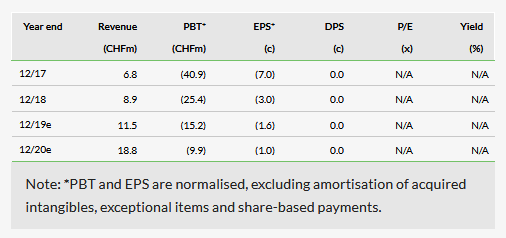

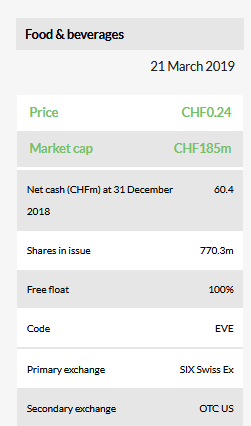

Evolva (SIX:EVE) has received a letter from the US Environmental Protection Agency (EPA), which has identified a study for which it could not complete its review, and it has requested more information. This letter has come shortly ahead of the expected regulatory registration. Evolva is co-operating with the EPA to resolve the issue, but this is very likely to result in a delay. At this stage it is unclear how long the delay will be, but we assume it could be c 12 months. Our fair value moves to CHF0.53 per share from CHF0.56 per share.

Early days, but delay very likely

Evolva is in close interaction with the EPA to resolve the issue identified, and to determine the next steps. While we do not know the detail of which study the EPA has highlighted, or indeed what information it has requested, we believe a best-case scenario would be a delay of c three months to the process, with the EPA being satisfied with any additional information provided. If the study has to be redesigned and performed again, the delay could be significantly longer. For the sake of conservatism, we assume a scenario of a 12-month delay.

Confidence in nootkatone remains

Evolva remains fully committed to the product, and indeed has been collaborating with the US Centers for Disease Control and Prevention (CDC) to bring the product to market. Evolva is confident that nootkatone will be registered as an active ingredient against ticks and mosquitoes in pest control, which will open up a significant market for the product.

