- Worst weekly equity decline in 2 years

- Triggered by wages indicating inflation will rise

- Bond selloff ensues

- Selloff pushes yields higher, causing a stock selloff

- Bond-stock selloff creates volatility; low vol. funds liquidate exacerbating selloff

- Equity selloff eases as trading week closes

- Declining dollar supports commodities and oil

- Trump will deliver his 2019 budget blueprint on Monday.

- Chinese New Year celebrations for the Year of the Dog begin in China and follow across much of Asia, including Hong Kong, Taiwan, Singapore, Malaysia and Indonesia. Chinese mainland markets are closed February 15-21.

- South African President Jacob Zuma’s fate is set to be sealed on Monday when the top leadership of the ruling African National Congress meets to conclude the transition to a new administration.

- The U.S. Consumer Price Index, due out Wednesday, probably increased at a moderate pace in January, economists project. Retail sales in the U.S., also out Wednesday, probably increased for a fifth straight month.

- Japan is expected to extend the longest stretch of economic growth since the mid-1990s when it reports fourth-quarter gross domestic product on Wednesday.

- Earnings season continues in full swing with reports from Loews (NYSE:L), before market open, EPS forecast $0.72 vs $0.79 YoY.

- The Stoxx Europe 600 Index rose 1.3 percent as of 8:16 a.m. London time (3:16 EDT).

- The MSCI All-Country World Index jumped 0.4 percent, the largest increase in more than two weeks.

- The U.K.’s FTSE 100 Index gained 1.2 percent.

- The Dollar Index dipped 0.29 percent.

- The euro increased 0.1 percent to $1.2262.

- The British pound increased 0.1 percent to $1.3835.

- South Africa’s rand climbed 0.3 percent to 11.963 per dollar.

- The yield on 10-year Treasuries gained three basis points to 2.88 percent, the highest in more than four years.

- Germany’s 10-year yield increased two basis points to 0.77 percent, the highest in more than two years.

- Britain’s 10-year yield rose four basis points to 1.605 percent.

Key Events

Last week, heightened concerns over a faster pace of policy tightening from the Fed gave US equity bulls their worst week in two years, with all major stock indices taking a beating.

The S&P 500 fell 5.16 percent. The Dow Jones Industrial Average dropped 8.3 percent. The NASDAQ Composite underperformed, falling the hardest, down 8.4 percent. The Russell 2000 – which has been proving to be a contrarian index, positively and negatively – outperformed, falling the least, 4.6 percent.

The selloff was triggered by a single component of the the January employment report, released February 2, which showed average hourly earnings to have increased 2.9 percent, the fastest jump since 2009. Wage growth is a leading indicator for inflation growth, as companies raise the cost of their goods and services to cover their own rising costs for employee wages.

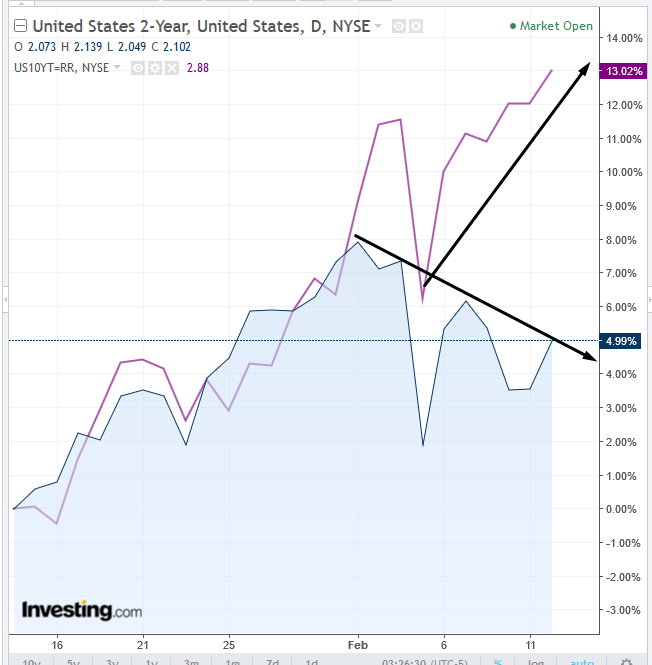

The realization that inflation was about to rise had bond investors spurning the current, 2.65 percent yield, since higher interest rates would naturally push yields ups. Furthermore, the very outlook for higher rates already pushed yields almost 25 basis points from 2.65 percent to 2.9 percent (ironically, the same as the wage growth), earlier, in a little over two weeks.

