My wife Denise asked me why stocks were hitting record highs Monday morning. I grinned in a manner that probably appeared smart-alecky. For one thing, stock benchmarks hit record peaks on numerous occasions over the last two months without much in the way of resistance. The only difference on this particular Monday are the easy-to-celebrate numbers for the Dow Industrials Average (16,000) and the S&P 500 (1800).

The Taper Effect

Secondly, investors see virtually no end to Federal Reserve stimulus. Granted, the Fed may or may not taper its bond-buying purchases in 2014, while leaving its zero percent interest rates for many years to come. Yet, in the spirit of the future hall-of-fame hoop star, Allen Iverson, I say, “We’re talking about tapering? I mean, we’re sitting here talking about tapering?” Every time that the central bank of the United States has ended or modified a controversial rate-manipulating program over the last five years, it has kick-started another policy — QE1, QE2, Operation Twist, QE3. Investors recognize that the Fed is not serious about interest rate normalization.

Need proof? Revisit the rationale for emergency level money printing (a.k.a. quantitative easing) going back to 2008. In that year, Ben Bernanke said that we needed to enact emergency level QE to inject liquidity into a crippled banking system. When the financial catastrophe concerns faded, however, the Federal Reserve came up with different excuses for providing emergency level stimulus, including trillion dollar deficits in 2010, Europe’s sovereign debt crisis in 2011 and 2012, as well as fiscal cliff/government shutdown troubles in 2013.

Let’s face the truth head-on. The only reason for not ending the purchase of bonds by the Federal Reserve is because the central bank is afraid of what might occur when the drug (i.e., interest rate suppression) is removed from the addicts (i.e., U.S. investors, consumers and businesses). If it made sense to save a fragile financial system from collapse with emergency liquidity, it does not necessarily make sense to juice stocks and real estate with steroids or growth hormones.

Capital Allocation

Deflating the balloon slowly may be a bigger challenge for the Fed and central banks around the globe than the initial crisis-aversion tactics of 2008; that is, letting the economy find its own way through a recession could have been more beneficial than endeavoring to eradicate every weak economic data point from 2010 forward. Nevertheless, this is the chosen path. The implication? More and more investors will allocate their capital in ways that they normally would not; more and more bearish prognosticators will flip, just as David Rosenberg, Paul Farrell and Nouriel Roubini have done; more and more money will chase more and more risk.

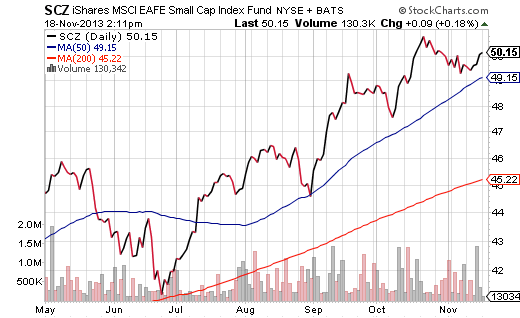

I am neither bearish nor bullish on stocks. With a well-defined risk management plan in place, one is afforded the luxury of holding onto assets for as long as they continue to provide value. I still recommend adding to stock ETFs with favorable trends like Vanguard Dividend Growth (VIG), Vanguard All -World (VEU), PowerShares DJ Pharmaceuticals (PJP) and First Trust NASDAQ Dividend (TDIV). While I continue to hold small-cap superstars like iShares Small Cap Value (IJS), it may be more advisable to tread lightly in areas where the valuations are getting harder to justify. (Note: Small-caps abroad remain attractive from a price-to-earnings ratio standpoint.)

Bonds

The bond market requires “duration consideration.” In particular, I am wary of erratic price movement at the longer end of the yield curve. Held-to-maturity short-term high yield ETFs in the Guggenheim BulletShares series remain a sweet spot. I also see limited downside in owning Pimco Short-Term High Yield (HYS). And while I remain unwilling to test the treasury waters directly, intermediate-to-longer-term munis via SPDR Nuveen Muni (TFI) is rewarding enough in spite of the risks.

Keep in mind, rushing to buy at all-time highs is rarely prudent; clamoring to put cash to work after six consecutive weeks of gains is more likely to fail than to succeed. Let the price activity meet you half-way. For example, an investor who is interested in iShares MSCI Small-Cap EAFE (SCZ) benefits from acquiring shares closer to a 50-day or 200-day moving average.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ETFs To Buy At Dow 16K

Published 11/18/2013, 03:47 PM

Updated 03/09/2019, 08:30 AM

ETFs To Buy At Dow 16K

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.