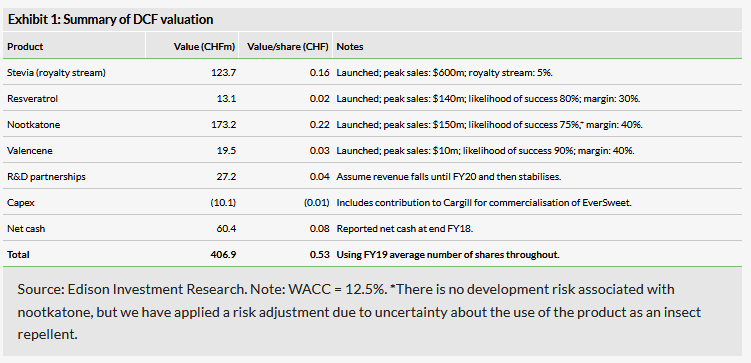

Valuation: Fair value of CHF0.53 per share

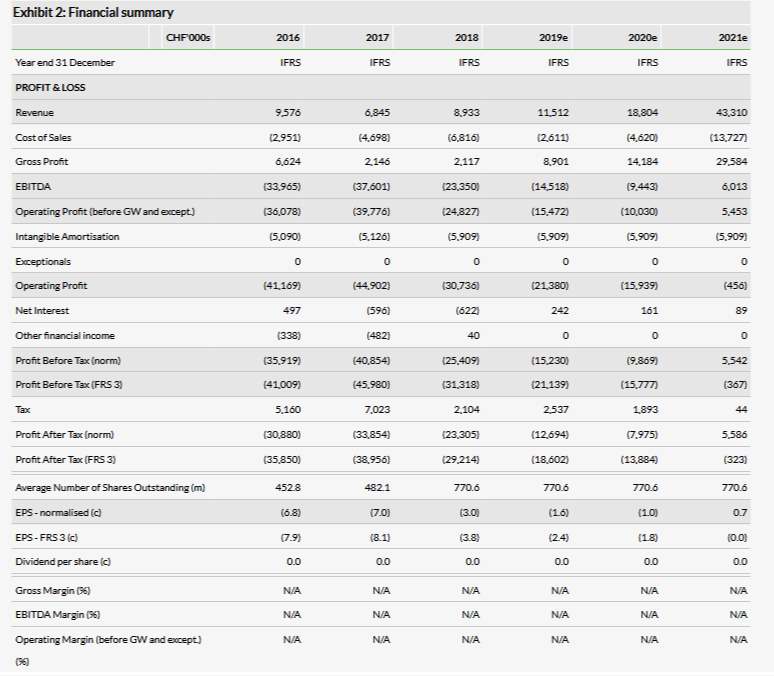

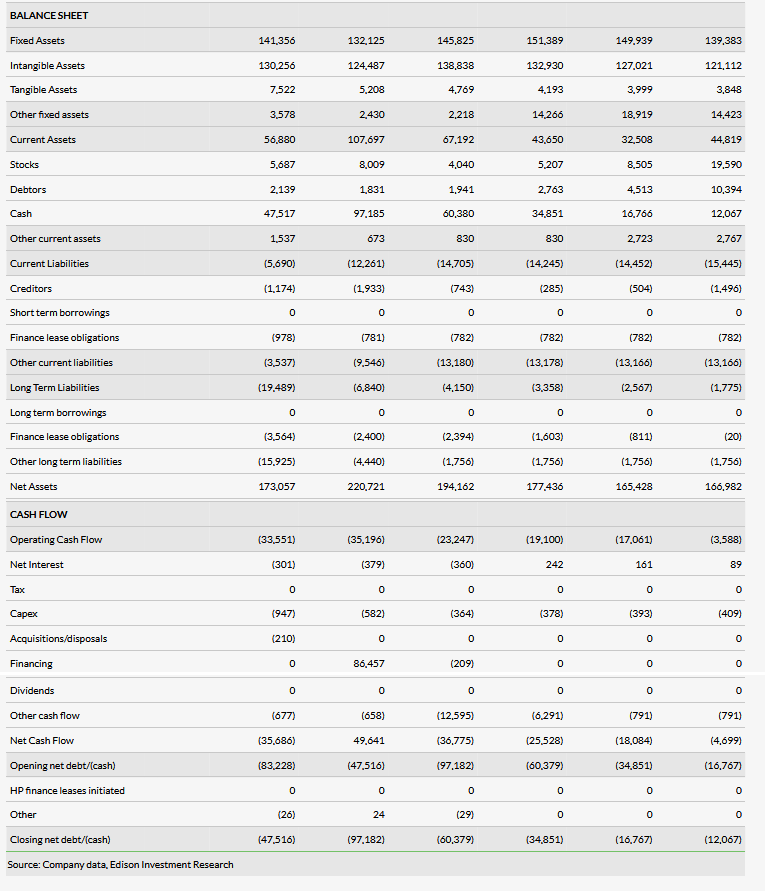

While it is unclear at this stage how long the delay could be, for the purposes of our model we choose to assume a 12-month delay to nootkatone approval in pest control. We continue to value Evolva on a DCF basis with a 25-year model. We now model break-even at the net profit (reported) level in FY22 (previously FY21) as a result of the delay. We note this is still in line with management guidance (break-even in FY21/23). We now assume that nootkatone use in pest control is likely to start to make a contribution from FY21 (previously FY20). Overall, our fair value decreases to CHF0.53/share (from CHF0.56/share previously).

Business description

Evolva is a Swiss high-tech fermentation company. It has a proprietary yeast technology platform, which it uses to create and manufacture high-value speciality molecules for nutritional and consumer products.

Valuation update

We detail our valuation in Exhibit 1. Our fair value decreases to CHF0.53/share (from CHF0.56/share previously). As discussed above, we have delayed our peak nootkatone sales by a year (to FY25) to allow for the delay in EPA approval and then further registration, with sales for pest control applications not starting until FY21. This causes our profit break-even to move to FY22 (from FY21). Our cash break-even assumption remains in FY22. These are both in line with management guidance, which is that profit and cash break-even will occur between FY21 and FY23.

We discuss our DCF valuation fully in our update note published on 12 March 2019.

As a reminder, nootkatone can be used in flavour and fragrance applications, and indeed has already been launched for this use. The bulk of the addressable market, however, is in pest control, and EPA approval is required for subsequent registration for use in pest control.