Cimarex Energy Co. (NYSE:XEC) is expected to trump estimates when it releases fourth-quarter 2019 results on Feb 19, after market close.

In the last reported quarter, Cimarex Energy’s earnings of 91 cents per share missed the Zacks Consensus Estimate of 93 cents due to lower commodity price realizations. The independent oil & gas exploration and production company beat earnings estimates once and missed the same thrice in the trailing four quarters.

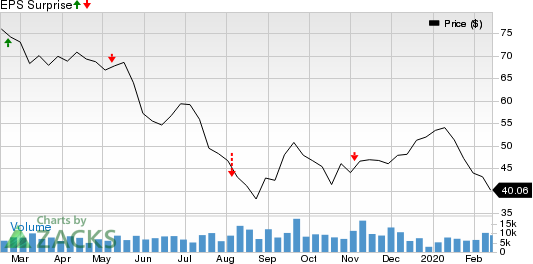

Cimarex Energy Co Price and EPS Surprise

Let’s see how things have shaped up prior to the announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for fourth-quarter earnings of $1.20 per share has seen nine upward revisions and five downward movements in the past 30 days. The figure suggests a year-over-year decline of 39.4%.

Further, the Zacks Consensus Estimate for revenues of $609.8 million suggests a 2.3% drop from the prior-year quarter.

What the Quantitative Model Suggests

Our proven model predicts an earnings beat for Cimarex Energy this time around. This is because it has the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

Earnings ESP: Cimarex Energy has an Earnings ESP of +1.25%. This is because the Most Accurate Estimate of $1.21 per share is pegged higher than the Zacks Consensus Estimate of $1.20. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Factors Expected to Aid Earnings

Cimarex, which is a leading explorer and producer of oil and natural gas with prime focus on the prolific Permian and Mid-Continent regions, is likely to have gained from production surge in the Permian Basin. The Zacks Consensus Estimate for the company’s fourth-quarter total production is pegged at 283 thousand barrels of oil equivalent per day (MBoe/d), indicating a rise from 251 MBoe/d in the year-earlier period.

Moreover, the Zacks Consensus Estimate for average realized oil price is pegged at $53 per barrel, implying an increase from the year-ago reported figure of $49.30. However, the Zacks Consensus Estimate for average realized natural gas price of $1.18 per thousand cubic feet points to a decline from the year-ago reported figure of $2.16.

The significant rise in total production on the back of Permian activities is expected to have boosted Cimarex Energy’s bottom line. Further, higher oil price realization is expected to have increased its profit levels.

Other Energy Stocks With Favorable Combination

Here are some other companies from the energy space that you may want to consider, as our model shows that these too have the right combination of elements to deliver an earnings beat in the upcoming quarterly reports:

EOG Resources, Inc. (NYSE:EOG) has an Earnings ESP of +0.18% and a Zacks Rank #3. The company is set to release quarterly earnings on Feb 27.

EQT Corporation (NYSE:EQT) has an Earnings ESP of +11.93% and a Zacks Rank #3. The company is set to release quarterly earnings on Feb 27.

Matador Resources Company (NYSE:MTDR) has an Earnings ESP of +0.11% and a Zacks Rank #3. The company is set to release quarterly earnings on Feb 25.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

EQT Corporation (EQT): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

Cimarex Energy Co (XEC): Free Stock Analysis Report

Matador Resources Company (MTDR): Free Stock Analysis Report

Original post

Zacks Investment Research