by Eli Wright

Though the results of Italy's much awaited constitutional referendum were no surprise, (polls actually got this one right), still Matteo Renzi's stinging defeat yesterday puts the Italian financial sector, and perhaps its future in the EU into question. As Renzi promised should the referendum not pass, he announced his intention to resign, which could happen as early as this afternoon in Italy.

Renzi's resignation could immediately trigger an Italian—and perhaps even Eurozone—banking crisis. As we wrote here on Thursday:

Italy is the eurozone’s third-largest economy, but the banking industry there is on precarious footing, currently grappling with over €200 billion in non-performing debt (from approximately 10 times as many unpaid loans compared to US institutions). So far this year, Italian banks have underperformed their European peers by 40%. For Italian bank shares the price of a “no” vote may already be priced in. However there’s a risk that as many as eight Italian banks could fail, which could become a contagion for other European banks. Unicredit (MI:CRDI) (MI:CRDI), Italy’s largest bank, Spain’s Banco Popular (MC:POP), Portugal’s Caixa Geral de Depósitos and even Germany's Deutsche Bank (DE:DBKGn) (DE:DBKGn) may end up seeing their shares battered.

The world's oldest bank, as well as Italy's third largest, Banca Monte dei Paschi (MI:BMPS), is in the most immediate trouble, having failed the ECB's recent stress test, and is in need of a rescue from somewhere. They have a meeting with JP Morgan and Italian investment bank Mediobanca advisors today regarding how to recapitalize in light of adverse market conditions.

In light of risks coming out of the Eurozone, markets will start this week on shakier footing. Though November was a great month for Wall Street, current event risk from the Eurozone could see US markets move lower this coming week. During November the Dow had a 1,000-point gain, to surpass 19,000 and increased 5.4%; the S&P 500 gained 3.4%; and the NASDAQ was up 2.6%. The smallcap Russell 2000 outperformed them all with a November jump of 11%, its best month in five years. Each of the four indices reached record highs.

However, after nearly three weeks of solid gains, the stock market finally took a break throughout last week. The Dow edged up 0.1%, the S&P slipped 1%, and the NASDAQ reversed 2.7%.

In Asia overnight the Italian referendum outcome took its toll: the Nikkei fell 0.82% to close at 18,274.99; the Shanghai Composite dropped 1.22% to 3,204.35; the Hang Seng dipped 0.33% lower, to 22,490.

In Europe markets opened higher: the FTSE is up 0.46% currently at 6,762; the DAX is up 1.64%, currently trading at 10,686 and the Stoxx 50 is up 1.38% to 3,059.

In US pre-market trading the S&P is up 0.38%, the Dow is up 0.42% and the NASDAQ is up 0.46%

The bond sell-off continued for most of last week, but has eased up following Friday's NFP report: 2-year bond yield is now 1.096%; 10-year yield is 2.371%; 30-year yield rose to 3.037%.

Forex

Last week provided mostly good news about the US economy. Data highlights included: Tuesday’s Q3 GDP reported an increase of 3.2% – the best quarterly pace recorded in two years. Friday’s NFP release showed 178,000 new jobs created in November, but the headline number turned out to be the unemployment rate which fell to 4.6%, the lowest level in nine years. If there was any disappointment with Friday's release it came from the wage growth, which fell 0.1%, instead of a 0.2% expected increase.

Last Friday’s NFP was the last major employment report prior to the Fed's next meeting which begins on December 13. It is almost certain a rate hike will follow. The approach of an almost certain rate hike has been one of the major catalysts driving the recent surge in the dollar. Barring an economic surprise, Trump’s policies after he takes office in January will determine whether the dollar’s bullish trajectory continues.

The recent dollar sell-off has spelled good news for the Canadian dollar, which gained 0.2% to end last week as oil prices rallied following an actual OPEC deal to cut production. Canadian data last week was also better than expected, with encouraging GDP and job growth numbers. CAD could extend to 1.31 next, although if the USD strengthens, it could fall to 1.35, close to its nine-month lows. It’s currently at 1.3321.

Fellow commodity currencies, AUD, NZD, and RUB gained last week as well, as did safe haven currencies such as the Japanese yen and Swiss franc. A rising dollar this morning has since erased some of those gains.

The pound and euro both ended the week up. However, both currencies took a tumble today, in response to Italian referendum results. The euro especially fell to a 20-month low before regaining some ground. GBP/USD is currently at 1.2698; EUR/USD is at 1.0598 and is nearing critical major support level around 1.04.

ECB President Mario Draghi is speaking at 9 AM ET this morning and his comments will help determine what happens next within the Eurozone. The ECB will meet again on Thursday to discuss an extension of its QE program. Due to the voting results in Italy and resultant turmoil, they may also have to discuss buying Italian bonds to quiet unsettled markets.

