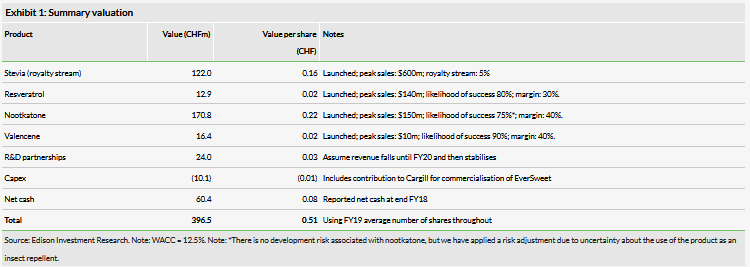

Evolva Holding SA (SIX:EVE) H119 results continue to validate its strategy to reduce operating costs and increase its focus on customers. Innovation continues to lead to the expansion of both existing markets and ingredient systems, with a new product launch now expected in FY20. This is not built into our forecasts as the product remains unknown. The contribution from EverSweet is expected to increase towards the end of FY19 when a new facility will come on stream, and all questions raised by the US Environmental Protection Agency (EPA) regarding nootkatone approval in pest control should be answered by mid-September. Our product forecasts remain broadly unchanged, but our fair value reduces slightly to CHF0.51/share (from CHF0.53/share) mainly due to FX movements, still providing substantial upside to the current share price.

Strategy

The company’s strategy continues to be focused on growing existing markets and improving customer relationships, having moved away from the phase of significant investment into R&D of new products. Following management’s decision to remain asset light, the company is making progress in building a network of contract manufacturers for its products, which it can leverage for its existing products and will ensure agility when bringing future products to market.

