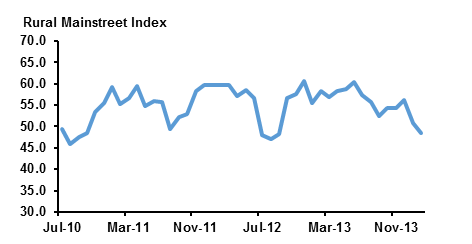

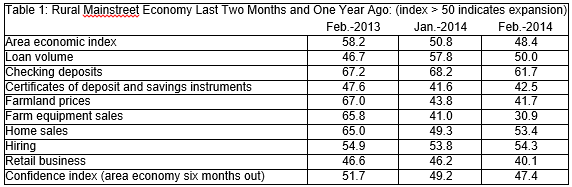

The rural economy shrunk for the first time since September 2012. The extreme cold and falling grain prices seen at the end of January were cited as the reasons for the decrease. Farmland values and farm equipment sales continue to trend lower from last month, which can be attributed to the uncertainty of the commodities market entering 2014.

The Rural Mainstreet Index, ranging between 0 and 100 with 50.0 representing growth neutral, decreased to 48.4 from a 50.8 in January, falling below growth neutral for the first time in over a year. Ernie Goss PhD., economist at Creighton University, suggests the reason for slower rate of growth is due to the decrease in corn, soybean and wheat prices.

Goss stated, “Despite year-over-year declines in agriculture commodity prices bank CEOs consider lower agricultural prices as the biggest threat to the 2014 economy. These softer prices have had, and will continue to have, negative impacts on the Rural Mainstreet economy.” The extremely cold weather experienced across much of the Midwest and increased heating costs were also cited as reasons for the decrease.

Source: Rural Mainstreet Index Creighton University

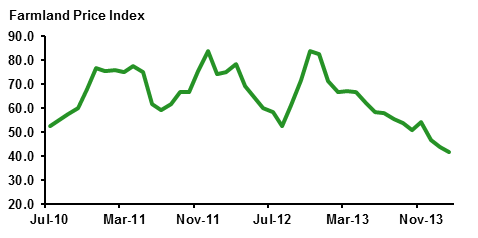

The farmland price index decreased to 41.7 from 43.8. “This is the third straight month that the farmland and ranchland-price index has moved below growth neutral,” said Goss, “With the Federal Reserve continuing to withdraw their economic stimulus, rising interest rates are expected to put downward pressure on agriculture commodity prices and farmland prices.”

Source: Rural Mainstreet Index Creighton University

Farm equipment sales sank to 30.1 from 41.0. Concern over the Federal Reserve tapering the stimulus and its effect on interest rates is a contributing factor to the large decline. Goss explained, ”Agriculture equipment manufacturers continue to experience strong sales abroad. However, equipment dealers and farm equipment manufacturers selling domestically are experiencing pullbacks in sales and production.”

Bankers were asked this month about their expectations for farmland prices over the next year and the biggest economic challenges the rural community faces in 2014. More than 35% of the bankers were confident that farmland prices would increase or stay the same over the coming year. Of the economic challenges given, an overwhelming 90% believed that low commodity prices would be the largest obstacle for their area in 2014, followed by the PPACA Affordable Care Act and overly aggressive EPA both receiving 5%.

Source: Creighton University

Survey

This survey represents an early snapshot of the economy of rural, agricultural and energy-dependent portions of the nation. The RMI is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Extreme Cold, Falling Crop Prices Blamed For Rural Economic Slowdown

Published 02/24/2014, 05:53 AM

Updated 07/09/2023, 06:31 AM

Extreme Cold, Falling Crop Prices Blamed For Rural Economic Slowdown

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.