by Pinchas Cohen

Key Events

- Mixed stocks send investors confused message

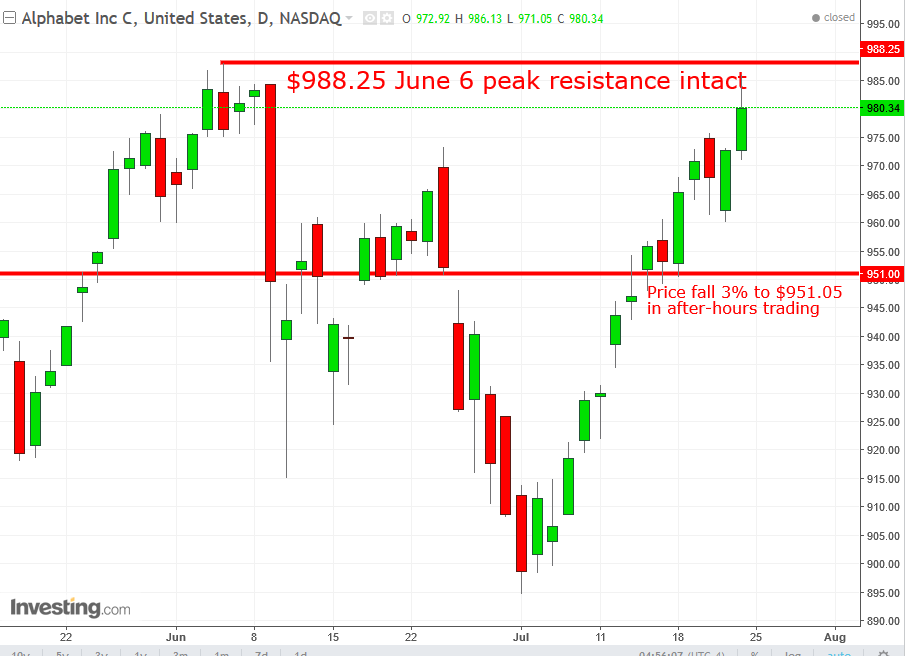

- Lower than expected results for Alphabet, the EU fine and hiding of pertinent information from investors cost the company 3 percent in after-hours trading

- Tech and financials offset a broader decline

- Oil advances on promise for deeper export cuts

- Dollar’s persistent decline, despite four-month high PMI vs the Eurozone’s slowest-in-six-months PMI, carries an ominous message

- All eyes and ears focused on earnings reports and FOMC rate decision

Global Affairs

Yesterday’s Close

Stocks closed mixed yesterday, sending investors a confused message for the rest of earnings season. A good example of investor uncertainty can be seen via Alphabet (NASDAQ:GOOGL) which reported yesterday.

The good news: the $5.01 EPS beat the Street's $4.49 expectations; revenue was up from a year ago, rising from $21.5 billion to $26.01 billion.

The bad news: investors will be sharing $2.7 billion of that revenue with the EU, after courts ruled that Google was abusing its dominance in web search to give an “illegal advantage” to its own shopping service in its results. Furthermore, the company is suffering from a 23 percent drop YoY in cost per click on the massive popularity shift from ads viewed via computer to mobile views as users increasingly choosing to surf the web via their mobile devices rather than computers. Clicked ads on desktop generally earn more per click than those viewed via smartphone. As well, Google is facing stiff competition in the ad arena from favorites such as Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN).

After outperforming the S&P 500's 4-percent with a 13.6 percent rise in its stock value over the last three months, investors punished Google with a 3-percent sell-off. The silver lining on future growth may be the collapse of the dollar, making the company more affordable for investors in other countries.

While the S&P 500 and Dow Jones closed lower, as shares of the healthcare giant Johnson & Johnson (NYSE:JNJ) dragged them down. Both the NASDAQ Composite and NASDAQ 100 made new records.

The two largest groups by weighting, tech and financials, were the only major S&P sectors to advance, offsetting broader declines among the remaining nine sectors.

