A bunch of bullish and bearish arguments below for you to chew on…

Tesla's Q4 Production And Deliveries

- Tesla (NASDAQ:TSLA) reported its Q4 production and deliveries on Saturday and the stock rose 1.6% to an all-time high yesterday. Here’s Hypercharts’ updated charts on Tesla’s deliveries, revenues, margins, etc.

- An article in WaPo: A Tesla Model S erupted ‘like a flamethrower.’ It renewed old safety concerns about the trailblazing sedans.

- Doug Kass and Mark Spiegel remain bearish on the stock.

Tesla has been in existence for 17 years and has never been profitable despite having no competition.

Tesla's shares have climbed from about $80/share at year end 2019 to almost $700/share.

Buoyed by its inclusion in the S&P Index, the company's market capitalization is now over $650 billion—representing possibly the biggest single large cap bubble in history.

"Noted competition will include the Audi Q4 e-tron and Q4 e-tron Sportback, BMW iX3 (in Europe & China), Mercedes EQB, Volvo XC40, Volkswagon ID.4 and Nissan Ariya, while less expensive and available now are the excellent all-electric Hyundai Kona and Kia Niro, extremely well reviewed small crossovers with an EPA range of 258 miles for the Hyundai and 238 miles for the Kia, at prices of under $30,000 inclusive of the $7500 U.S. tax credit. Meanwhile, the Model 3 now has terrific direct "sedan competition" from Volvo's beautiful new Polestar 2 and the premium version of Volkswagon's ID.3, and next year from the BMW i4." Mark Spiegel

As noted above, faced with an onslaught of competition - by Audi, Volkswagen (DE:VOWG) and others—and a relatively shallow moat, Tesla's market capitalization is now over 5x that of Ford (NYSE:F) , General Motors (NYSE:GM) , and Fiat Chrysler (NYSE:FCAU), which, as a group, sell 17 million units/year vs. Tesla's estimated production of 500k cars in 2020.

Tesla's has little proprietary in terms of electric car technology—while its global competitors have over a century of experience of consistent manufacturing and distribution of high-quality automobiles, and which subsidize ongoing operating losses from their electric car efforts.

Tesla has been in existence for 17 years and, adjusted for the sale of emission credits, has never been profitable despite having no competition, and no need for advertising.

Despite limited world-wide competition, Tesla has propped growth by cutting unit prices. What happens when the well reviewed competition gears up for delivery in 2021? Market share will be pressured and operating margins will decline.

Meanwhile, management turmoil has intensified over the last two years.

Bottom Line

In an era of cultism, Tesla is the stock (and Bitcoin is the currency)!

Bull-Bear Arguments And Debate

A guy named Gary Black tweeted this bullish outlook:

Another friend’s bearish take:

The bigger picture is this: Musk has spent 5-10 years talking about achieving 500,000 cars by 2018, alternatively by 2020, or alternatively 1 million cars by 2020. In the end, Tesla achieved the absolute bottom of range at the very end of the time period.

It’s like the student handing in a paper on the very last minute of the semester’s grace period, which then squeaked by with the absolute minimum passing grade.

So in other words, Tesla managed to meet, on this metric, the absolute minimum it had promised over the last 5-10 years.

Usually, a company that’s trading at a premium in the market—let alone a company that is trading at roughly 100 times the standard industry valuation multiple—would have to actually *beat* its guidance over some period of time, let alone 5-10 years. Here, Tesla managed to cough up the absolute bare minimum in order to do what the most generous definition had been of its promises over the last 5-10 years.

The same goes for those driverless robotaxis. It managed to deliver only 1 million of those by the end of 2020.

Oh wait, Tesla didn’t deliver one million robotaxis yet? And they’re not appreciating from the original $40,000 purchase price to at least $200,000 by the end of 2020? That can’t be. Surely Musk would not have lied about those things, would he?

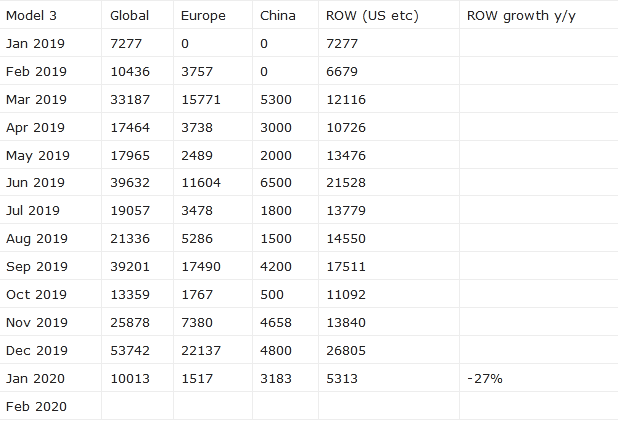

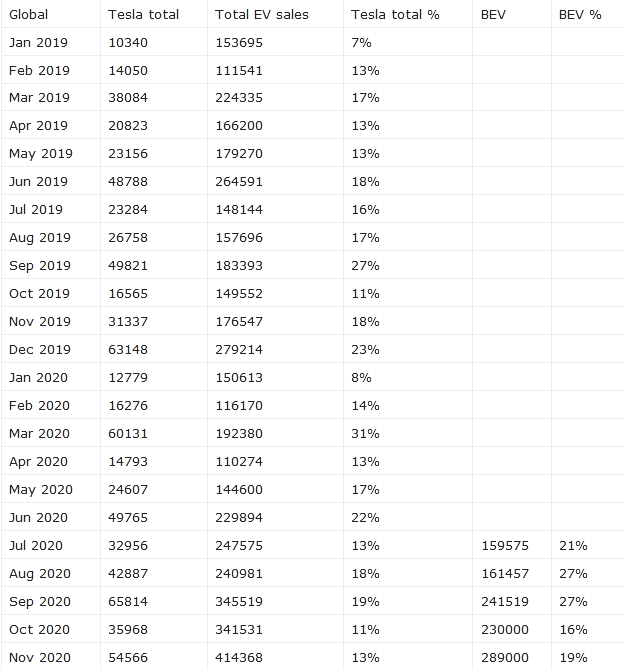

Meanwhile, the global EV sales numbers for November are in, and Tesla fell to 13% market share (19% BEV only) which was down from 18% in August (27% BEV only):

You can see that the heavily US-weighted “rest of world” category—which excludes Europe and China—was down 1% year-over-year in November. This is Model 3 only, by the way, not all Tesla vehicles—for the Model Y was not yet sold outside North America yet: