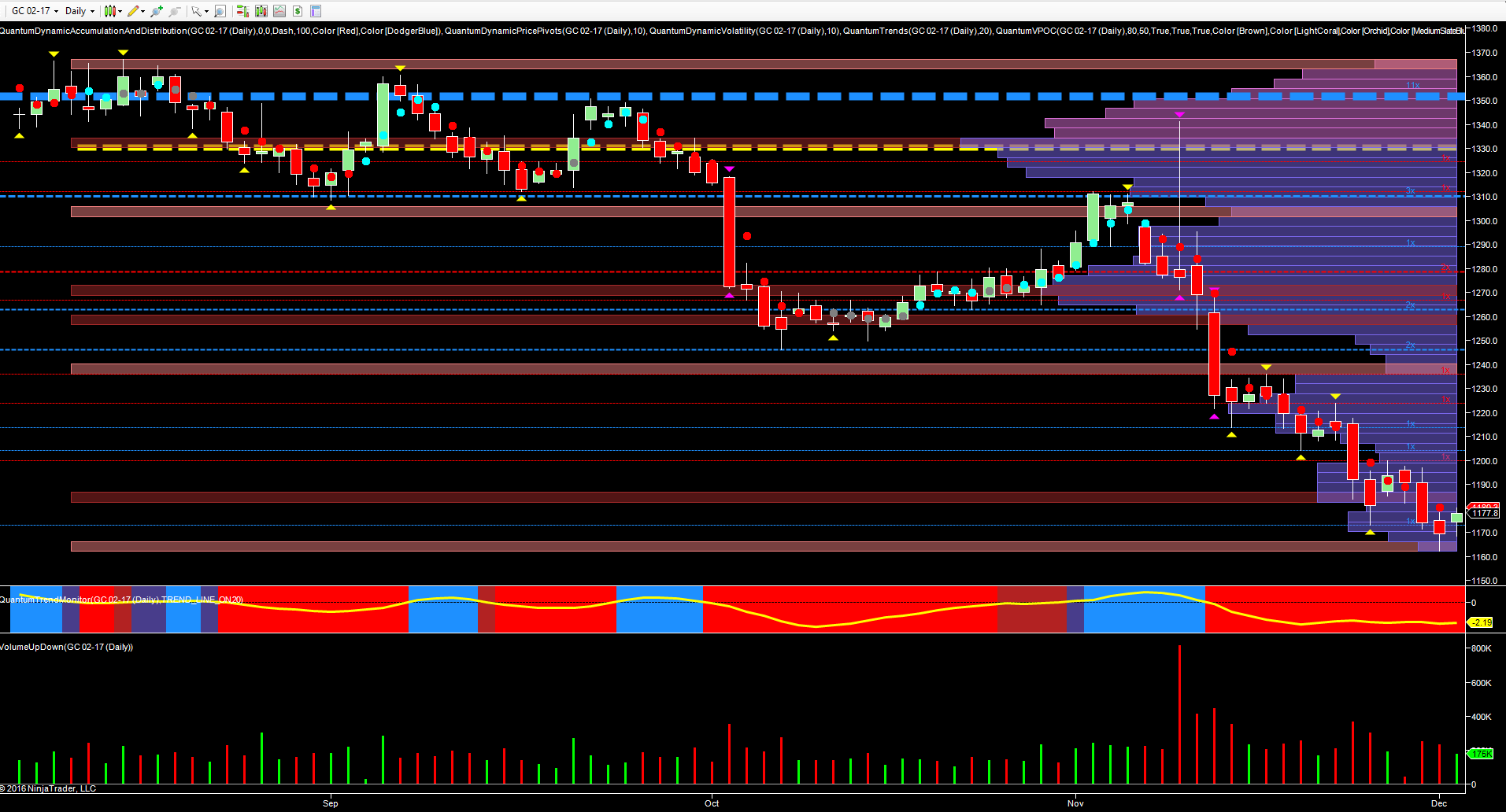

The heavily bearish sentiment for gold continued to remain firmly in place once again last week, as the precious metal continues its stately progress ever lower, following the cataclysmic candle of the 9th November, when ultra high volume confirmed the heavy selling. Since then the price of gold has continued lower, punctuated with minor rallies, with last week’s effort to regain the $1200 per ounce level duly snuffed out. Gold closed the week at $1177.80 per ounce on the daily chart.