Today’s Global Market Open

Earlier this morning, Asian equities were mixed, continuing yesterday’s market lack of clarity, as investors work to find a coherent strategy regarding earnings ahead of tomorrow's Federal Reserve policy decision.

The MSCI Asia Pacific Index fluctuated near its 10-year high, in a tug of war between rising stocks in Australia, and falling shares in Japan and China.

Oil

Oil extended gains to $47 a barrel on a Saudi Arabian promise to deepen cuts to crude exports next month and lower the global oversupply.

The Dollar

The dollar resumed its decline, after yesterday’s recovery on the US's manufacturing PMI which hit a four-month high in July, even as the eurozone’s economy grows at its slowest pace in six months—as shown by its Composite PMI falling to 55.8 in July from 56.3 in June. The fact that the dollar is resuming its decline, even against the euro, to its lowest level since June 23, 2016 (the day of the Brexit referendum vote) sends a extremely bearish message: traders don't want to touch the dollar with a ten-foot pole.

Can the two-day FOMC meeting bring back optimism on the greenback? That would require a masterful balancing act after Fed Chairwoman Janet Yellen’s recent dovish remarks. If she becomes hawkish again investors may lose faith in her, due to her increasingly changing economic outlook. After being directed to slow down their outlook for rising rates, traders’ focus will now be on any signal from the Fed on their balance-sheet reduction plan.

Already bearish dollar traders are keeping an eye on the political turmoil in Washington on the heels of the President's son-in-law and senior advisor Jared Kushner yesterday said he had no improper contacts with Russian officials during the campaign. Kushner and former Trump campaign manager Paul Manafort will be questioned by Senate committees on Wednesday.

Up Ahead

- The UK is holding post-Brexit trade talks with the US in Washington.

- China posts industrial profits for last month; early indicators point upward.

- Japanese data for June is due this week and may show sluggish CPI levels, even amid a tightening labor market and increased household spending.

- Fed policymakers begin their meeting on Tuesday, with a rate decision due on Wednesday.

- The US economy probably gained traction in the second quarter as spending by American consumers picked up after a lull early this year. The GDP report follows the two-day Fed policy meeting.

- Chipotle Mexican Grill (NYSE:CMG), McDonald’s (NYSE:MCD) Advanced Micro Devices (NASDAQ:AMD) and JetBlue (NASDAQ:JBLU) all report today.

Market Moves

Currencies

- The Dollar Spot Index was flat as of 8:33 a.m. in London (3:33 EDT), erasing an earlier 0.1 percent loss.

- The euro rose less than 0.1 percent to $1.1649, after dropping 0.2 percent on Monday. The currency is trading near its highest level since January 2015.

- The yen eased at 111.10 per dollar, after advancing against the greenback for five straight days.

- The Australian dollar rose 0.1 percent, after erasing an earlier decline. Attention turns to two key events on Wednesday: The release of the June quarterly inflation data, and a speech on monetary policy and the labor market from Reserve Bank of Australia Governor Philip Lowe.

Stocks

- The Stoxx Europe 600 climbed 0.4 percent after sliding 1.6 percent over the previous three sessions.

- Japan’s TOPIX lost 0.3 percent.

- Australia’s S&P/ASX 200 Index added 0.7 percent.

- South Korea’s KOSPI retreated 0.5 percent.

- Hong Kong's Hang Seng was little changed while China's Shanghai Composite slipped 0.2 percent.

- S&P 500 futures were little changed after the underlying gauge slipped 0.1 percent.

- NASDAQ 100 futures declined after Alphabet slumped in after-hours trading as sales fell short of the most optimistic estimates.

Commodities

- WTI crude gained 0.6 percent to $46.60. It rose 1.3 percent Monday after Saudi Arabia said it would cap shipments at 6.6 million barrels a day in August, one million lower than the same time during the previous year.

- Gold was little changed at $1,255.16, after rising for three straight days.

Bonds

- The yield on US 10-year Treasuries was steady at 2.25 percent.

- Australian benchmark yields rose one basis point to 2.69 percent.

- Yields in France fell one basis point, while those in the UK and Germany were little changed.