H119 results

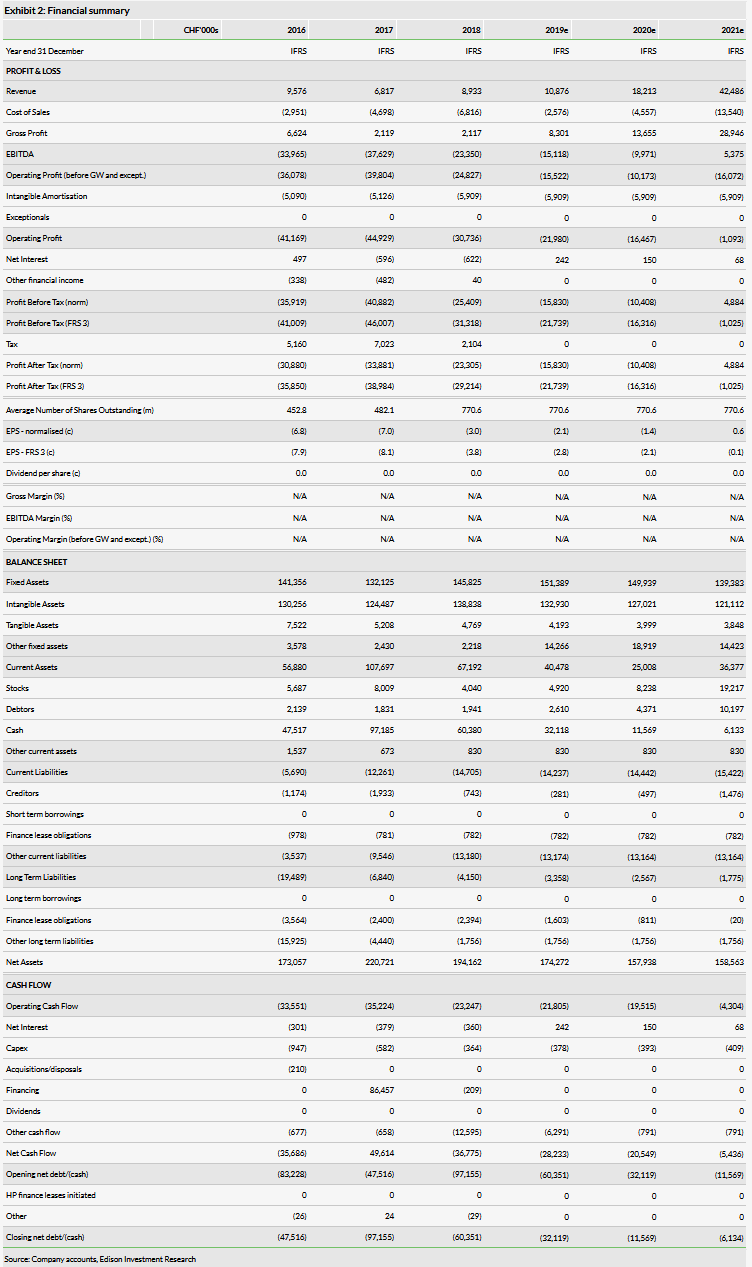

Total revenue was up 67% in the period, to CHF6.4m. Product-related revenue was up 65% to CHF3.0m and R&D revenue was up 69% to CHF3.4m. Operating expenses were down significantly, reflecting the work done over the past 12–24 months to streamline the business. EBITDA improved to a loss of CHF6.7m. Net cash at end H119 was CHF45.3m and cash burn in H2 is expected to slow as commitments on the EverSweet facility will not recur. Guidance for FY19 remains the same and we therefore leave our forecasts unchanged.

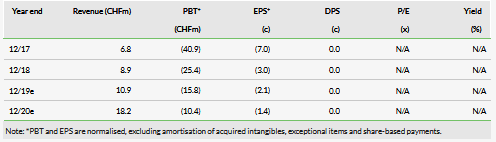

Valuation: Fair value of CHF0.51 per share

We have updated our model to reflect current FX. We continue to value Evolva on a DCF basis with a 25-year model assuming cash break-even in FY22, in line with management guidance (which is for cash break-even in FY21/23). We still assume that nootkatone use in pest control starts to contribute from FY20. We also continue to make no allowance for the new product scheduled to be launched in FY20, as we have no details. Overall, our fair value decreases slightly to CHF0.51/share (from CHF0.53/share previously) due to the movement in FX.

Business description

Evolva is a Swiss high-tech fermentation company. It has a proprietary yeast technology platform that it uses to create and manufacture high-value speciality molecules for nutritional and consumer products.

Valuation

We detail our valuation in Exhibit 1. Our fair value decreases from CHF0.53/share to CHF0.51/share, mainly due to FX movements. We have trimmed our FY19 sales figures to better reflect the end of the US BARDA (Biomedical Advanced Research and Development Authority) contract, and we have also reduced our tax contribution to zero for FY19–21, in line with management guidance at H1 results that the tax credits have been exhausted. We continue to assume that nootkatone sales for pest control applications start in FY20 given the delay in approval. With the H119 results, Evolva’s management has stated that all questions raised by the EPA will be answered by mid-September. Although management would not be drawn into providing updated guidance on the timeline for approval, we expect sales will start in FY20.

It was announced with the H119 results that a new product will be launched in FY20. Given no further detail has been provided due to commercial reasons, we have not added this product to our sales model, but recognise it provides some upside to our current forecasts. We assume that cash and profit break-even for the company will occur in FY22, in line with management guidance. As a reminder, guidance is that cash break-even will occur between FY21 and FY23.

We use a 25-year DCF valuation with a fade. Each product has varying peak sales, margins, ramp-up assumptions and probabilities of success, as detailed above. In each case, we reduce the R&D and operating expenditure after launch to reflect the lower level of investment required once the product is established on the market. We start to fade stevia in 2031 (year 13) and the other products in 2035 (year 17) and we assume they become commoditised and their operating margins fall to the single digits, which is the level of commoditised food ingredients. Stevia remains a key product at c 25% of our valuation, after adjusting for tax and capex, but note that we see greater value overall in nootkatone.

Our valuation purely reflects the products on which Evolva has chosen to concentrate and we ascribe zero value to all other alliances/collaborations and other projects. We recognise that the latter do retain some residual value, but for the sake of conservatism we err on the side of caution. Management has stated it would consider these existing projects if commercial partners express an interest in them. As discussed above, we also ascribe no value to a new compound discussed in the H119 results and due to be launched in FY20 that remains unknown to the market. As a reminder, three new compounds were discussed in the FY18 results, but again no details were given. For the sake of conservatism, we also do not value vanillin; although this had seemed like a promising compound several years ago, the collaboration with Evolva’s partner IFF had been disappointing and we removed vanillin from our valuation. We note the encouraging comments made by management with the H119 results, so vanillin could also provide some upside to our forecasts.