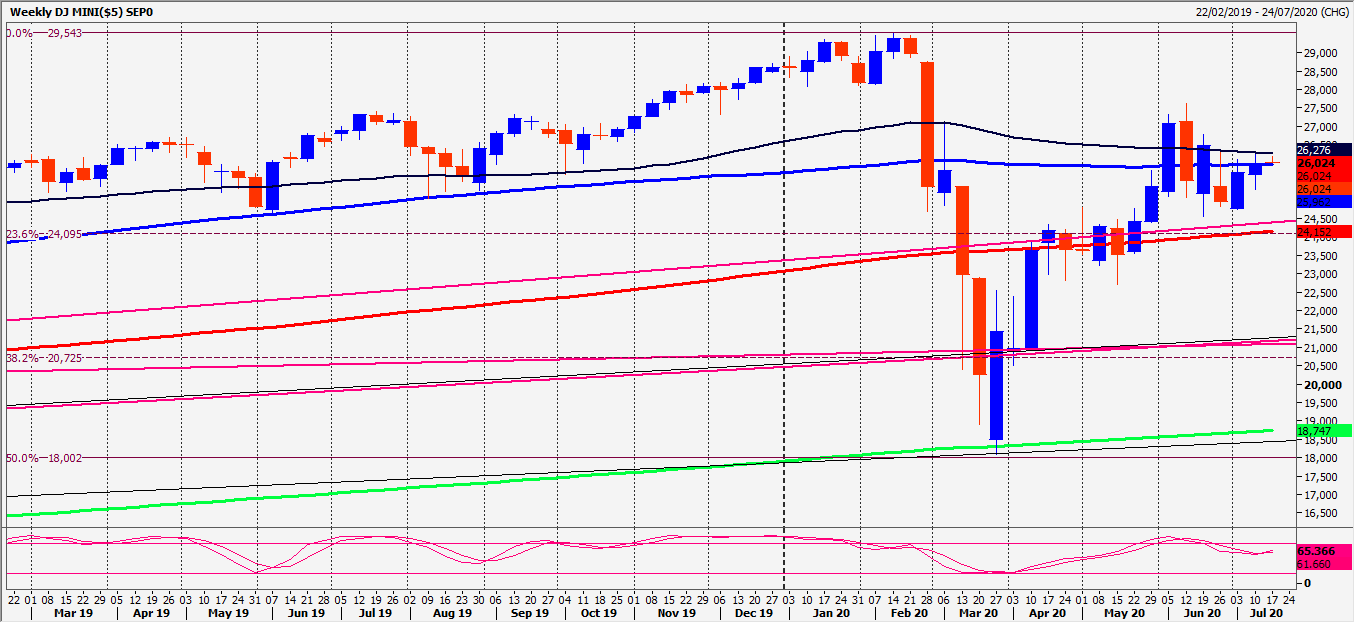

Emini Dow Jones September Futures shot higher through the 200-day moving average at 26180/200 with shorts stopped above last week’s high at 26280. We hit the next target of 26450/480, then unexpectedly crashed almost 600 points from 26524.

Nasdaq September Futures continued higher to test the big 11,000 number, reaching a new all-time high 11058. Finally, severely overbought conditions kicked in, as we crash 500 points, leaving an important negative candle. Bulls who bought since Thursday now trapped in losing positions and this should weigh on any recovery attempts today.

Today’s Analysis

Emini Dow Jones hit the lower target of 25540/500 and held overnight. Having spectacularly rejected the upper end of the 1-month range, we clearly remain in a difficult sideways trend. Holding first resistance at 26200/300 targets the best support for today at 25900/800. Longs need stops below 25700. A break below here targets support at 25400/300. Longs need stops below 25200.

First resistance is at 26200/300 but above here allows a retest of 26500/525.

Nasdaq negative candle signals a neutral/negative outlook to ease severely overbought conditions. It is now risky to hold longs after what could be considered a short term sell signal. Holding first resistance at 10665/695 targets minor support at around 10560 and last week’s mid-week low at 10505 before strong support at 10430/410. Brave bulls, who feel the need to buy the dip can try longs with stops below 10350. A break lower targets 10300/290 then support at 10220/200.

Shorts at first resistance at 10665/695 stop above 10760. A break higher targets resistance at 10870/900.

Trends

- Weekly outlook is positive

- Daily outlook is positive

- Short Term outlook is neutral