by Pinchas Cohen

Key Events

- China expansion continues in June, without relying on manufacturing

- Japan confirms global recovery

- US slows down global recovery

- Oil had best week this year

- Copper reaches two-year high

- HSBC leads financials on earnings

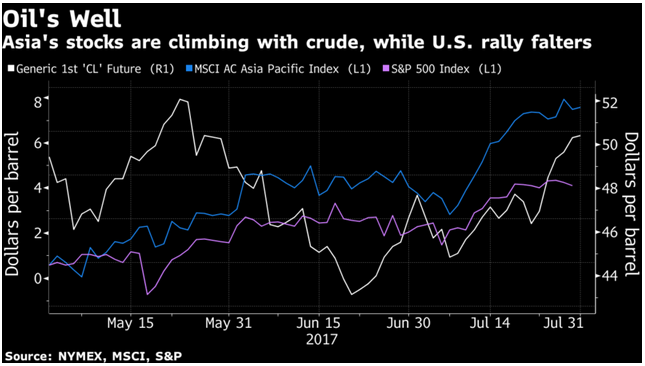

After oil extended its rally of last week—its strongest of this year—commodity prices rose in Asian trading, leading a surge in raw-material producers.

While stock indices from Tokyo to Sydney are mixed, European futures started flat but are heading for their first gain in three trading days.

Raw-material companies BHP Billiton (NYSE:BHP), Rio Tinto (NYSE:RIO), Nippon Steel and Sumitomo Metal (OTC:NSSMY) lead the MSCI Asia Pacific Index—poised for its seventh month of rises—in a rally.

HSBC (LON:HSBA) and Heineken (AS:HEIN) reported earnings beats.

Global Affairs

China’s official factory gauge, the Manufacturing PMI index missed estimates, slowing to 51.4 in July, slightly under forecasts for 51.5, and lower than June's 51.7 reading. The services figure, Non-Manufacturing PMI declined from 54.9 a month earlier to 54.5, a larger fall than manufacturing PMI. This drop points toward China's strategy to transform itself from the world’s largest manufacturer and exporter and shift a more service-oriented and consumer-driven economy.

Although both PMI numbers were higher than 50, which indicates growth, the slight decline during a robust growth period comes amid a government crackdown on leveraging. In addition to the safer investment environment and large amount of capital flight, the data declined only minutely, which in this case should be considered a bullish signal.

Japanese industrial output for June advanced 1.6 percent from the previous month, rebounding on solid global demand, helped by the country's automobile, electronics and hi-tech sectors. The country's current account surplus makes it particularly sensitive to global demand. It's also the reason why the yen is considered a safe haven asset.

Further evidence of the global recovery is the rally in Asian stocks this year. The MSCI Asia Pacific Index is on course for a 3.7 percent gain for the month of June, its biggest since January.

The US economy is treading water firmly but slowly. Gross domestic product (GDP) expanded 1.9 percent for the first half of the year—below the 2.2 percent average pace through the end of 2016. The US economy, which is 29.95 percent of the global economy, is proving to be a drag on the otherwise stimulated global recovery.

The United States is facing a standoff on two fronts. The first is with Russia after Congress approved new sanctions against the country, which led to over 700 American diplomats being kicked out by Putin. The second is toward China, the world's second biggest economy and the US's largest trading partner, after North Korea test-fired another intercontinental ballistic missile on Friday.

Investor focus turns to corporate earnings and geopolitics as the week begins. Since the Brexit vote, equity traders have become focused almost exclusively on the former, while currency and bond traders maintain their sensitivity toward the latter. Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Berkshire Hathaway (NYSE:BRKa) and Toyota (NYSE:TM) are expected to release earnings reports this week.

HSBC's (NYSE:HSBC) second-quarter earnings beat estimates, with adjusted revenue and pretax profit rising 4 percent and 13 percent respectively, as the bank routed investments into better-returning Asian markets. If that wasn’t enough good news for shareholders, the bank plans to return another $2 billion of cash to investors via a share buyback program.

Up Ahead

10:00: – Pending Home Sales (MoM) (Jun): Expected to rise from -0.8 percent to 1.0 percent. Markets to watch: S&P 500, Dow Jones, NASDAQ, US dollar crosses

The US Dollar Index declined to its lowest level since June 2016 and is heading toward its lowest level since early May. Should it fall below its 91.92 level, the implications suggest a further decline toward 85.00.

Stocks

- Japan’s TOPIX closed 0.2 percent lower after swinging between gains and losses. Earnings that beat expectations from the likes of Hitachi Ltd (T:6501) and TDK Corp. (T:6762) were outweighed by a firmer yen against the dollar.

- Australia’s S&P/ASX 200 Index rose 0.3 percent.

- South Korea’s KOSPI added 0.1 percent.

- Hong Kong’s Hang Seng rose 1.1 percent. HSBC Holdings (HK:0005) was among the biggest contributors to the advance as its stock jumped 2.5 percent to its highest intra-day level since November 2014.

- China's Shanghai Composite climbed 0.6 percent.

- Euro Stoxx 50 futures rose 0.1 percent as of 7:52 a.m. in London, or 2:52 EDT.

- S&P 500 futures fell 0.1 percent.

- A bout of volatility last week sent the NASDAQ 100 and S&P 500 lower.

Currencies

- The yen pared gains to trade little changed at 110.64 per dollar, near Friday’s 1-1/2-month high.

- The euro was hit $1.1733.

- The Australian dollar fell 0.1 percent to 79.80 U.S. cents after reaching 80 cents last week. The Aussie rebounded from a brief dip following the latest China data.

- The Dollar Spot Index rose 0.1 percent after declining 0.4 percent last week for a third week of retreats.

Bonds

- The yield on 10-year Treasuries fell one basis point to 2.28 percent.

- The yield on 10-year bunds was steady at 0.54 percent in early European trading.

- 10-year Australian government notes were steady at 2.69 percent.

Commodities

- West Texas Intermediate rose 0.3 percent to $49.88 after briefly testing above $50 a barrel for the first time since May. It added to gains from Friday, which came as inventories for crude and gasoline shrank.

- Copper climbed as much as 1.2 percent to $6,400 a metric ton, matching the intra-day level reached last week. In mid-July, Citigroup noted that copper has additional room to rise after the metal reached a two-year high; Top global producer Chile raised its price forecasts.

- Gold was little changed at $1,268.48 an ounce, set for a sixth month of gains in seven months total.