The Fed funds rate is 0.25% higher now than it was this time last week. What does this mean for our income investments – especially our monthly dividend payers?

We’ll explore in a minute. First, let’s allow ourselves a moment to appreciate the attractiveness of meaningful monthly distributions.

Our bills arrive every 30 days. But most stocks only pay their dividends every 90. So why don’t we bridge the gap and line up our income with our expenses?

Electricity bill? No problem – got an emerging market bond distribution to cover that.

Cable? No hurry to cut the cord (and risk live sports) when we have a REIT stock that covers this month’s bill.

As I’ve written before, my 8 favorite monthly dividend payers combine to pay $3,333 every single month on a $500,000 portfolio. (From an average 8% yield, paid every 30 days.) And this is all pure dividend gravy – money we can spend without having to tap our capital.

But before we rush to our favorite stock screener and start plugging in “monthly payouts”, let’s be mindful of rising rates. Some every-30-day-payers are particularly good buys, but others should be avoided.

Two More Hikes Likely

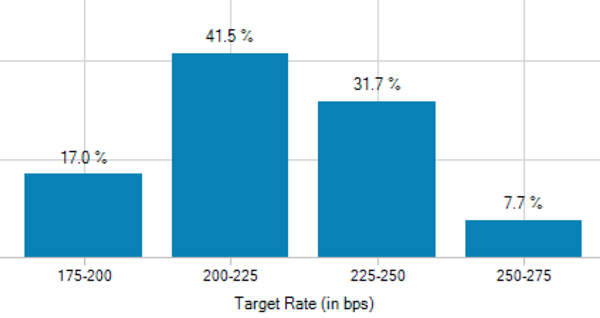

We can’t always take the Federal Reserve’s comments at face value, but traders today are handicapping Fed Chair Jerome Powell at his word. The smart money is betting that Jerome & Co. hike twice more in 2018:

Current Bets: 2 More Hikes

A 0.50% move doesn’t sound huge, but it’s big enough to bother regular vanilla bonds – and their proxies – when we’ve been living in a no-yield world. In fact, this has already happened to the most well-known monthly payer.

Stay Away (Still): O No

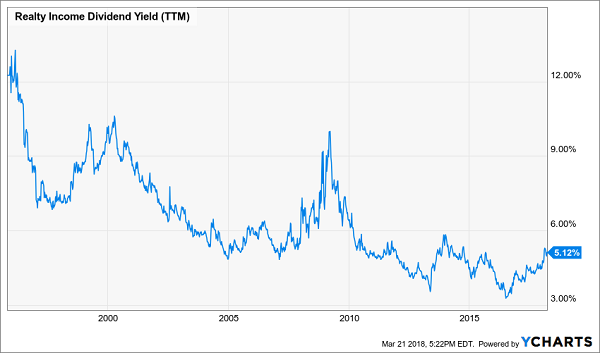

Realty Income Corporation (NYSE:O) was the first firm to stake its claim as “the monthly dividend company.” In fact, it trademarked the phrase! And Realty Income has been a fantastic investment through the years. But there’s a problem with popularity – low yields:

The Bear Market in O’s Yield

The bright spot for income investors? The Big O is down 21% since I warned readers to avoid it. This price decline has been good for the stock’s yield, which is now above 5%:

It Was a Good Time to Avoid O

Five percent remains respectable today. It puts the stock’s payout on a perch just above the safest fixed income investments (like Treasuries).

But is 5%+ enough compensation given that O’s property holding are shakier than ever? I’m not sure. As a retail landlord, it’s a crapshoot every month as to which rents are going to get paid – and which tenants will succumb to “Death by Amazon (NASDAQ:AMZN).”

Instead of gambling on O, I’d prefer to bet on surer things – like bonds that will actually rise in value as rates continue to climb.

Buy Instead: Safe Floating Rate Bonds

Instead of investing in dicey retail strip malls, I prefer corporate debt. After all, the Fed is raising rates because the economy is rolling. That’s good for corporations’ balance sheets and their ability to repay their loans.

We need to pick the right companies, of course, to make sure you get paid back. One monthly payer on the corporate side is the VanEck Vectors-Investment Grade Floating Rate (NYSE:FLTR). This fund buys floating rate notes from businesses that are rated as investment grade by Moody’s, S&P, or Fitch.

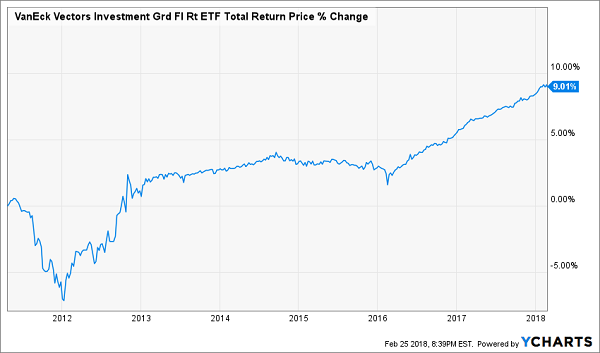

So far, so good. Unfortunately it currently pays a paltry 1.9%:

FLTR: Slightly Better Than Your Mattress

And FLTR has delivered a total return to investors of just 9% since inception (nearly seven years ago). Yikes.

The best deals in the corporate bond market are actually just below the somewhat arbitrary investment grade cutoff. It’s where contrarian fund managers and investors like us capitalize on the fact that any pension funds, banks, and insurance companies are not allowed to invest in these “low quality” issues per their by-laws.

The result is a sweet spot of value, thanks to the lack of big money chasing these types of bonds.

Agencies’ ratings shortchange a lot of very good debt. You just have to pick and choose the quality companies with plenty of cash flow to service their debt obligations. Or those with enough assets to make their creditors whole no matter what happens.

My preferred way to invest in this market is with my favorite floating-rate bond fund that today pays 5.1% yearly (and has double-digit price upside potential, too.)

With a single-click of our mouse (or tap of our phone), we can hire the best (and most well connected) bond managers on the planet to build a portfolio for us. And we can even get them to work for us for free if we buy the fund today!

This ultimate rate-proof bond fund also pays a monthly dividend (again, good for 5.1% annually). And it delivers total returns between 10% and 15% yearly when the Fed is raising interest rates (as it is right now).

It’s one of 12 monthly payers in my “8% Monthly Payer Portfolio”. With just $500,000 invested, it’ll hand you a rock-solid $40,000-a-year income stream. That’s an 8% dividend yield … and it’s easily enough for most folks to retire on.

The best part is you won’t have to go back to “lumpy” quarterly payouts to do it! Of the 19 income studs in this unique portfolio, 12 pay dividends monthly, so you can look forward to the steady drip of $3,333 in income, month in and month out—give or take a couple hundred bucks – on every $500K in capital you’re able to invest.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."