Over the last 30 years, the popularity of impact investing and a desire to ‘do good’ with investment portfolios has blossomed. In April 2019, The Global Impact Investing Network estimated the global impact investing market was $502 billion. While impressive, it represents less than 1% of the investing universe.

Impact investors, looking to have a positive social and environmental influence, tend to analyze factors not typically on the radar of traditional investors. In particular, ESG, an acronym for environmental, social, and corporate governance, is a framework for investors to assess investments within three broad factors.

We all want to make the world a better place, but are investment portfolios the right tool to do that?

To answer the question it is important to step back from impact investing and explore investment goals and how wealth grows fastest to help answer the question.

As a wealth fiduciary, our mission is managing our client’s portfolios in a risk-appropriate manner to meet their financial goals. Whether a client is ultra-conservative or uber-aggressive, the principle of compounding underlies every strategy we employ. Compounding, dubbed the “eighth wonder of the world” by Albert Einstein, is an incredibly important factor in wealth management.

Wealth compounding is achieved through consistency. Targeting steady growth while avoiding large drawdowns is the key. To do this, we develop an aggregation of diversified investment ideas.

Investment diversification is well-touted but not well understood. Commonly it is believed that portfolio diversification is about adding exposure to many different investments within many different asset classes. True portfolio diversification is best created by owning a variety of assets with unique, uncorrelated cash flows that each individually, offer a promising risk and return trade-off.

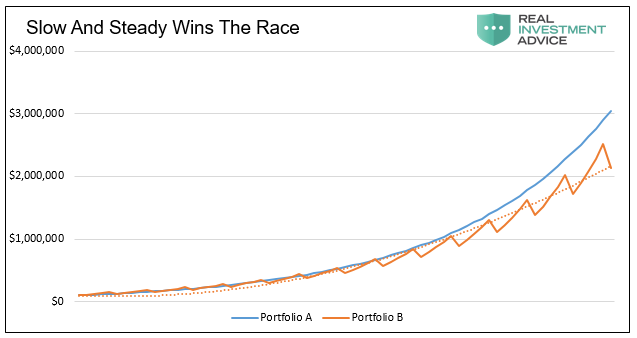

To demonstrate the importance of drawdown avoidance, we compare two portfolios. Both average 5% annual growth. Portfolio A grows by a very dependable 5% every year. Portfolio B is a more typical portfolio with larger growth rates but occasional drawdowns. Portfolio B grows 10% a year for four years but experiences a 15% drawdown every fifth year. Despite earning 5% a year less in four of five years, portfolio A avoids losses and grows at an increasing rate to portfolio B as highlighted below.

Consistent, steady returns and no drawdowns build wealth in the most efficient manner. The more investment options we have, the better we can diversify and minimize portfolio drawdowns. When options are limited, our ability to manage risk is limited.

Is doing ‘good,’ good for you?

The cost of impact investing is two-fold. First, by limiting the purchase of certain companies and industries, you forego the potential to buy assets offering a better risk-return tradeoff than other assets in the market. Second, due to the smaller size of your investable pool, your ability to diversify is hampered. The combination of these costs show up as more volatile returns which results in a lessened ability to compound.

While impossible to quantify, this cost is hopefully more than offset by the feeling of having a positive impact on the world.

Inclusion or Exclusion

To invest with purpose, there are some things you may or may not have considered. Foremost on the list is the question, “Where are your investment dollars truly going?” Most investments in stocks and bonds are in securities that were issued in the past. The company behind those stocks or bonds already raised capital and is using it to achieve their mission. We may avoid buying stocks in coal miners or tobacco companies, but the funds from a market transaction go to another investor, not the company. This holds equally true if we buy stocks or bonds of a company we deem has a positive social or environmental impact.

That does not mean our investment decisions are fruitless. Our participation affects the perceived health of a company via the liquidity we’ve provided or taken from the company’s securities. When equity prices decline and/or bond yields rise, a company will find it harder and more costly to raise new capital.

Bill Gates has some interesting views to help us understand our potential role in social impact investing.

In a recent Financial Times article, Fossil fuel divestment has ‘zero’ climate impact, says Bill Gates, the billionaire philanthropist argues environmental change is achieved via investing in disruptive and innovative companies that tackle environmental problems, not divesting from those that do not.

“Divestment, to date, probably has reduced about zero tonnes of emissions. It’s not like you’ve capital-starved [the] people making steel and gasoline,” he said. “I don’t know the mechanism of action where divestment [keeps] emissions [from] going up every year. I’m just too damn numeric.”

If you are interested in impact investing, we ask you to consider Bill Gates advice of inclusion not exclusion. Use the entire menu of investment opportunities and rigorous analysis to determine which assets are worthy. If the “disrupters” qualify under your investment protocol, include them in your portfolio and perhaps favor them. However, be cognizant of the cost of shunning companies that are doing things you don’t like.

A well-diversified portfolio with a positive risk/return structure will provide more stability and limit drawdowns. By growing your wealth as efficiently as possible, you will be able to invest more into companies that are having a positive social impact and have more wealth which you can donate in more direct, impactful ways.