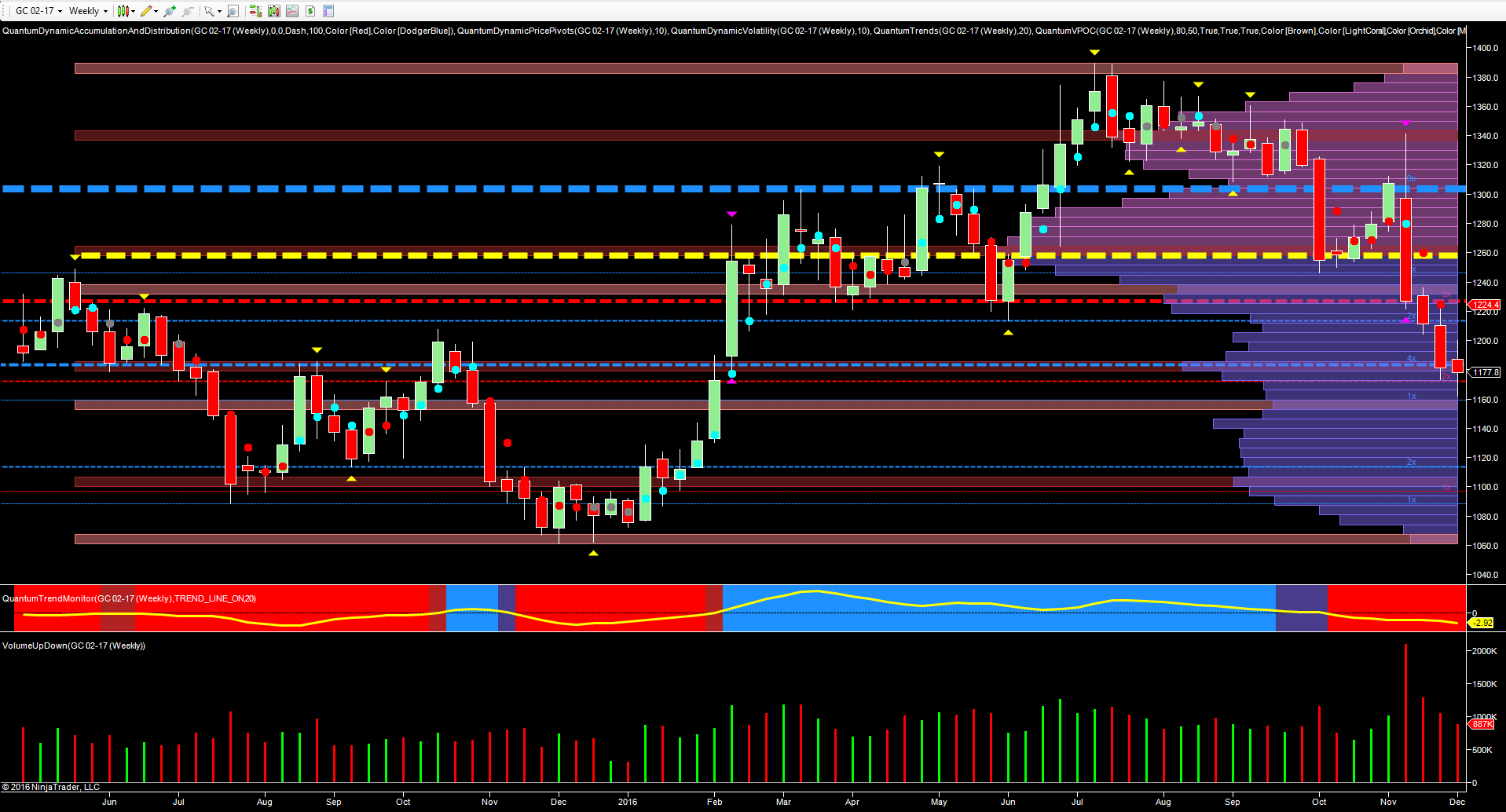

And with a much vaunted rate hike from the Fed now waiting around the corner, the outlook for gold looks bleak. Whilst the daily chart confirms the negative sentiment, it is perhaps the weekly chart which provides further technical evidence which confirms this picture.

First we have the extremely strong resistance overhead in the $1300 per ounce area, denoted by the blue dotted line. Below this, is our volume point of control, denoted by the yellow dotted line in the $1260 per ounce area, adds its own downwards pressure.

Next, comes the platform of support at $1225 per ounce which failed to halt the progress lower, and is now yet another area of strong resistance to any recovery. Finally, last week, whilst the candle itself closed as a doji, further potential support was taken out in the $1185 per ounce area.

The only glimmer of hope is the declining volume associated with the four consecutive down candles. This suggests the heavy selling pressure is waning, and given the indecision of the doji candle, we may see a congestion phase build in due course, with a potential rally higher.

Longer term however, the outlook for gold still remains very bearish, and with a low volume node below in the $1160 per ounce area, any move through here will see gold set to test potential support in the $1090 per ounce area, and down to $1060 per ounce into next year.