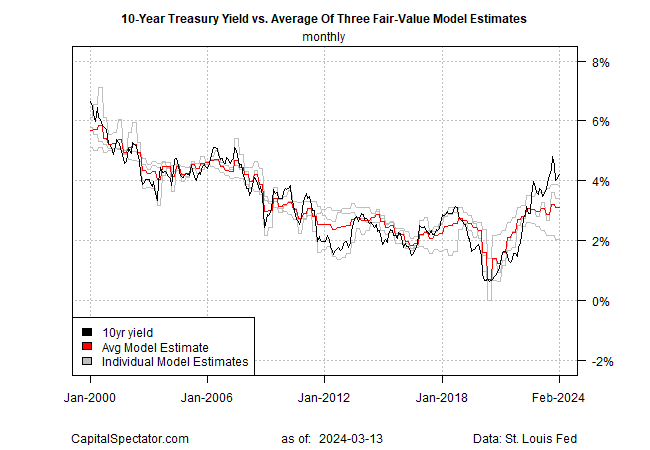

The US 10-year Treasury yield continues to trade well above a ‘fair value’ estimate, based on the average of three models maintained by CapitalSpectator.com.

The market premium continues to suggest that the benchmark rate’s upside potential is constrained, but at the same time, recent history suggests a relatively quick decline toward fair value still faces long odds, arguably due to behavioral and other factors.

Yesterday’s US consumer price inflation data for February dealt another blow for expecting the 10-year yield to slide. CPI numbers posted mixed results and traders sold bonds, which lifted the benchmark rate to 4.16%, a one-week high for Mar. 12.

Nonetheless, the 10-year yield continues to trade in a range relative to the past four months–and well below the previous peak of ~5%. From a technical perspective, the recent drop in the 10-year rate’s 50-day moving average below its 200-day counterpart implies that a downside bias still prevails.

Today’s revised average fair value estimate for the 10-year yield is 3.09% for February (red line in the chart below), virtually unchanged from the previous month.

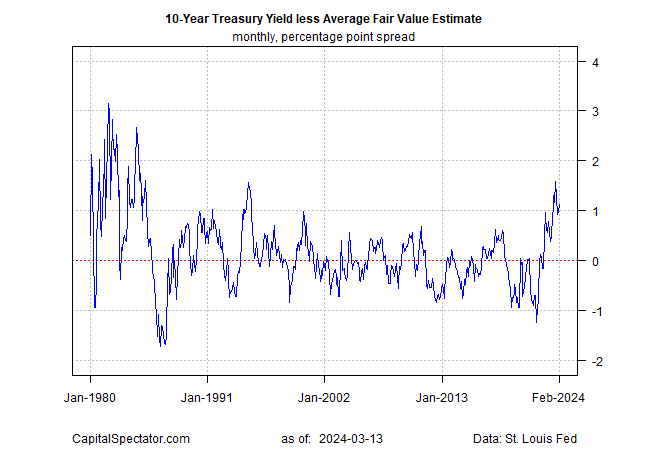

Reviewing the difference in the average fair value vs. the market rate continues to reflect a substantial premium in favor of the crowd’s estimate. The current differential is 112 basis points. That’s a hefty market premium, although it’s fallen from the cyclical peak of 159 basis points from October 2023.

History shows that a market premium at current levels is rare but not unprecedented. What would be surprising is if the current market premium persists and rebounds.

What would drive such a trend?

Inflation remaining higher for longer is on the short list of factors.

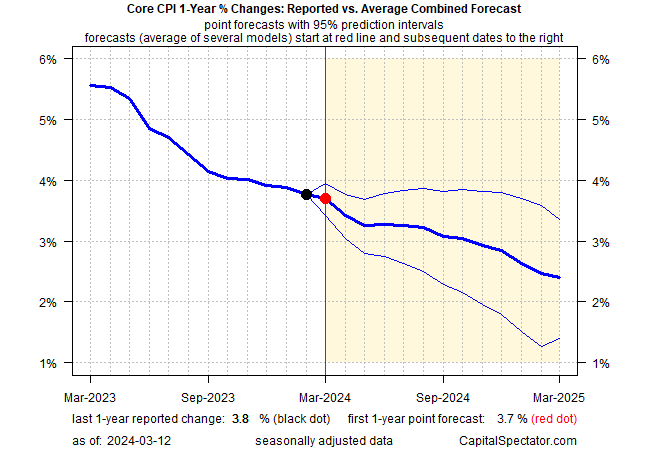

A reasonable takeaway from yesterday’s CPI report suggests that disinflation continues, albeit slowly. Focusing on core CPI, which is arguably a more reliable measure of the trend vs. headline CPI, indicates that inflation pressure eased to 3.8% for the year-over-year rate through February, the lowest in nearly three years.

Meanwhile, CapitalSpectator.com’s revised forecast for core CPI’s one-year trend (based on a set of econometric models) anticipates another dip in inflation for March.

The market premium for the 10-year rate, in short, still looks a bit excessive. There’s a case for arguing that the market premium reflects uncertainty about the near-term path of inflation.

But short of a burst of reflation in the months, which looks unlikely, the main takeaway in the analysis above still points to a relatively flat to lower 10-year yield, aided by sluggish but ongoing disinflation.