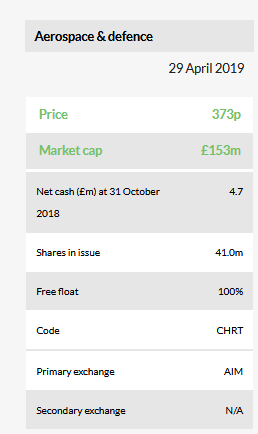

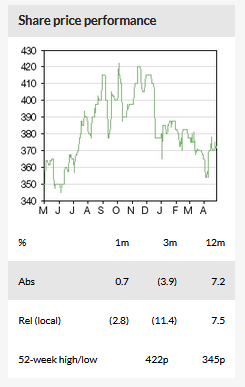

As anticipated at the H119 results, order intake for Cohort (LON:CHRT) remained strong through the second half of the year. With the addition of Chess, the backlog at the year end should stand at more than £175m, comfortably a record for the group. It represents c 1.3 years of revenues based on our FY20 expectations and while many of the contracts are multi-year, it does provide increased sales cover for the medium term. Cohort continues to deliver against its growth strategy, appears to be largely insulated from Brexit concerns and still trades on an undemanding P/E multiple.

Record order book underpins outlook

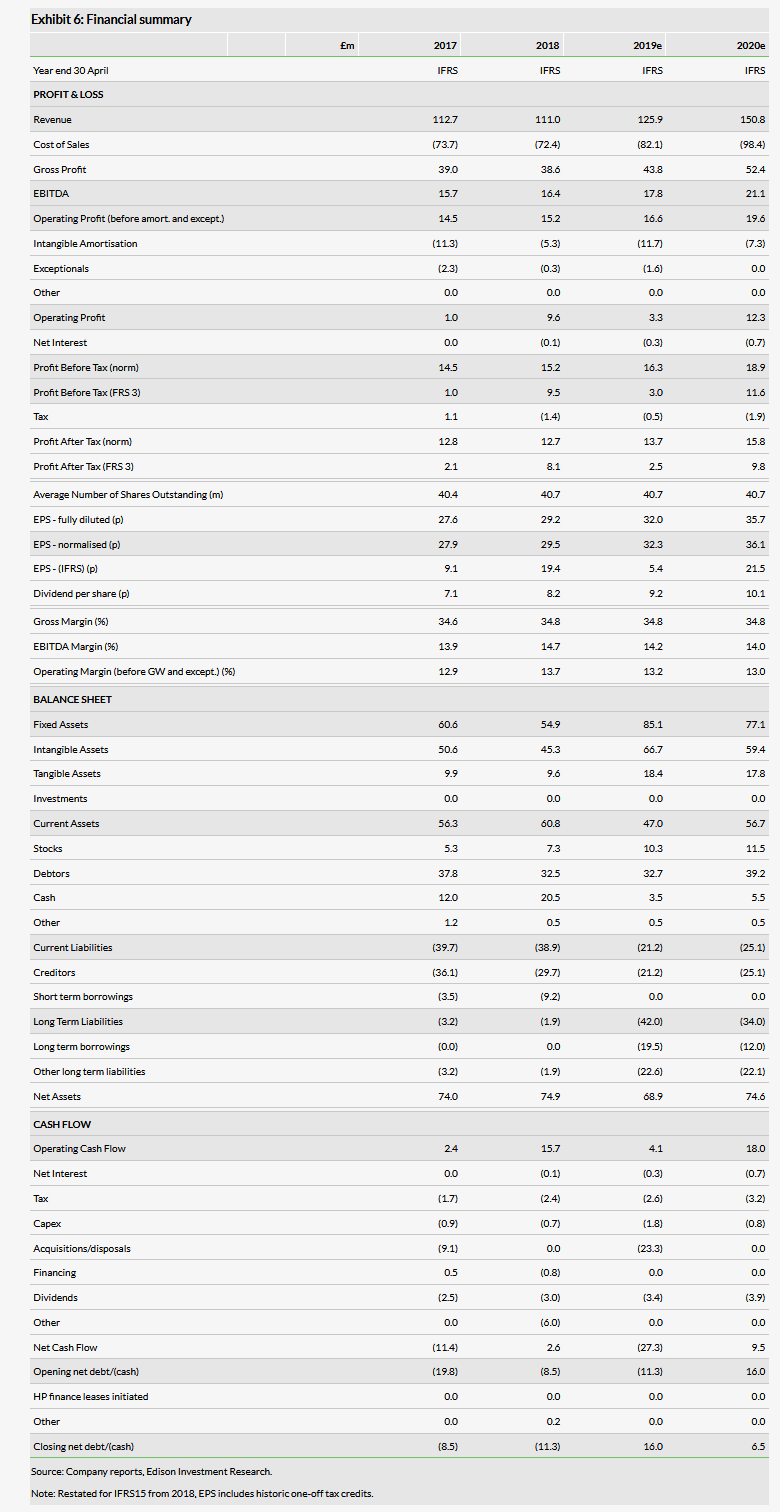

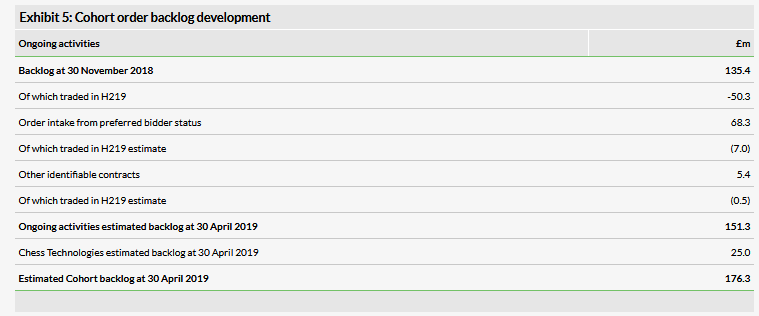

The record order intake in FY19 of over £150m, combined with the addition of the Chess Technologies order book, is expected to swell Cohort’s year-end backlog to at least £175m. The backlog compares with £102.2m at the end of FY18, and £108.8m at the half year, and represents around 1.4 years of sales based on our FY19 estimate, although delivery will be spread over at least five years. With Chess likely to add around £25m of unfilled orders, the backlog for the ongoing activities is expected to have risen by around 50% thanks to several major multi-year awards and renewals. Following £32.8m of orders secured in November the backlog rose to £135.4m. Of this, £50.3m was due for delivery in H219, providing order cover for FY19 sales at that time of 81%. Subsequent order intake further improved the FY19 sales cover to 85%, as well as providing support for the medium term.

Chess adds US presence

One of the most strategically significant contracts signed recently was the announcement by Chess in late March of a sub contract for the US DOD to supply electro optical (EO) tracking and control systems to Liteye, the prime contractor for a highly mobile containerised counter unmanned air systems (C-UAS) solution. Although small at in excess of £3m, it verifies the