by Eli Wright

The market’s response to Donald Trump’s election victory remains surprisingly positive thus far. Still, it's not clear how much longer these gains can continue, nor how much positive Trump-related momentum is already priced in.

Overnight in Asia, the Nikkei hit a 10-1/2-month high and closed up 0.77%, up to 18,106.02; the Shanghai Composite rose a nearly identical 0.76%, to 3,217.17; the Hang Seng ticked 0.16% higher, to 22,379.

In Europe the FTSE is up 0.43% to 6,804.7; the DAX has increased 0.23% to 10,689.5; the Euro Stoxx 50 is 0.29% higher, having risen to 3,033.

The S&P tried to extend its gains on Friday, but ended by closing lower, down 0.24%, to 2,181.90. The next resistance level is 2,193, though traders should anticipate possible profit-taking before Thursday, when U.S. markets will be closed for Thanksgiving. There shouldn’t be too much movement however: the VIX is down to 12.85 and exhibiting a bearish continuation pattern over the past week. 11.40 is the next major support level.

The Dow slipped 0.19% on Friday, closing at 18,867.93, near the all-time highs reached earlier last week. The NASDAQ closed down 0.23%, to 5,321.51. In pre-market trading, the S&P has edged up 0.17% and the NASDAQ is up 0.02%. The Dow has ticked 0.03% lower.

The US 10-year Treasury yield is at 2.332%; the 30-year yield is currently at 3.01%.

Forex

Fed Chair Yellen spoke last Thursday. Her comments bolstered the general consensus that rates will likely rise next month. Most of last week’s economic data (including Retail Sales, CPI, Building Permits and Housing Starts) point to a stronger U.S. economy, which futher enhances the chances of a rate increase. A December rate hike is currently over 95% likely.

“The Committee must remain forward looking in setting monetary policy,” Fed Chair Yellen testified on Thursday. “Holding the rate at its current level for too long could encourage excessive risk-taking and ultimately undermine financial stability.”

A rate hike would almost certainly advance the USD yet further. The US Dollar Index has done gained strongly over the past two weeks, closely tracking Treasury yields. On November 4 the Index closed at 97.09; today it's at 101.10.

The Japanese yen has fallen to its weakest levels versus the dollar since May 30. The next major resistance level is 112, but there should be a bearish reversal before USD/JPY reaches that point.

The euro is currently on a 10-day losing streak. It has already broken the $1.0566 level, an area that was last seen twelve months ago. Last December's daily low, 1.0537 is the next target for the pair.

With the ECB’s divergent monetary policies, not only is parity a possibility for the euro, but Citigroup says it “now predicts the euro will tumble to just 98 cents in the next six to 12 months.”

Whether this prediction plays out remains to be seen, of course: Many analysts believe that too much good news has already been priced in for the USD. Additionally, in contrast to last year’s euro plunge, despite its drop versus the dollar in recent days, the euro is actually up 1.8% against a basket of other currencies that includes all its major trading partners.

Additionally, while analysts believe the Fed wants to raise rates three more times in 2017, no one can be certain how either the U.S. economy or the dollar will perform. “There is clear evidence of better outcomes in countries where central banks can take the long view, are not subject to short-term political pressures,” Yellen said, warning that Trump’s plans for fiscal stimulus and deregulation in the financial sector could derail the Fed’s long-term plans.

ECB President Mario Draghi will speak at 10 AM ET, and his comments may shed more light on the direction the euro will take over the short term.

Commodities

Gold is hovering near six-month lows, at $1214.75 as a stronger USD continues to hamper demand for the safe-haven metal.

The precious metals rebound which occurred earlier in the year went off course in mid-September. While there is no telling how long dollar strength will continue even as volatility remains low, gold is edging closer to $1,200. Should that line be crossed, a bearish scenario would be heavily favored, with the possibility of a quick decline to $1,100 coming into view, followed by perhaps yet further declines.

Silver has been steadily losing value, as well, and currently sits at $16.675.

Copper has climbed approximately 11% since the beginning of November. However, despite hopes for a Trump infrastructure-spending boom, the industrial metal may be overpriced at this point and headed for a downturn. Copper is currently trading at $2.517.

Oil jumped at the end of last week, as renewed hopes emerged for an OPEC production freeze deal. Iranian Oil Minister Bijan Zanganeh said that prices could jump to $55 if an agreement is reached that included non-OPEC members. Of course, we've heard some version of this optimism many times before, so it remains to be seen what will happen at OPEC's November 30 meeting. The strong dollar is currently suppressing oil prices, as are concerns about a U.S. supply glut. Baker Hughes announced last week that the U.S. oil rig count jumped by 19, to 471. Crude is currently trading at $47.13; Brent is at $47.66.

Stocks

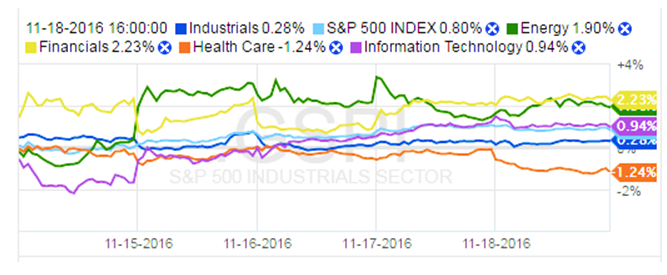

As copper, one of manufacturing's benchmark industrial commodities has fallen, so has the industrial sector as a whole. Last week, the S&P gained 0.76%; In comparison, Industrials rose just 0.18%.

S&P Performance vs Sectors

Source: Fidelity.com

The financial sector rose 2.23% last week, outperforming the S&P, as Wall Street optimism about Trump’s banking policies continued. The energy sector continues to receive a boost from Trump’s energy-independence plans, as well as from the recent (small) surge in oil prices. It moved up last week by 1.9%. IT, which had had been hard hit over the past two weeks, performed better as well, up 0.94%.

The health care sector was pulled 1.24% lower, as investors took profits off the table.

Of note, the Russell 2000 Index has been gaining for eleven straight days now, rising 10% to record highs. It’s currently at 1,317.14. The Russell, which tracks small caps with little exposure to overseas markets, is a good indicator that there remains substantial faith in the US economy moving forward.

With equity markets reaching elevated highs, there may be more profit-taking this week, ahead of the long holiday weekend which begins Thursday.