The first part of this article highlighted what we believe is the start of a broad market sector rotation setup in the U.S. and global markets. This second part will highlight what we believe are excellent examples of sector trade setups for our friends and followers.

As China continues to pour capital into its markets to stabilize the outflow and fall of asset prices, a number of interesting components of broader sector rotation are setting up. First, the U.S. stock market has rolled lower in what we are calling a “first-tier” of the “waterfall event.”

Additionally, mid-caps, transportation, energy and financials have all started to roll-over and begun to rotate lower. We believe the contraction in economic activity and global market engagement as a result of the Wuhan virus will result in a much bigger and broader downside price move than many are expecting in the coming weeks.

The death toll for the Coronavirus outbreak reached 910, surpassing the number that died in the 2003 SARS episode. This is causing huge issues with global supply chains and shipping companies as I talked about last week in my HoweStreet Interview.

We believe traders need to be aware of the continued capital shift that has been taking place over the past 4+ years. As foreign markets struggle and the U.S. dollar continues to strengthen, capital has been moving into the U.S. stock market as a protective measure. We think this will continue throughout the virus event, yet we believe the U.S. stock market will contract and move lower as a result of the.

Many U.S. companies are still exposed to foreign markets through overseas engagement and retail locations, automakers, consumer products, manufacturing, heavy equipment and dozens of other sectors, which derive 5% to 25%+ of their revenues from China and other overseas markets. McDonald’s (NYSE:MCD), Starbucks (NASDAQ:SBUX), Caterpillar (NYSE:CAT) and dozens of other U.S. companies have broad exposure in China and Asia. We think this virus event could last well into July and possibly much longer. Because of this, we believe a broad sector rotation will set in and that volatility will continue to increase over the next 6 to 12+ months.

Here are the three sectors we believe have a strong potential for setting up a fantastic trade.

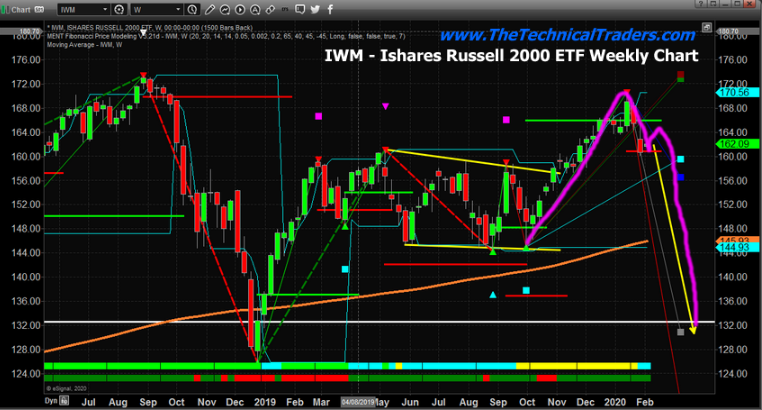

The Russell 2000 (NYSE:IWM) has already started to move a bit lower over the last few weeks. Even though the U.S. stock market was plowing higher throughout most of December and January, the Russell 2000 is actually showing signs of a rounded top formation with a very clear downside “first leg” (waterfall) type of price decline. We believe broader market contraction and sector rotation could push IWM below $144 in an attempt to target historical support near $126.

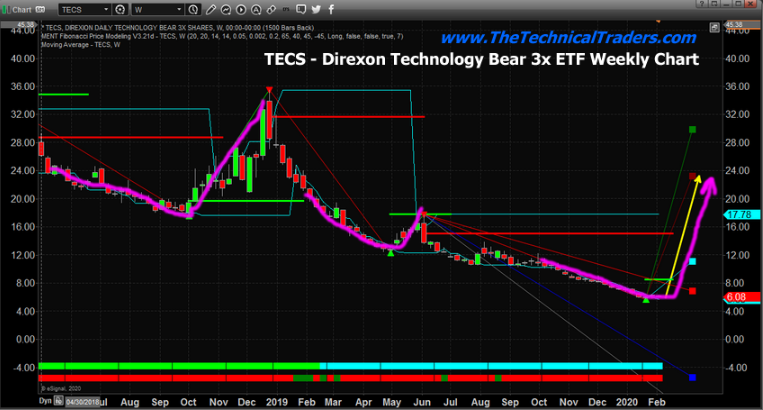

The technology sector may see a broader market decline over the next 30 to 60 days that could push TECS from recent lows, below $6, to levels above $12 to $16 on a reactionary move in this 3x ETF. TECS has experienced very low volatility over the past 3+ months while the U.S. stock market has continued to rally in Q3 and Q4. Any breakdown in the global technology sector could push TECS well above recent peak levels near $18.

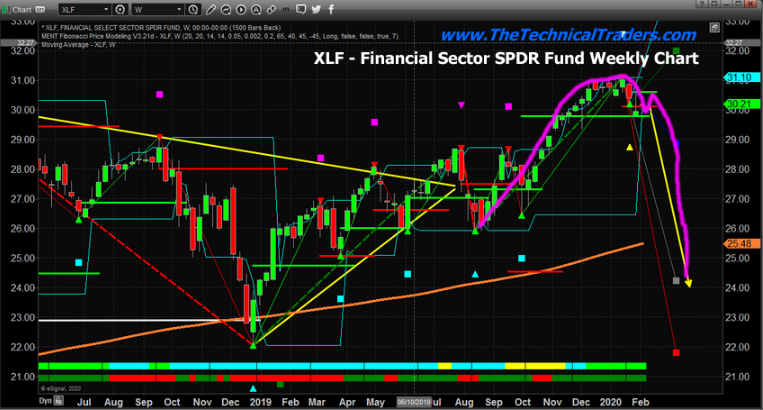

The financial sector is very likely to experience a 3% to 10% decrease in consumer activity related to the lack of travel, outside entertainment, shopping and food services activities and could see extended risk to loans, debts and other services as a result of a global economic market contraction. We believe a downside risk exists in XLF where the price will likely break below $30 and target the $25 to $26 level over the next 30 to 60+ days. Ultimately, XLF must hold above the December 2018 lows near $22 if the current downside rotation ends within recent price ranges. A move below $22 would indicate we have entered a new stage of a bear trend.

The reality of the situation for most of us is that we are not at immediate risk of catching anything except a common cold or flu. As skilled traders, we must identify an opportunity where it presents itself and we must attempt to learn to capitalize on that opportunity. We believe these sectors, and many others, are about to present very real trading opportunities for skilled traders.

The virus is expected to double in scope every 6.5 days based on modeling data. Obviously China and Asia are the biggest risks right now. Our biggest concern is that the virus spreads into India and Africa. We believe a spread into these regions could add hundreds of thousands or millions of infected people to the lists. At this point, it is far too early to tell how extended this virus event will become – yet we feel we are just starting this rotation and the true scope of it won't be known for many weeks or months.