by Pinchas Cohen

Key Events

- Yesterday, bullish sentiment reigned with multiple record-highs hit in the US and globally

- Today, investors are displaying a case of fear of heights

- European shares were dragged down by miners on falling industrial metals

- Apple underwhelms; falls within an exceptionally bullish rally, dragging down suppliers

- Sterling extends yesterday’s high of the year, after BOE warns of rising interest rates and surprise inflation

- OPEC / NOPEC bullish announcement greeted by oil declines

Global Financials

Yesterday, the three main US indexes – the Dow Jones Industrial Average, the NASDAQ Composite and the S&P 500 all registered record closes, with the SPX also hitting a fresh record high. All the US benchmarks closed near their highs, demonstrating that bears were overwhelmed, as the bulls advanced with little or no resistance.

The US market wasn’t alone. The MSCI All-Country World Index registered what may be an unprecedented, back-to-back triple-whammy: a record close, record high and a close at the index's highest point of the day. This may prove to validate that markets are signaling it's an exceptional risk-on environment, which isn’t merely bullish but rather totally carnivorous.

Bears strategically focused their resistance on Apple (NASDAQ:AAPL) and some of its biggest suppliers, after investors found yesterday's much heralded—and anticipated—gadget and iPhone unveiling less than inspired.

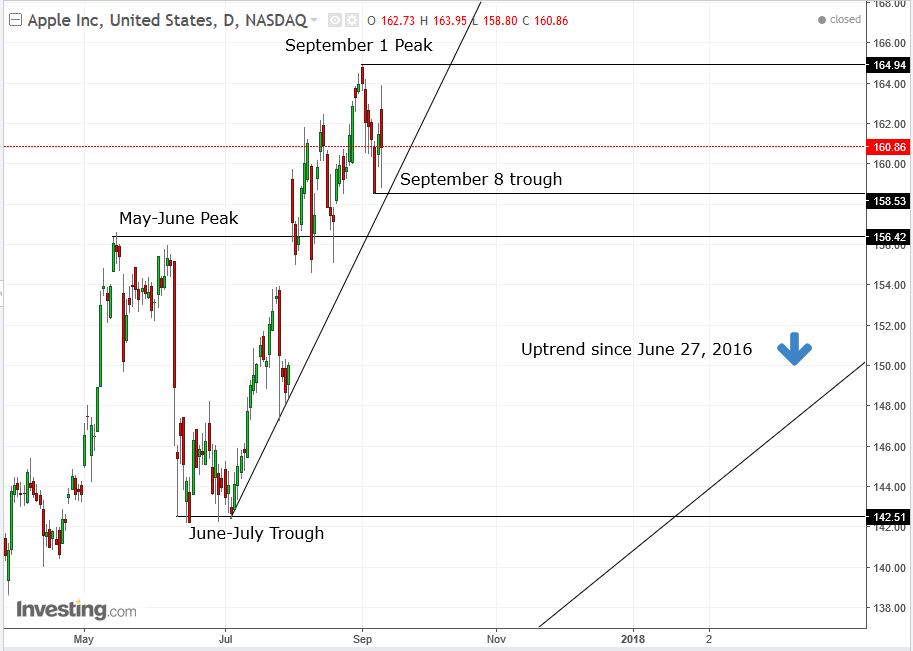

The company's share losses were pared after the stock bounced off the $159 price area, where buyers bought on the dip to the September 8 trough, above the uptrend line since July 6. Should the price rise above the September 1, $164.94 high, it would be an indication of the trend’s integrity; a close below the $156 level, under the uptrend line since June 6, as well as the May-June peak, would suggest a potential decline to the longer uptrend line since June 27, 2016, when Apple joined the post-Brexit vote rally.

That uptrend line, is now at $136 and rising. The next horizontal support is the June-July $142 trough, where buyers who contributed to the 15 percent, $165 move would be tempted to give it another go and sellers who lost money at that time may want to make it back. Sideliners who felt left out may want to join the party too. All would be providing demand, supporting the price.

Today, global stocks slowed their advance, as investors took a breather, on concerns they went too far. While Japanese and Australian shares advanced, Hong Kong equities declined, and shares of Apple suppliers in Asia, such as Hon Hai Precision Industry (TW:2317) and Pegatron Corp (TW:4938) which trade in Taiwan and AAC Technologies Holdings (HK:2018) which trades in Hong Kong, extended yesterday’s slide, taking their cue from US trading and speculative Apple traders who were unimpressed with yesterday’s big reveal.

