Delta Air Lines, Inc. (NYSE:DAL) will be slashing overall capacity by 40% in the next few months, the highest in its history, including 2001, as air travel demand sees a rapid fall and revenues take a hit amid the fast-evolving coronavirus outbreak. The airline is witnessing a significant increase in cancellations, with net bookings for travel being negative over the next four weeks. In fact, the carrier is seeing more ticket cancellations than bookings over the next month.

Per the company’s CEO Ed Bastian, “the speed of the demand fall-off is unlike anything we’ve seen – and we’ve seen a lot in our business. We are moving quickly to preserve cash and protect our company. And with revenues dropping, we must be focused on taking costs out of our business.”

With government travel restrictions, Delta will not be flying to continental Europe for the next 30 days. This halt could further be extended if needed. However, the airline will continue service to London. With significant reduction in capacity, the carrier will be grounding up to 300 aircraft. In response to the lower capacity, the company is also delaying new aircraft deliveries, which in turn would help in preserving cash. To further cut costs, Delta plans to reduce capital expenditures by a minimum of $2 billion this year. The carrier has also started offering voluntary short-term unpaid leaves, apart from freezing hiring. The Atlanta-GA based airline has also substantially reduced the use of consultants and contractors.

Bastian expects the downturn to get worse in the future. Keeping in mind this deep crisis, he is foregoing his salary for the next six months.

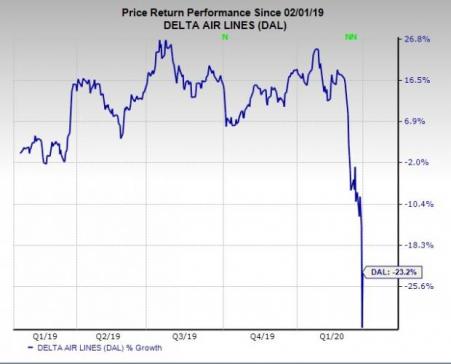

Due to the coronavirus-led demand slowdown, shares of Delta have declined 23.2% since the beginning of February.

Zacks Rank & Key Picks

Delta currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Transportation sector are Azul (NYSE:AZUL) , Ryanair Holdings (NASDAQ:RYAAY) and GATX Corporation (NYSE:GATX) . While Azul and GATX sport a Zacks Rank #1 (Strong Buy), Ryanair carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Each of the stocks has an impressive earnings history. Azul’s earnings surpassed estimates in each of the preceding four quarters, with the average being 209%. Ryanair trumped the Zacks Consensus Estimate in three of the last four quarters and missed the same once, with the average positive surprise being 56.3%. GATX’s earnings also outperformed the Zacks Consensus Estimate in each of the trailing four quarters, with an average of 21%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

GATX Corporation (GATX): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research