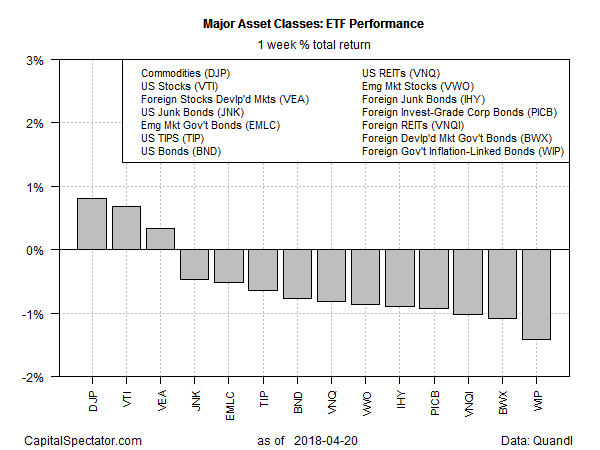

Broadly defined commodities posted the strongest advance last week for the major asset classes, based on a set of exchange-traded products. The gain marks the second week in a row that raw materials prices topped the performance list.

The iPath Bloomberg Commodity (DJP) edged up 0.8% for the five trading days through Friday, April 20. The gain lifted DJP to a weekly close that’s near a two-year high.

Mark Schultz, chief analyst at Northstar Commodity, told CNBC last week:

Prices [for commodities] had been relatively depressed over the last 3½ years.

It’s been a down type of market mainly because we have dealt with at or near-record production just about everywhere around the globe. That is now reversed, and you’re starting to see things build back up.

Last week’s biggest loser among the major asset classes: foreign inflation-indexed government bonds. SPDR Citi International Government Inflation-Protected Bond (WIP) slumped 1.4%, leaving the ETF at its lowest close in a month.

One of the headwinds for WIP, and foreign assets generally after conversion into US dollars: a rally in the greenback. The US Dollar Index edged higher last week, settling at its highest weekly close since early March.

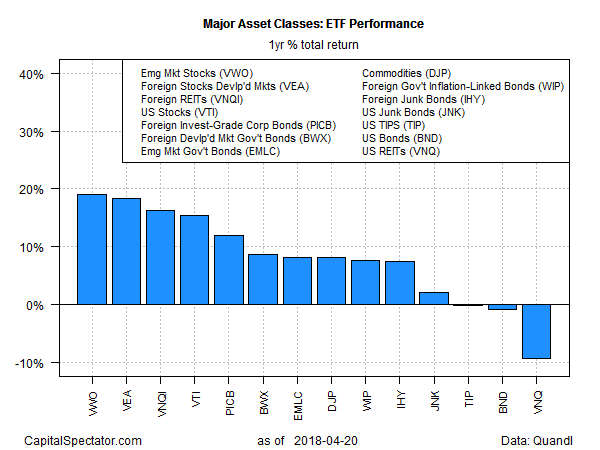

For the one-year trend, stocks in emerging markets continue to lead among the major asset classes. Vanguard FTSE Emerging Markets (VWO) posted a 19.0% total return for the trailing 12-month period at the close of trading on April. 20.

Meantime, US real estate investment trusts (REITs) remain in last place for year-over-year changes. Vanguard Real Estate (VNQ) continued to fall last week and is currently in the red by 9.9% in annual terms.

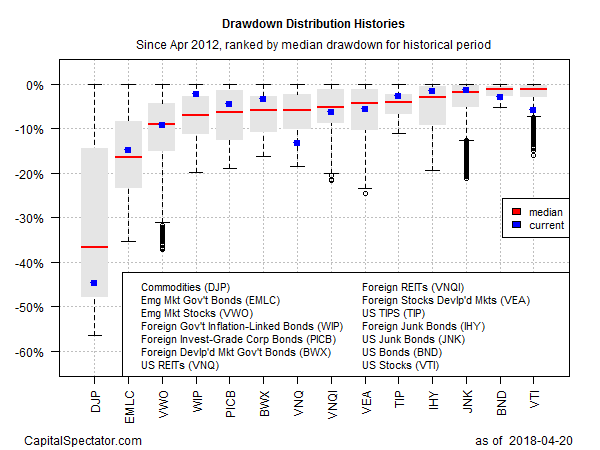

Comparing all the major asset classes through the risk lens of current drawdown shows that commodities, despite the recent rally, remain deep in the hole. DJP’s latest peak-to-trough slide exceeds 40%, far below the current drawdowns for the rest of the field.