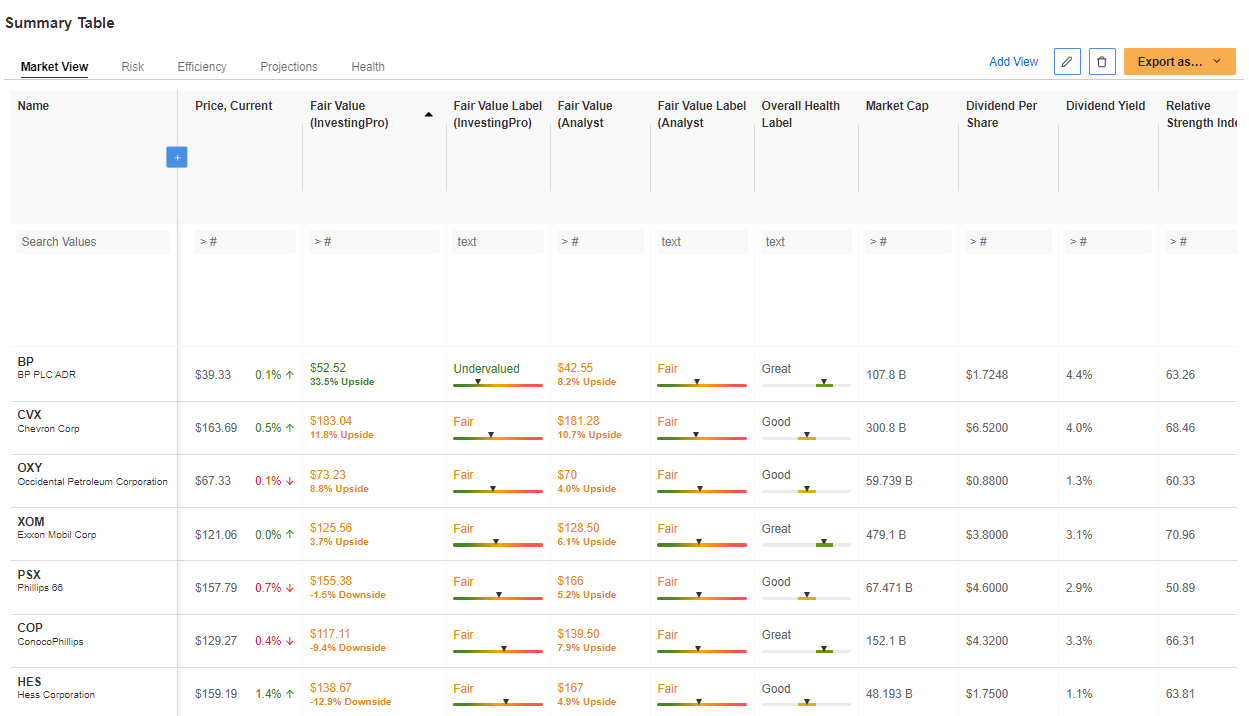

However, a strong performance from Chevron could spark a wave of optimism. The company's fair value index suggests potential for over 11% growth, the second highest among its competitors. (See Figure 3) This makes a positive surprise all the more enticing.

Source: InvestingPro

Technically, a breakout above the key $168 per share demand zone would be a powerful bull signal, potentially leading to a retest of the previous highs near $190.

ExxonMobil: Strong Financials Fuel Stock Price Growth

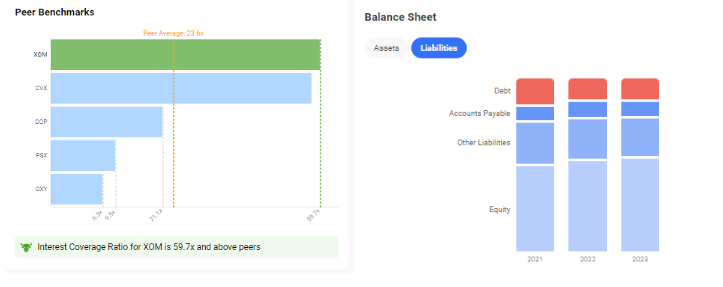

ExxonMobil's stock price has reached historic highs, pushing the company's market capitalization to a staggering half a trillion dollars. This surge can be attributed, in part, to ExxonMobil's rock-solid financial position.

Over the past few years, the company has diligently reduced its debt burden, leading to significantly lower interest costs.

This strong financial health is particularly crucial in the current environment of rising interest rates, as the Federal Reserve is expected to maintain its restrictive monetary policy until at least September.

Source: InvestingPro

This combination of a strong balance sheet and potentially sustained high oil prices creates a positive outlook for ExxonMobil's stock price.

Tomorrow's first-quarter earnings report could dampen the current uptrend if it significantly disappoints investors. However, barring any major surprises, the base scenario remains one of continued growth for ExxonMobil's stock.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.