Tuesday May 23: Five things the markets are talking about

Trump risk and geopolitical concerns triggered by the U.K news overnight has investors prone to risk-aversion moves.

The yen has rallied and the pound has dropped along with stocks, as the market turns cautious after a suspect terrorist bomb attack in the U.K. and the latest reports on the Trump administration.

In the U.S., political wrangling returns to the fore, taking the focus away from global economic growth. It’s being reported that President Trump asked intelligence chiefs to publicly deny any collusion between his campaign and Russia.

Also, the White House is set to deliver Trump’s first full budget to lawmakers later today. The plan is to cut -$3.6T in government spending over 10 years – Investors should expect fallout.

1. Stocks mixed results

Risk aversion mood has kept many investors on the sidelines overnight.

In Japan, the Nikkei stock average fell -0.1%. Its broader TOPIX dropped -0.2%.

In South Korea, the KOSPI rallied +0.3%, while in Hong Kong, the Hang Seng fell -0.1%.

In China, the Shanghai Composite Index lost -0.5%.

The selloff of Brazilian assets has resumed, the Ibovespa index has slumped another -3.9% in overnight trading as a political crisis has returned to the country after last year’s impeachment process.

In Europe, regional indices are trading modestly higher buoyed by stronger PMI and IFO data out of Europe (see below). Some positive earnings results are also adding to the sentiment.

U.S stocks are set to open in the black (+0.1%).

Indices: Stoxx50 +0.6% at 3598, FTSE +0.2% at 7509, DAX +0.3% at 12660. CAC 40 +0.7% at 5359, IBEX 35 +0.9% at 10885, FTSE MIB +0.6% at 21449, SMI -0.4% at 9049, S&P 500 Futures +0.1%

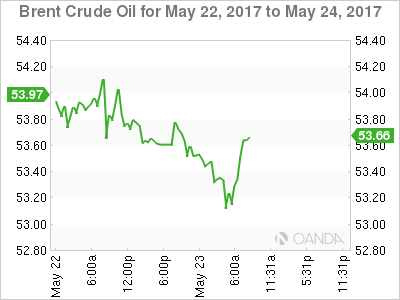

2. Oil prices fall on White House proposal to sell U.S oil reserves, gold unchanged

Ahead of the U.S open, oil prices are under pressure, weighed down by Trump’s plan to sell off half of the U.S.’s stockpile, threatening a future and further “glut” despite OPEC trying to tighten the market.

Brent crude has ended a run of four consecutive session gains to trade -36c lower at +$53.51 per barrel. U.S. light crude (WTI) is down -33c at +$50.80.

Note: The White House plans to sell -50% of its oil stockpile from 2018 to 2027 to raise +$16.5B to help balance the budget. The budget is to be delivered to Congress today.

OPEC meets on Thursday, May 25 and are expected to extend the period of their pledge to cut output by -1.8m bpd from just the first half of this year to all of 2017 and the first quarter of 2018.

Note: Yesterday, Kuwait’s oil minister said ‘not’ all OPEC countries and allies were on board for a nine-month extension and producers would discuss this week whether to extend output cuts by six or nine months.

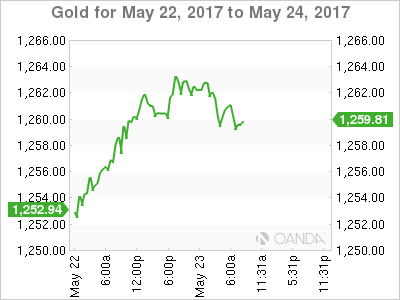

Gold prices are little changed (+$1,259.49 per ounce) despite the geopolitical events overnight. President Trump controversies and a weaker USD have been providing the yellow metal support over the past week.

Note: Spot gold advanced +2.2% last week over Trump’s alleged links to Russia and his firing of former FBI chief James Comey raised concerns about his ability to push through promised fiscal stimulus.

3. U.S debt supply to back up yields

This week’s U.S Treasury debt supply is expected to back up U.S yields a tad. Today, there is +$26B sale of two-year notes is due, followed by +$34B five-year notes tomorrow and +$28B sale of seven-year notes Thursday.

Ahead of the U.S open, 10’s are trading at +2.24%. U.S. yield have been under pressure by political worries out of D.C. that is deflating investors’ optimism towards a rollout of large fiscal stimulus this year.

Note: The Fed’s minutes for May are due tomorrow afternoon. The market will focus on clues about the pace of interest-rate increases as well as discussions about how to wind down the Fed’s balance sheet.

Currently, fed funds show a +79% chance that the Fed would raise short-term interest rates at its June 13-14 meeting – the odds was at +74% on Friday and +51% a month ago.

Elsewhere, yields on Aussie debt lost -4 bps to +2.45%, while German bunds slipped -1 bps, France and the U.K fell -2 bps.

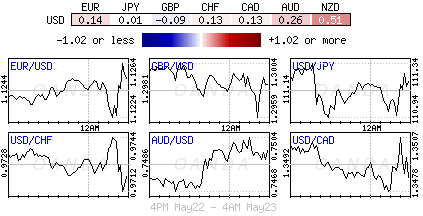

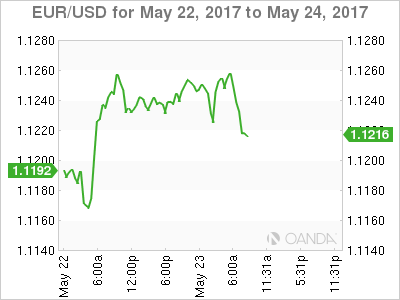

4. U.S. dollar losing its luster

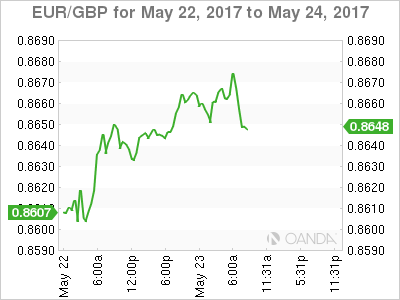

The EUR/USD (€1.1258) trades atop of its six-month high aided by yesterday’s comments from German Chancellor Merkel reiterating that the large German surpluses are being “aided by a weak EUR currency.” Other regional data (see below) this morning is also providing the single unit support.

The pound (£1.2988) is off its overnight highs on the terror incident in Manchester, but still within reach of the psychological £1.3000 handle. However, to many, £1.3000 is considered the key pivot and with any momentum through theses levels expect the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

JPY (¥111.14) has befitted from safe-haven flows following the U.K terror incident.

5. Eurozone composite PMI stronger than expected

Data this morning showed that the composite PMI for the eurozone was slightly stronger than expected in May, with an unchanged reading of 56.8 comparing to a consensus forecast for a slight drop to 56.6.

Digging deeper, it’s a six-year high and points to robust growth in Q2. Most of the support comes from France and Germany, both of which recorded significant increases, while other economies slowed.

The surveys also pointed to a possible weakening of activity in coming months, with new orders at their lowest for four-months. Inflationary pressures have also eased slightly.