by Eli Wright

To everyone's surprise, “Quitaly,” the rubric bestowed on the result of Italy's “no” vote during Sunday’s constitutional referendum, didn’t have the negative affect on markets that most people expected. Unlike the UK's Brexit vote, which sent markets plunging over the course of the several days after the result was made public, European and US equities generally moved higher yesterday, with some US indices pushing above the all-time highs at which they began the day. To perhaps no one's surprise, Italian bond yields also pushed higher. The euro, which reacted negatively at first finished up on the day as well.

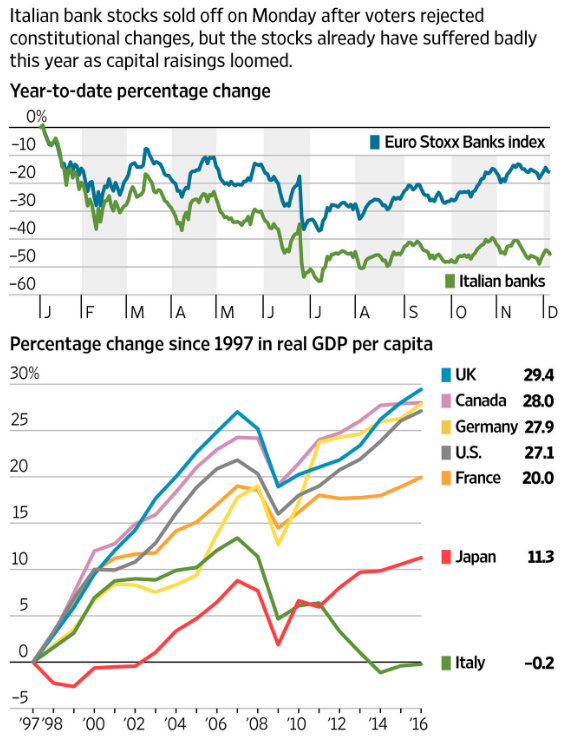

Longer term, markets could still be headed downward because of Quitaly-generated political uncertainty along with ongoing weakness in the Italian banking system, which could infect other EU financial institutions, but yesterday markets didn't appear to be risk averse in any way.

Overnight risk-on led most major Asian markets higher: the Nikkei closed 0.47% up, at 18.360.54 while the Hang Seng rose 0.75%, to 22,675.15. Only the Shanghai Composite dipped a bit – down 0.16% to 3,199.

In Europe, the FTSE, DAX, and Euro Stoxx 50 were all up yesterday following the Quitaly news. This morning, they opened mixed, with the FTSE down 0.04% at 6,744.30; the DAX 0.09% higher, at 10,694; and the Stoxx 50 up 0.49%, at 3,069.

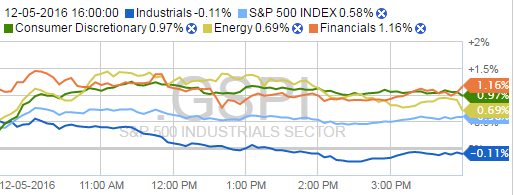

Wall Street was up across the board: The Dow closed at a new record high, up 0.24% to 19,216.24; the S&P 500 rose 0.58% to 2,204.71; and the NASDAQ ended the day 1.01% higher, at 5,308.89. The Russel 2000 gained 1.76% and moved up to 1,337.61.

US markets are continuing their push higher in pre-market trading, with the Dow up 0.05%, the S&P up 0.08%, and the NASDAQ up 0.15%.

US 2- and 10-year Treasury yields went up yesterday: the two year yield is at 1.12% while 10-year yield reached 2.38%. The 30-year however fell, down to 3.053%.

Forex

As with equity markets, the euro didn’t have the steep drop-off that many expected. This may have been partly due to aggressive EUR/USD short covering ahead of the referendum, but by the end of the day, buyers gained the upper hand and the euro hit its highest level in almost three weeks. Still, although currently euro bears aren’t nearly as predominant as they were last week, with the virtually assured Fed rate hike on the horizon, the smart money is holding dollars rather than euro.

Following the euro's trajectory, sterling is currently up, as well, trading at 1.2763.

The US dollar has seen some downward pressure over the past two days, flirting with 100.00 earlier today, the first time since the post-US election rally that the dollar index came close to breaching 100, a strong point of psychological support. Though many expect the dollar to move up when the Fed announces its rate decision next week, some are taking a more bearish view.

Commodities

Oil prices eased in early trading yesterday, but then continued to climb, as Brent passed $55 per barrel, a fresh 16-month high. “It seems that any dip is seen as a buying opportunity,” said Carsten Fritsch, analyst at Frankfurt's Commerzbank. Since OPEC’s freeze agreement was struck last Thursday, Brent has jumped close to 19%, while crude has increased by 16%.

Oil is slightly lower this morning, with Brent trading at $54.63 and Crude at $51.47.

Gold's five-year bearish tendencies continue, though the metal's downtrend appeared to accelerate more steeply on November 9, following the US election. After rising rapidly to $1,260 to start 2016, upward movement slowed through the middle of the year. However, the recent downturn has been sharp, with the daily chart showing a rapid fall to $1,080 in 2017 could be in the cards.

Gold is currently trading at $1,169.75.

Stocks

The S&P 500 ticked up yesterday after a week of sell-offs. The big sector gainers were Energy, Financials, and Consumer Discretionary.

Source: Fidelity.com

Energy rose 0.69%. Nevertheless, with oil prices tailing off yesterday, Energy shares could begin to lag as well.

As mentioned here yesterday, positive Thanksgiving/Cyber Monday data and an optimistic outlook for holiday sales boosted the Consumer Discretionary Index nearly 1% higher.

Though the Italian banking sector has been a losing proposition, down close to 50% YTD, US financials have a different story to tell. The US Financial Index was one of yesterday's big gainers – up 1.16%.

Source: WSJ

The earnings trickle begins this week with AutoZone (NYSE:AZO), which is reporting Q1 2017 earnings before the market opens. Expected EPS is $9.31 on 2.39 billion in revenue. AutoZone’s earnings per share have grown by double digits for 40 consecutive quarters. Management has done a good job of investing cash, and AutoZone’s trailing 12-month ROI has been 34.01%; the five-year average is 36.43%. Both figures are well above AutoZone’s competition: O'Reilly Automotive's (NASDAQ:ORLY) TTM ROI is 26%; Genuine Parts' (NYSE:GPC) is 15.89%; Advance Auto Parts' (NYSE:AAP) is 10%. AutoZone’s 19.17 P/E ratio is also lower than competitors', which means the stock may currently be undervalued, or that share price has not yet caught up to earnings.

AZO shares have increased approximately four percent this year and are currently trading $784.36. Economics within emerging markets could could pressure the company going forward. Stores in Mexico and Brazil make up nearly 8.5 percent of the company’s locations, and both the Mexican peso and Brazilian real have been hard hit in the wake of the US election. However, the consensus target the 12-month stock price is $857, an upside of 9.26%. The lowest estimates see AutoZone slipping to $770 – less than 2% downside.