positioning of Chess’s anti UAV defence systems (AUDS) technology in the US market following previous operational successes with the US military. The technology was recently featured in BBC’s Panorama programme about the Gatwick drone incident. It also serves as a bridgehead for Cohort’s other product offerings and activities into the major US defence and security market, which could provide a new driver for future growth.

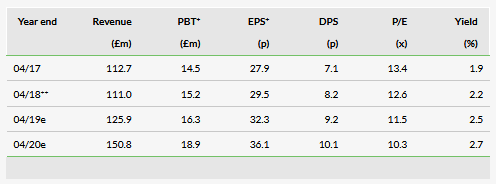

Valuation: Rating does not reflect progress

Despite the encouraging developments during H219, Cohort is trading on a P/E multiple for FY20 (ie 12 months forward) close to single digits. The rating looks anomalous given the consistent execution of its strategy compared to many peers.

Business description

Cohort is an AIM-listed defence and security company. Including the recent addition of Chess Technologies, it operates across five divisions: MASS (34% of FY18 sales); SEA (34%); MCL (16%); and the 80%-owned Portuguese business EID (17%).

Order successes verify strategy

Cohort continues to successfully execute on its strategy to deliver both organic and acquisition-driven growth, with robust financial discipline and controls. It exploits the agility and innovation of smaller, more entrepreneurial business models while providing the stability of a larger company with shared capabilities and extended market access, supported by a strong financial position.

The continued success in achieving contract renewals, combined with new business opportunities, would appear to verify the relevance of Cohort’s capabilities and know-how to its customer base. Many of the renewals are for longstanding contracts where Cohort has established credentials as the incumbent, enabling it to maintain its tenure. The expertise of the divisions in their own fields attracts new business opportunities both domestically in the UK (and Portugal for EID), as well as in export markets, as can be seen from the success in EWOS (electronic warfare operational support) markets and land and sea communications.