Commodities

Oil prices took a sizeable leap last week when OPEC members agreed on a deal to limit output by 1.2 million barrels per day (about 2% of global oil production). Crude is currently trading at $52.18, while Brent is at $55.09.

A continuing oil rally could now depend on non-OPEC members such as Russia also committing to cut output when OPEC meets next on December 9. Longer-term, prices will also depend on the ability of OPEC members to stick to their quotas, despite the obvious incentives to cheat and profit from a few extra barrels produced on the side.

Oil could also receive a boost as the permit to build the Standing Rock section of the Dakota Access Pipeline was denied following weeks of protest by Native Americans and environmentalists. The setback may only prove temporary; the US Army Corps of Engineers will look for an alternative route for the pipeline.

Gold ended the week on a slightly higher note, rising 0.82%. However, with strength returning to the dollar in today's trading, as well as the belief that a mid-month rate hike is imminent, gold will likely head back down again. It’s currently trading at $1,166.75

Stocks

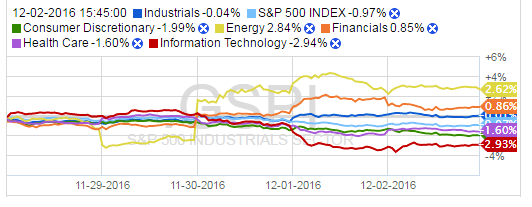

As mentioned earlier, Wall Street finished the week down. However, the Financial and Energy Indices showed gains on the week, finishing on positive notes.

Source: Fidelity.com

Within the Energy sector, a number of companies performed well. Whiting Petroleum (NYSE:WLL), RPC (NYSE:RES), Transocean (NYSE:RIG), EOG Resources (NYSE:EOG), Sunoco LP (NYSE:SUN), and Continental Resources(NYSE:CLR) all pushed higher by 10-30% since the OPEC production freeze announcement. However, several Big Oil stalwarts, such as Exxon (NYSE:XOM) and Chevron (NYSE:CVX) saw only small, 2-3%, gains.

Goldman Sachs analysts see oil prices hovering around $55 through the first half of 2017, which means smaller drillers like EOG Resources, who say they are more agile today after below-$50 oil forced severe cost-cutting measures in order for them to remain profitable, are put in a strong position to prosper as the price of oil rises. Big Oil companies, like Exxon, Chevron, or Royal Dutch Shell (NYSE:RDSb), may see fewer benefits at this price point.

After performing well early last week on the tails of positive Black Friday/Cyber Monday sales the Consumer Discretionary Index lagged at the close of the week as a result of broader profit taking, finishing down 2%. However, the National Retail Federation expects total holiday season sales to grow by approximately 3.6% this year, to $655.8 billion. If so, the retail sector could see a boost.

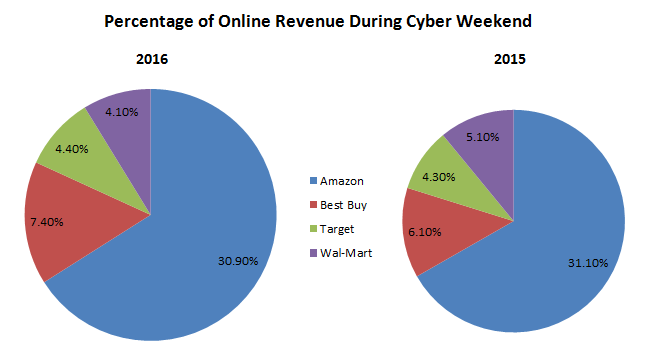

The bigger question is whether any e-tailer can mount serious competition to Amazon (NASDAQ:AMZN), which accounted for fully 30% of Cyber Weekend revenue. Shares of brick-and-mortar retailers Best Buy (NYSE:BBY), Target (NYSE:TGT), and Wal-Mart (NYSE:WMT) are all up. However, many people expected Wal-Mart’s investment in online sales to have moved it ahead of Target when in fact, Target’s slice of the Cyber Weekend pie eclipsed that of Wal-Mart, 4.4% to 4.1%. Wal-Mart’s percentage of online revenue actually declined by 1% YoY.

Source: Slice Intelligence

Christmas sales may be a given this time of year, the notion that a Santa Rally in December is assured might just be a myth.

Financials received a 0.85% boost to close the week in the black. This may have partly been due to Trump appointing former Goldman Sachs banker Steve Mnuchin as the next Secretary of the Treasury. Trump still needs to fill several other Treasury posts, as well as nominate the next head of the SEC. His selections could have an impact on the financial and banking sectors this week as could blow-back from the Italian/Eurozone banking sectors.

After a quiet week, earnings are set to pick up again, with AutoZone (NYSE:AZO) reporting on Tuesday, Costco (NASDAQ:COST), Lululemon (NASDAQ:LULU), and H&R Block (NYSE:HRB) reporting on Wednesday, Broadcom (NASDAQ:AVGO) on Thursday, and Vail Resorts (NYSE:MTN) on Friday.