European and US futures weakened ahead of equity market opens, while the VIX, also known as the 'fear' gauge, is on the rise, after reaching the support of its uptrend line, the bottom of a triangle – the pinnacle of which may prove a catalyst – as opposing emotions, greed and fear, collide.

The European equity market opened on a sour note, with the Stoxx Europe 600 down after a six day rally, as miners fell along with most industrial metals.

Accordingly, the dollar lost its bounce, after its 1.15 percent rebound from last Friday’s 91.01 low, in a correction within a downtrend, after having completed a bearish flag pattern.

The 10-year Treasury yield declined for the first time after advancing for 4 straight days.

It moved lower from its newest, September 8, 2.016 trough in the shape of a high wave candle, after falling below the June 14, 2.103, previous trough, a 7.9 percent shift toward its uptrend line since July 7, connoting fear, as investors waver to and fro, unsure of where to go next.

Similarly, all other havens are rising, including the Swissy, the yen and gold; the VIX elevates, as both US and global stocks reach unprecedented highs, even as Pyongyang announced its acceleration toward a nuclear weapon with which to attack the US homeland itself, not just US bases abroad, and after Treasury Secretary Steven Mnuchin threatened additional sanctions on China – to include blocking access to the US financial system – pending its disunity in adhering to the new UN restrictions.

Crude oil’s advance is losing its grip. The commodity's price is falling even after OPEC and NOPEC hold talks on extending production limits.

The decline, even though the leaders of both groups, Saudi Arabia and Russia, suggested rolling cuts into the second half of 2018—allowing for a longer extension depending on market conditions—is yet another in a series of signs that OPEC and NOPEC have been losing their grip along with control of prices. Investors may still be concerned over the global glut, and these fears are quantified and visually plotted in the chart above, via the falling trading channel since February, in which both buyers and sellers agree that prices should fall, as buyers buy only on ever lower dips and sellers likewise sell at ever lower peaks.

Sterling extended yesterday’s advance. It hit a one-year high, spurred by a surprise 2.9 percent inflation reading, beating the 2.8 percent forecast, just one day after the BOE warned of complacency and underestimating rate rises, ahead of the Bank of England’s policy meeting on Thursday.

Still, investors aren't convinced there's a hike on the way, at least not this Thursday, as interest-rate futures show a mere 7 percent probability of a hike, up from 5.3 percent before both the warning and the inflation data release. Nevertheless, the pound registered a new peak, though it is nearing the top of its rising channel since October, which suggest a correction toward 1.3000.

Up Ahead

- U.S. producer price data is due today, followed by consumer prices on Thursday.

- The U.K. reports wage data Wednesday. The Bank of England will almost certainly leave policy unchanged Thursday.

- Also scheduled this week is data on China’s August industrial production, retail sales and fixed asset investment.

- Australia releases jobs numbers on Thursday.

Market Moves

Stocks

- Japan's TOPIX rose 0.6 percent at the close in Tokyo.

- Australia’s S&P/ASX 200 Index was little changed and the KOSPI in Seoul finished the session 0.2 percent lower.

- Hong Kong’s Hang Seng Index fell 0.3 percent, while the Shanghai Composite Index fluctuated.

- Apple suppliers, Hon Hai Precision Industry Co. and Pegatron Corp. fell, weighing on the Taiex Index index, which was down 0.7 percent.

- The MSCI Asia Pacific Index added 0.1 percent.

- The Stoxx Europe 600 Index decreased 0.2 percent as of 8:08 a.m. London time, the first retreat in more than a week on a closing basis.

- S&P 500 Futures declined 0.1 percent.

- The MSCI All-Country World Index increased less than 0.05 percent, hitting its highest point on record with this sixth consecutive advance.

- The MSCI Emerging Market Index fell 0.1 percent, the first retreat in a week.

- The U.K.’s FTSE 100 fell 0.5 percent, the biggest fall in a week.

Currencies

- The Dollar Index declined 0.15 percent.

- The yen advanced 0.25 percent to 109.97, falling the psychological round number.

- The euro increased 0.1 percent to $1.1978.

- The Swissy added 0.15 percent to 0.9587

- The British pound climbed 0.3 percent to $1.3326, the strongest in a year.

Bonds

- The yield on 10-year Treasuries dipped one basis point to 2.16 percent.

- Germany’s 10-year yield declined one basis point to 0.39 percent.

- Britain’s 10-year yield advanced one basis point to 1.087 percent, the highest in five weeks.

Commodities

- Gold gained 0.15 percent to $1,337.20 an ounce.

- West Texas Intermediate crude dipped 0.1 percent to $48.16 a barrel.

- Copper declined 0.7 percent to $3.02 a pound, the lowest in almost three weeks.