Tuesday December 19: Five things the markets are talking about

As is widely expected, markets remain stable and contained within tight ranges through the last few session of the pre-Christmas week.

Developed market volatility is at its lowest level in nearly three-years, but given the sensitivity currently being shown to political developments, investor caution is a necessity.

Today’s main focus will be the progress of the U.S tax reform bill, with the House of Representatives expected to vote on it this afternoon, followed by the Senate either today or tomorrow.

In the U.K., a full cabinet discussion on the future trading relationship with the EU is taking place, following yesterday’s preliminary discussions. Sterling beware, the market is expecting that the second stage of Brexit negotiations to be more challenging than the recently concluded initial discussions.

1. Stocks look to U.S Tax Bill for support

In Japan, regional equities eased overnight in choppy trade as construction shares extended losses on bid-rigging scandal. The Nikkei ended -0.2% lower, while the broader Topix shed -0.3%.

Down-under, Aussie shares closed near their decade high overnight as optimism over the U.S tax bill boosted investor sentiment. The S&P/ASX 200 index rallied +0.5%, while in Korea’s KOSPI edged -0.1%

In China and Hong Kong, stocks followed Asian markets higher, inspired by a record-setting session on Wall Street. The Shanghai Composite index was up +0.53%, while the blue-chip CSI300 index was up +0.8%. In Hong Kong, the Hang Seng index was up +0.7%, while the Hang Seng China Enterprises index rallied +1.11%.

In Europe, regional indices trade higher across the board continuing the upward trend as year-end approaches, supported by positive investor sentiment on U.S tax reform, as well as a continued elevated German Ifo reading this morning (see below).

U.S stocks are set to open in the black (+0.1%).

Indices: STOXX 600 +1% at at 393.1, FTSE +0.2% at 7554, DAX flat at 13317, CAC 40 -0.1% at 5416, IBEX 35 +0.3% at 10275, FTSE MIB +0.1% at 22420, SMI +0.1% at 9460, S&P 500 Futures +0.1%

2. Oil rallies on U.K pipeline issues, gold stable

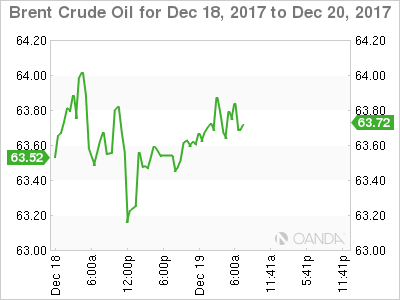

Oil prices remain better bid amid an ongoing North Sea pipeline outage and because a strike by Nigerian oil workers threatened its crude exports. Also, signs that booming U.S. crude output growth may be slowing is also supporting the market.

Brent crude futures are at +$63.72 a barrel, up +49c or +0.8%, from yesterday’s close. U.S. West Texas Intermediate (WTI) crude futures are at +$57.70 a barrel, up +40c or +0.7%.

North Sea operator Ineos has declared “force majeure” on all oil and gas shipments through its Forties pipeline system, while in Nigeria, the Petroleum and Natural Gas Senior Staff Association have started industrial action after talks with government agencies ended in deadlock.

With oil inventories falling globally, investors will take direction from this week’s supply reports. Today’s API data (4:30 pm EDT) is expected to show a further reduction in U.S crude inventories.

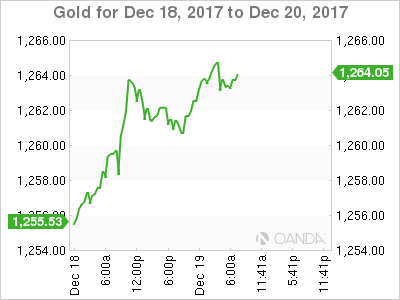

Gold prices remain range-bound as the ‘big’ dollar holds firm on U.S tax bill hopes. The ‘yellow’ metal has increased +0.2% to +$1,263.21 an ounce, the highest in more than a week.

