Everywhere you look now, someone has an opinion about the direction of the markets under a Trump presidency. There is speculation on everything from the impact of his trade policies to the potential of further deficit spending and legislative changes. These factors have coalesced to send many sectors of the stock and bond markets into a tizzy as investors grapple for positioning.

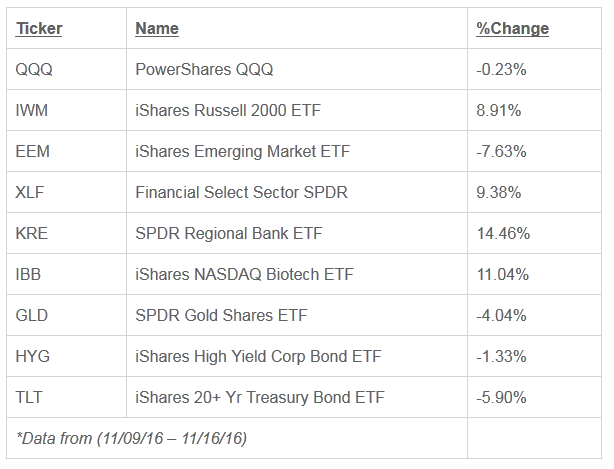

The table below illustrates some of the biggest movers in the ETF universe since the Wednesday following the election. Many of these sectors tend to be favorites among institutional portfolios and large traders that want gross exposure in a hurry. They are diversified, liquid, and mostly cheap to own.

There are some obvious standouts in this list that are worth noting. The growth engines have shifted from large cap tech (PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) to small cap stocks (iShares Russell 2000 (NYSE:IWM)). Banks (SPDR S&P Regional Banking (NYSE:KRE)) and financial stocks (Financial Select Sector SPDR (NYSE:XLF)) are viewed as a strong bet if legislative restrictions are loosened and interest rates continue higher (iShares 20+ Year Treasury Bond (NASDAQ:TLT)). Biotech (iShares Nasdaq Biotechnology (NASDAQ:IBB)) got the sigh of relief that Hillary wasn’t going to clamp down.

The most important thing to realize is that all this repositioning has occurred in a very short period. It doesn’t necessarily mean that these trends will continue indefinitely or even completely reverse course in due time. Anyone who guarantees this is the new “playbook” for the next four years is optimistically staring into a crystal ball or taking too much crystal meth.

Ultimately, what other people say doesn’t matter. It’s how you interpret and react to the news that is of greatest importance to your wealth. Let’s look at some examples of rational and irrational portfolio moves that you may have considered recently:

Examples Of Irrational Portfolio Moves

- I’m going to sell all my bonds because Jeffrey Gundlach says interest rates are going to 6%.

- I’m going to buy nothing but banks, health care stocks, and small caps because those are the week-one leaders.

- I’m going to own gold…because, you know, Trump likes gold. I’ve seen pictures of his house.

- I’m going all in on infrastructure and construction stocks because Trump likes to build.

- I’m going to start dabbling in the forex markets because there have been big trading opportunities there.

- I’m going to sell everything. I’m terrified of an unforeseeable event that could crash the financial markets.

Examples Of Rational Portfolio Moves

- I think that interest rates are due for a modest rise higher, so I’m going to slightly lower the duration of my bond holdings.

- I think that value stocks will outperform growth over the next several years. I’m going to incrementally transition from growth to value indexes.

- I see that international stocks have been punitively discounted, so I’m going to slowly start accumulating more exposure here.

- I’m going to do absolutely nothing. I was happy with my holdings before the election and I’m still happy with them now.

The initial list is mostly based on speculation and one-sided bets. Chasing performance or stepping aside from quick drops can initially create a sense of relief. However, that can also rapidly turn into additional stress if you made drastic asset allocation changes based on knee-jerk reactions that prove to be false.

The second list is mostly based on level-headed and balanced choices. They are designed with an intermediate to long-term mindset that eschews emotions for the sake of evidence. There is nothing wrong with taking a slight tack in your navigation if it’s well-planned and executed.

It’s also worth pointing out that many of the trends that received a boost from the Trump win were already set in motion well before this event. Interest rates were already trending higher. Financial stocks were already outperforming. Small caps have been a high momentum play since the February lows. That picture hasn’t changed; it’s merely been exacerbated by the sharp moves in recent weeks. There have been plenty of opportunities to capitalize on these trends if you have been paying attention all along.

The bottom line is that you should be careful drinking from the firehose of assumptions in the initial weeks of any change to the political or financial picture. The smart move is to continue along a steady and balanced path until you receive additional data or price to confirm your views. That may lead to incremental and logical steps to reduce exposure in some areas or capitalize on new opportunities in others.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.