Every investor is a value investor by nature, as they try to buy stocks at lower prices and sell those off at higher rates, resulting in value additions to their investments. The concept of accumulating solid stocks at lower prices is in sync with the idea of investing in utility stocks. Investing in value stocks and utility stocks has one thing in common — both provide returns to the investors over the long term.

Return from the Utilities sector over the past decade has been 17% — significantly lower than the Zacks S&P 500 Composite’s 191.9%. Despite their lower returns, when compared with Zacks S&P 500 Composite peers, utility stocks are considered as safe investment options, owing to the ability to provide steady performance irrespective of economic cycles and pay regular dividends to shareholders. The sector’s dividend yield over the past decade has been 3.2%, outperforming the Zacks S&P 500 Composite’s 1.73%.

Demand for water, gas and electricity does not vary much during the economic cycles, which provide stability to utility stocks’ earnings. In addition, government regulations and huge investments required for entry make the space lesser competitive than other sectors. These factors have been aiding the stability of utilities’ operations.

These capital-intensive utilities benefited from the Fed’s July rate cut. The following two rate cuts further enabled the sector to source funds at cheaper interest rates and create more cash flows. At present, the rate stands in the 1.5-1.75% band.

Utilities have been gradually shifting their focus to cleaner generation and storage projects, as well as have been educating customers to lower their utility bills without compromising on energy usage. On a whole, a steady transition to renewable generation is noticed in this space, as the companies are aimed at lowering generation-related emissions.

Amid such favorable trends in the utility space, we can suggest few utility stocks for value investors, which are undervalued at the current share-price levels and are the best options to buy for 2020.

Strategy to Discover Value Stocks

There are plenty of strategies for discovering value stocks, but we have found that pairing a stock carrying a favorable Zacks Rank, along with an impressive grade in the Value category of our Style Scores system, generates the highest returns. The proven Zacks Rank puts an emphasis on earnings estimates and estimate revisions, while our Style Scores work to identify stocks with specific traits.

Value investors can also try analyzing a wide range of traditional figures and metrics to help determine whether or not a company is undervalued at its current share-price levels.

Our Value category highlights undervalued companies by looking at a variety of key metrics, including the popular P/E ratio, as well as the P/B ratio, and a variety of other fundamentals that have been used by value investors for years.

Key Picks

Here we have selected utility stocks carrying a Zacks Rank # 1(Strong Buy) or # 2 (Buy), along with Value Score of “A” and “B”. These stocks have market capital of more than $1 million. You can see the complete list of today’s Zacks #1 Rank stocks here.

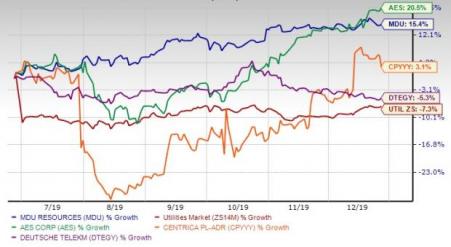

Price Performance (Six Months)

The AES Corporation (NYSE:AES) , with a $13.12-billion market cap, a Zacks Rank of 1 and Value Score of “B”, currently has a forward P/E ratio of 14.74, lower than Zacks S&P 500 Composite’s P/E ratio of 19.53. Another notable valuation metric for AES is its P/B ratio of 1.89 compared with the Zacks S&P 500 Composite’s 3.32. The stock’s 2020 earnings estimate moved up 2.08% to $1.47 over the past 60 days. The company has a long-term (three to five years) earnings growth rate of 9.10%.

MDU Resources Group, Inc. (NYSE:MDU) , with a $5.9-billion market cap, a Zacks Rank of 2 and Value Score of “B”, currently has a forward P/E ratio of 18.31. Its P/B ratio is pegged at 2.1. The stock’s 2020 earnings estimate moved 6.25% north to $1.70 in the past 60 days. The company has a long-term earnings growth rate of 7.10%.

Centrica (LON:CNA) PLC (OTC:CPYYY) , with a $6.57-billion market cap, a Zacks Rank of 2 and Value Score of “A”, currently has a forward P/E ratio of 12.86. Its P/B ratio is pegged at 1.82. The stock’s 2020 earnings estimate has been revised 2.13% upward to 48 cents in 60 days’ time. Centrica has a long-term earnings growth rate of 6.10%.

Deutsche Telekom AG (DE:DTEGn) (OTC:DTEGY) , with a $78.07-billion market cap, a Zacks Rank of 2 and Value Score of “A”, currently has a forward P/E ratio of 14.14. Deutsche Telekom’s P/B ratio is pegged at 1.54. The stock’s 2020 earnings estimate moved 6.08% north to $1.22 over the past 60 days. The company has a long-term earnings growth rate of 7.70%.

Lower valuations, with higher earnings estimates and long-term earnings growth rates, make these stocks prudent investment options right now.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 top tickers for the entirety of 2020?

These 10 are painstakingly hand-picked from over 4,000 companies covered by the Zacks Rank. They are our primary picks to buy and hold.

Start Your Access to the New Zacks Top 10 Stocks >>

The AES Corporation (AES): Free Stock Analysis Report

MDU Resources Group, Inc. (MDU): Free Stock Analysis Report

Centrica PLC (CPYYY): Free Stock Analysis Report

Deutsche Telekom AG (DTEGY): Free Stock Analysis Report

Original post

Zacks Investment Research