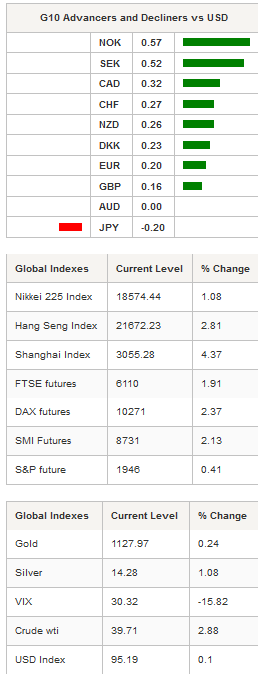

Wall Street put an end to a six-day losing streak and showed Asian stock markets the way up. The S&P 500 added 3.90%, erasing completely previous day losses, the Nasdaq gained 4.24% while the most popular Dow Jones gained 3.95%. Asian markets have not been left behind and benefit from US optimism as fears ease. In mainland China the Shanghai adds 4.37% while the tech-heavy SZSE Composite edges higher by 2.58% as the People’s Bank of China eased further monetary policy and injects CNY150bn through reverse repos funds. However in early session, traders were still suspicious of Chinese shares and seemed to favour other Asian regional markets as both Shanghai and Shenzhen were trading lower during the Asian morning. In Hong Kong the Hang Seng adds 2.81% while in Tokyo the Nikkei 225 adds 1.08% and the TOPIX 1.45% as Kuroda reaffirmed its trust in the Japanese economy’s ability to reach the 2% inflation target with the current level of stimulus. However, the BoJ is ready to make necessary adjustment if needed. USD/JPY’s response was muted as the pair has been treading water in the Asian session, moving between 119.70 and 120.37. The incertitude surrounding the upcoming decision from Federal Reserve to start hiking interest rate together with the second read of US Q2 GDP due later this afternoon are preventing trader to start building strong long USD position.

Wednesday, New York Fed Chief William Dudley said that “the decision to begin the normalization process at the September meeting seems less compelling to me than it did several weeks ago. But normalization could become more compelling by the time of the meeting as we get additional information”. Even though Mr. Dudley hopes the Fed will be able to raise interest rates this year, he reiterated the well-known “data dependant” argument. After having fallen almost 2% yesterday, EUR/USD stabilised around 1.1350 this morning ahead of US GDP figures. US Q2 GDP is expected to be revised up to 3.2% annualised from 2.3% first estimate. A higher read would certainly accelerate the dollar rally, bringing the single back to 1.12, at least.

In Australia, Q2 private capital expenditure came in on the soft side as it contracted 4%q/q versus -2.5% median forecast. On the bright side, the fall is marginally slower than a revised contraction of 4.7% (from 4.4%) during the first quarter. AUD/USD fell on the news and is now trading slightly above the $0.71 threshold. On the equity front, Australian shares added 1.17% in Sydney while in New Zealand the S&P/ASX 200 gained 1.02%.

In Europe, futures are all trading into positive territory with the German DAX up 2.37%, CAC 40 2.36%, FTSE 100 100 1.91%, SMI 2.13% and Euro Stoxx 50 2.20%. GBP/USD lost as much as 2.30% in less than 2 days and is now stabilising just above the 1.5161 level implied by the 61.8% Fibonacci retracement on June rally. On the downside the closest support can be found at 1.5330 (low from July 8) while on the upside the next resistance stands at 1.5550 (Fib 50%)

Currency Tech

EUR/USD

R 2: 1.2252

R 1: 1.1871

CURRENT: 1.1338

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5485

S 1: 1.5425

S 2: 1.5330

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 120.17

S 1: 115.57

S 2: 113.86

USD/CHF

R 2: 0.9904

R 1: 0.9588

CURRENT: 0.9525

S 1: 0.9151

S 2: 0.9072