by Pinchas Cohen

Key Events

On Friday, animal spirits roared back to life as all three major US indexes—the Dow, NASDAQ and S&P 500—hit fresh records. As well, the S&P registered its 48th record of the year as it finished a sixth straight week of gains.

The dollar and yields also closed higher on domestic political developments. The Senate approved President Donald Trump’s $4 trillion budget, which paves the way for Congress to consider his tax reform proposal.

Once again today, politics dominates the market narrative, beginning with Japan where President Shinzo Abe’s snap election didn’t have anything close to the dismal outcome seen by UK PM Theresa May in June. Rather, Abe's decision to call an early vote paid off—big time. He won by a landslide, even as Typhoon Lan pummeled parts of the country.

Abe's victory sets him on course to becoming Japan’s longest serving, post-WW2 leader. Spurred by the victory, Tokyo’s Nikkei 225 Index reached a 21-year high; the Japanese index is on its longest winning streak in its 70-year history.

While politics was the impetus for the move, economics has provided legitimacy, with Japan seeing 6 straight quarters of growth right now. Oki Motsumoto, CEO and Chairman of Monex Group, a Tokyo based financial services firm, says Abe’s win is good for the market, but sees the move as done, since expectations of Abe’s win have now been “discounted by today”. Nevertheless, he believes it will continue to be good for markets in the longer-term too.

It could also be said that Abe’s win is a green light for 'Abenomics', the massive economic stimulus plan championed by the Prime Minister. Following that logic to its conclusion, the green light extends into the future for the Bank of Japan to resume its massive asset purchasing program. And, of course, it also provides a green light for Abe to resume with this consumption tax increase.

Global Financial Affairs

Politics continues to drive European markets as well. Investors sold off the euro this morning, for a second day, as they await the resolution of a pair of thorny eurozone standoffs: Catalonia's increasingly dramatic secession effort in Spain and stalled Brexit negotiations. The single currency is potentially forming the right-shoulder of an H&S top. Will it complete before any resolutions emerge?

With Spain's threat of direct rule now on the table, Catalonia's parliament is scheduled to meet on Thursday in order to decide on their response which may be a formal declaration of independence. The next level would then be for Spain to remove regional President Carles Puigdemont from office and charge him with treason, whereupon he could face up to 30 years in jail. After that, what happens in Catalonia is anyone's guess.

While politics has been driving a sense of uncertainty, investors are likely to focus on the more familiar uncertainty of monetary policy going forward. The global financial community is entering a period where there just may be a changing of the central bank guard, led by the departure of US Fed Vice Chair Stanley Fischer earlier this month and the much anticipated Trump nomination of the next Fed Chair.

The potential for an additional Fed rate hike this year remains an ongoing question (though some believe there may be more than one), while the ECB potentially moving in a new policy direction direction could lead to a clear policy path vacuum. Should this happen, the uncertainty might create ripple effects across global financial markets.

Up Ahead

- UK PM Theresa May is expected to speak to Parliament today on the progress of Brexit negotiations.

- The US Q3 GDP, released on Friday, is expected to have expanded at 2.5 percent YoY in the third quarter, taking into account the effects of Hurricanes Harvey and Irma.

- US big-ticket Durable Goods Orders are expected to have increased, a sign of firmer manufacturing growth.

- Earnings reports today include Halliburton (NYSE:HAL) which reports before the open (consensus EPS $0.38 vs $0.01 YoY) and T-Mobile (NASDAQ:TMUS) which reports after the close (consensus EPS $0.44 vs $0.27 YoY

Market Moves

Stocks

- Japan’s TOPIX climbed 0.8 percent, cementing a rally to the highest since mid 2007. The Nikkei jumped 1.1 percent to once again hit the highest since 1996.

- The MSCI Asia Pacific Index added 0.2 percent.

- South Korea’s KOSPI was little changed while Hong Kong’s Hang Seng fell 0.5 percent.

- Australia’s S&P/ASX 200 lost 0.2 percent.

- The Stoxx Europe 600 Index jumped 0.3 percent as of 8:03 a.m. London time.

- The MSCI All-Country World Equity Index fell less than 0.05 percent.

- The U.K.’s FTSE 100 gained less than 0.05 percent.

- Germany’s DAX climbed less than 0.05 percent.

- The MSCI Emerging Markets Index dipped less than 0.05 percent.

- S&P 500 Futures sank less than 0.05 percent, the first retreat in more than a week.

Currencies

- The Dollar Index is being traded near the high of the day, after it had gained 0.26 percent to the highest since October 6.

- The euro dipped 0.2 percent to $1.1757, its weakest in two weeks.

- The British Pound rose 0.1 percent to $1.3201.

Bonds

- The yield on 10-year Treasuries declined less than one basis point to 2.38 percent as investors continue to embrace risk.

- Germany’s 10-year yield declined two basis points to 0.44 percent, the biggest fall in a week.

Commodities

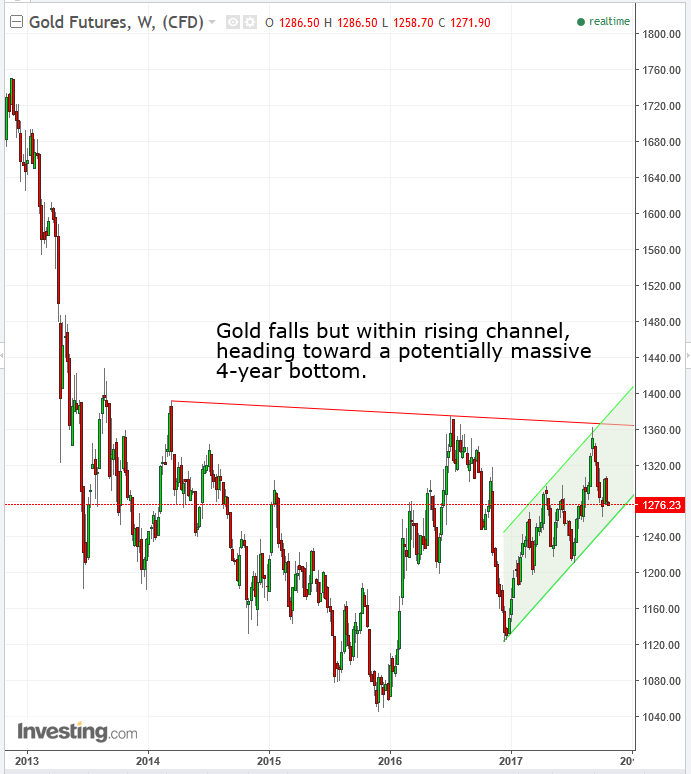

- Gold fell 0.4 percent to $1,275.59 an ounce, the weakest position for the commodity in more than two weeks. Could it be heading for a potentially massive 4-year bottom?

- West Texas Intermediate crude gained 0.2 percent to $51.92 a barrel. With $52.86 looking like the Bears' line in the sand, are bulls set to regroup at support before the next attack?