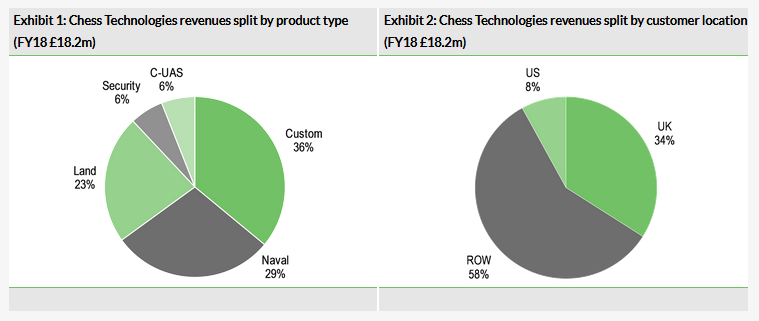

The addition of Chess Technologies with its strong military and export orientation (in FY18, 66% of sales were to overseas customers including 8% to the US) should provide the opportunity to take Cohort’s overall offering to a wider audience.

The initial consideration of £20.1m for 81.84% of Chess is expected to leave Cohort with a net debt position at the year end, which at the half year was estimated to be around £16m. With further potential payments of up to £21.8m over the next two financial years, we expect the focus for FY20 will be on organic development. As a reminder, the split of Chess’s revenues is shown below.

Contract awards in H219

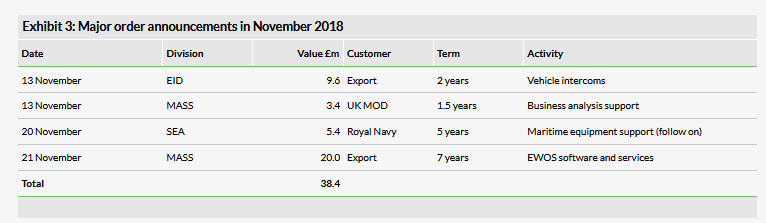

In November, the following major contract awards were announced and these were included in the backlog calculation for 30 November 2018 of £135.4m.

We note that at the half-year results the company indicated an order intake of £32.8m in November 2018 and we think this discrepancy with the figure shown in Exhibit 4 could reflect a delay between award and confirmation.

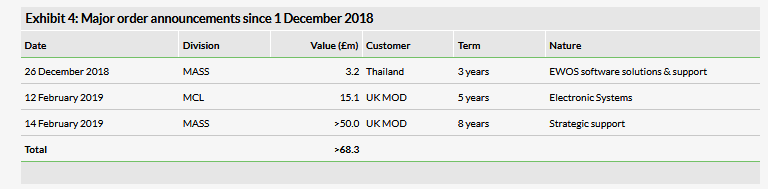

The contracts announced in H219 primarily reflect the conversion of three preferred bidder status prospects noted at the half year. We suspect there are a number of unidentified contracts that may have been signed without announcement during the period which could further boost the year-end backlog.

On 27 March 2019 Chess was awarded a subcontract worth in excess of £3m for the US DOD to supply its AUDS technology to be integrated into a highly mobile containerised C-UAS solution.

Development of expected year-end backlog

For the ongoing businesses (ie excluding Chess), of the £135.4m backlog at the end of November 2018, £50.3m was deliverable in the remainder of the financial year, taking total sales and orders on hand for delivery in FY19 at that time to £96.0m. Management indicated that of the preferred bidder status contracts outstanding at that point, some £7m of additional revenues would be delivered in H219. These have all now been awarded with an aggregate value in excess of £68.3m, leaving a further £14.9m of sales to be booked and shipped for H219 to reach our estimated revenues for the ongoing business of £117.9m for FY19, less than was required in H218.

Conclusion

As is normal for Cohort, its core business has cycles of major multi-year orders being renewed and then progressively traded from backlog. Further significant renewals are expected in FY20. The fact that intake and backlog are at record levels suggests that underlying growth is real with new business complementing the renewals. In addition, it should be remembered that the record performance is being achieved at a time when SEA’s submarine activity is at a relatively low ebb, with major orders not expected until FY21. We believe investors should be encouraged by the underlying progress and that Chess Technologies will enhance growth prospects further. The current rating does not appear to reflect this.