3. Sovereign yield rise on U.S tax optimism

Global bond yields have edged up ahead of the U.S. open as the market bets that U.S. lawmakers will finally pass Trump’s tax legislation this week that could boost growth and inflation.

Note: A view that interest rates will rise over the short-term, but inflation will remain subdued over the long term, has dominated the yield “flattening” trade.

The spread between U.S. shorter-dated and longer-dated Treasury yields widened yesterday from its narrowest in a decade on profit trading.

The yield on U.S. 10-year Treasuries has backed up +1 bps to +2.39%. In Germany, the 10-year Bund yield has advanced +1 bps to +0.32%, while in the U.K., the 10-year Gilt yield has also climbed +1 bps to +1.158%.

Down-under overnight, the Reserve Bank of Australia’s (RBA) Dec. minutes reiterated that the low level of interest rates was continuing to support the Australian economy with inflation to pick up gradually as the economy strengthens. Policy makers also noted that an appreciating FX rate would be expected to result in a slower pick-up in economic activity and inflation than currently forecasted.

4. Dollar stays calm

On Monday, the ‘mighty’ U.S dollar was mostly weighed down by worries that the Fed may not raise interest rates at a faster pace in 2018 despite solid U.S growth.

Despite the Fed raising interest rates by +25 basis points last week, the central bank did not revise its long-term views on inflation, and stuck to its earlier projections of three rate increases next year. A percentage of the market had expected the Fed to change its viewpoint in light of more robust economic growth.

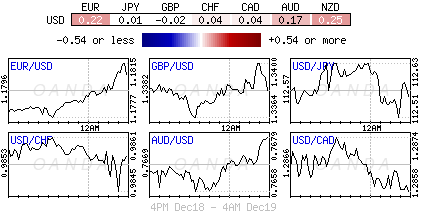

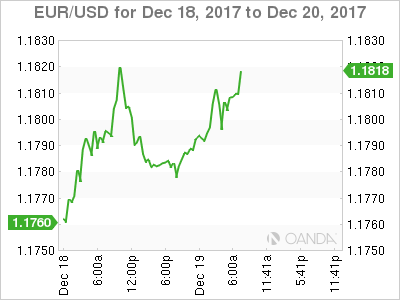

The overnight session saw a relatively subdue price action, but the USD remains a tad softer as the market continues to assess the potential impact of U.S tax bill. The EUR/USD (€1.1806) is a tad higher by +0.2%, while GBP/USD (£1.3370) trades further away from strong resistance at the £1.3400 handle. USD/JPY remains unchanged at ¥112.60.

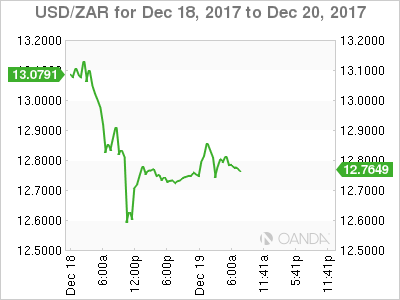

The ZAR ($12.7852) has seen some of yesterday’s strong gains retrace in the aftermath of the ANC party leadership vote outcome. It’s been a wild +7-8% swing for the currency over the past couple of sessions. The USD/ZAR tested $12.40 area after market-favored Ramaphosa was formally elected.

Bitcoin was last down -1.04% at $18,763, following an early-week fall amid the launch of CME futures trading.

5. German Ifo and E.U Labour costs

German data released this morning showed that Dec Ifo at 117.2 was a tad lower than the forecast of 117.5.

The small decline in the business sentiment from a record high suggests that the outlook for next year is bright despite the uncertain political backdrop and the prospect of ECB QE tapering. But with wage growth still very subdued in Q3, the ECB will be in no hurry to raise interest rates.

Elsewhere, the annual growth rate of euro-zone total hourly labour costs slowed from +1.8% in Q2 to +1.6% in Q3. Digging deeper, wage growth also fell (from +2.1% to +1.6%).

With productivity growth running at around +0.8%, this implies that unit labour costs are increasing at a very “modest” pace which is somewhat inconsistent with the ECB’s near +2% inflation target.