by Eli Wright

Without doubt, Wednesday's much anticipated Fed Interest Rate Decision will be the primary market driver this week. For today, the current oil surge in oil price is also a key factor.

The Fed's final monetary announcement of 2016, whether or not it will hike rates on December 14, is basically a foregone conclusion. Currency, equity and commodity markets will be closely monitoring the Fed’s actions on Wednesday, as well as what's said about plans for follow-up rate hikes in the year ahead. The dollar’s appreciation and a rise in bond yields might dampen growth and lower inflation. However, it’s not outlandish to expect two more rate increases in 2017, which could still keep markets buoyant.

Oil will likely also propel markets, at least to start the week. On Saturday, non-OPEC members agreed to cut oil production by 600,000 barrels per day. When added to the OPEC cuts agreed to on November 30, that’s a full two percent drop in output.

In Japan, the weaker yen helped boost markets; the Nikkei rose 0.84% overnight, to close at 19,155.03. China cracked down on stock buying by insurance firms today. As a result, the Shanghai Composite, which had been advancing on strong buyer sentiment, retreated 2.4% to 3,153.93, the largest single-day loss since June. The Hang Seng fell 1.69%, to 22,377, after markets were thrown a wrench when Trump said in an interview with Fox News on Sunday that he saw no reason why the US should be bound by a “One China” policy under which Taiwan is officially regarded as part of mainland China.

In Europe, markets are currently down: the FTSE is down 0.2% in early trading at 6,941; the DAX is down 0.34% to 11,165.5. The Stoxx 50 is down as well, 0.1% to 3,196.

Wall Street majors all closed at record highs last week: the Dow rose 500 points to close at 19,756.85; the NASDAQ rose 0.5% on Friday to finish at 5,444.50, while the S&P 500 ended 0.6% higher, at 2,259. The Russell 2000 also finished at an all-time high, up 0.09%, to 1,388.66.

For today, markets could edge higher in advance of the Fed rate hike and as the Dow reaches higher, toward the 20,000 mark. However, watch the pre-market for signs of a profit-taking pullback. Thus far in pre-market trading the action has been mixed. The Dow is down 0.06%, the S&P and NASDAQ are both up, approximately 0.03% each.

The selloff in US bonds is deepening and yields are up across the board: the 2-year yield is at 1.153%; the 10-year yield 2.513% and the 30-year yield is 3.203%.

Forex

The euro is higher in early trading this morning. However, with markets pricing in the high probability of a rate hike on Wednesday, in conjunction with the ECB decision late last week to extend QE measures for another year, the outlook for the single currency remains bearish. The uncertainty in Italy following the referendum vote and the potential appointment of Foreign Minister Paolo Gentilone to replace Prime Minister Matteo Renzi will also continue to weigh on the euro. Parity might not occur before the end of the year but it could happen relatively soon.

Like the euro, sterling is also higher this morning. However the Fed decision will likely weigh on it, too. The BoE has a rate decision on December 15, but it is unlikely the central bank will do anything, given the proximity to the Fed’s announcement and the uncertainty over triggering Article 50 (the start of Brexit) early next year. UK inflation data comes out two days before the BoE statement, which means their announcement will reflect the most up-to-date information regarding the state of their economy.

The yen is trading lower against the dollar, a boon for Japan, since investors leaving the safe-haven currency make the country's exports more affordable.

A shock to the Dollar Index only seems likely if the Fed raises rates more than 25 bp (highly unlikely given their cautious stance) or completely fails to raise rates (also unlikely, since the Fed wants room to maneuver in a slowly improving economy with a new President about to take office).

Commodities

Oil prices shot up over five percent this morning, to the highest levels since mid-2015, after non-OPEC countries agreed to join OPEC in cutting production. Brent is currently trading at $56.92 while crude is at $53.98.

With the deal to curb output now in place, the focus now becomes compliance:

“We believe that the observation of the OPEC-11 and non-OPEC 11 production cuts is required to sustainably support... oil prices to our 1H17 WTI price forecast of $55 a barrel,” Goldman Sachs said. “While better compliance than we expect would initially lead to higher prices – with full compliance worth an additional $6 per barrel to our price forecast – we expect that a greater producer response, especially in the U.S., would eventually bring prices back to $55.”

Gold continues to decline. As of this writing, the precious metal has fallen to $1,154. It could fall below $1,100—or even further, to $1,050—before this extreme selling phase passes. Of course, gold’s valuation is closely tied to the USD, and any decision by the Fed this week could influence its trajectory.

Stocks

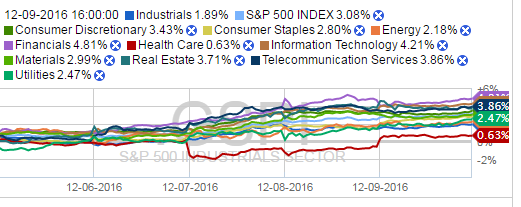

The S&P 500 had a strong week last week, rising 3.08% and closing at a record high of 2,259.53. Energy and Financials had been performing well since the post-election Trump Rally began. Consumer Discretionary has had a positive outlook since holiday season sales forecasts came out – and the Thanksgiving and Cyber Monday billing didn't disappoint. It was encouraging to see last week’s exuberance being led in part by other sectors as well – Consumer Staples, Utilities, Healthcare, and Information Technology.

Source: Fidelity.com

Healthcare lagged the overall S&P on the week. However, it gained 1.23% on Friday alone, boosted by Alexion (NASDAQ:ALXN) which gained 4.82% (and notably, is up 16.24% this past month), as well as Pfizer (NYSE:PFE) and Bristol-Myers (NYSE:BMY), which gained 2.46% and 3.28%, respectively.

Consumer Staples rose 2.8%, bolstered by Dr Pepper's (NYSE:DPS) 3.03% one-day increase on Friday (and 9.06% monthly gain), as well as approximately 2.4% increases by both Coca-Cola (NYSE:KO) (whose CEO announced he will step down in May, to be replaced by President and COO James Quincey) and Monster Beverage (NASDAQ:MNST).

Utilities bounced nearly 2.5% off of NRG Energy (NYSE:NRG) and Exelon (NYSE:EXC), which rose 14.4% and 5.73%, respectively on the week. Interestingly, though NRG has had a good month—up more than 16%, it still hasn't cracked the top ten Utility stocks in YTD performance.

Telecom benefited from the strong performances of Frontier (NASDAQ:FTR), AT&T (NYSE:T), and Verizon (NYSE:VZ), which gained 5.46%, 4.58%, and 3.37%, respectively. AT&T's gains came on the heels of a less combative tone from the senate during hearings this past week regarding AT&T’s proposed acquisition of Time Warner (NYSE:TWX), a deal Trump has openly criticized.

Of the 67 companies in the Information Technology Index, only two – NVIDIA (NASDAQ:NVDA) and Harris (NYSE:HRS), were down on the week. The biggest gainers were Autodesk (NASDAQ:ADSK) (+14%), Western Digital (NASDAQ:WDC) (+9%) and Broadcom (NASDAQ:AVGO) (+8%), covered here, prior to their quarterly earnings report last week.

Energy gained 2.18 percent last week. However, as mentioned at the start of this article, the bump-up in oil prices due to non-OPEC nations agreeing to limit production could provide a boost to a variety of companies in this sector.