As a rule, higher yields spur capital diversion from stocks to bonds. When stocks are at nose-bleed, record-high levels, investors are all too happy to find a less risky alternative that would let them sleep more soundly at night. That's why this particular yield jump follows a period of unprecedented low yields based on near-zero interest rates, for which traditional bond investors were forced to seek a meaningful yield elsewhere.

Luckily, over the past few years the stock market provided an unprecedented low volatility environment, allowing traditional yield seeking investors to buy into dividend stocks. Since these investors are long-term asset holders, the record high stock levels didn’t scare them. They’d wait out any crash.

They were just interested in the dividends. The fact that the S&P 500 rose nearly 37 percent since 10-year Treasury yields reached their 1.4 percent record low in early July 2016 till the SPX's 2,8782.87 record (both high and close, with bears nowhere to be seen, only highlighting the complete shock of the reversal) on January 26, before the selloff, was the fat cherry on top.

The sudden jump in yield provided an upside breakout of the 2.6 percent level. Here is an example of intermarket support/resistance principles. The bond oversupply pushed yield through a resistance (while, a resistance is normally supply, in the bond price/yield inverse relationship, a resistance is a demand for the bond, which lowers the yield). The broken resistance reversed momentum from bullish to bearish on bonds (since the outlook for higher interest rates renders current yields relatively lower), which rotated funds out of stocks and into shorter maturity bonds, so that they’d be able to buy the higher yielding bonds sooner.

The bond oversupply pushed yields through a resistance of demand (for bonds, within the bond price/yield inverse relationship), rerouting all the traditional bond investors who may have never quite grown comfortable investing in stocks. The volatility of the sudden fund outflow from equities riled institutions invested in low volatility funds, forcing a rapid liquidation.

The race to unwind positions based on a low volatility environment created more supply than demand, forcing institutions to sell at lower prices. The rapid price plunge – especially from record levels – naturally scared retail investors into dumping their stocks, pushing prices that much lower.

Global Financial Affairs

This morning, investors in Asian and European markets enjoyed a reprieve from the worst weekly selloff since 2011. Chinese shares listed on the mainland's Shanghai Composite, having fallen 9.5 percent during the past week, along with shares listed on the Shenzhen Composite, which lost 8.4 percent last week, together with shares listed on Hong Kong’s Hang Seng, which declined 9.5 percent during last week’s selloff, today all provided buyers with the deepest dips. However, while mainland shares enjoy a rebound, Hong Kong shares extend their decline, testing last week’s lows.

South Korea’s KOSPI rose, after President Moon Jae-in was invited by North Korean dictator Kim Jong Un for a meeting. Australia’s S&P/ASX 200 was pulled lower by bank shares, on an inquiry into the nation’s financial system. Japan is closed today for a holiday.

The STOXX Europe 600 advanced, led by miners and chemical manufacturers. S&P 500 futures moved higher, continuing the rebound that began on Friday, when the index pared an initial, sharper decline.

Traders are awaiting U.S. consumer-price data to be released on Wednesday with some trepidation. Pressure on equities has been coming from the Treasury market, where yields spiked to a four-year high amid concerns the Federal Reserve may accelerate its rate hike schedule.

This morning ’s rally in Asia took place amid attempts to thaw the tensions on the Korean Peninsula. Vice President Mike Pence told the Washington Post the U.S. is ready to engage in talks about North Korea’s nuclear program, signaling a shift in policy. The comments came after North Korean leader Kim Jong Un used his sister as an emissary to invite South Korea’s president for talks in Pyongyang, as the Winter Olympic Games got underway. The won outperformed Asian currencies.

The Dollar Index met with resistance at the 90.50 level, where there was a congestion in mid to late January, as well as by a downtrend line since December 18.

The dollar’s decline supported commodities, with metals higher and crude oil halting a six-day slide. Note, while the November-December congestion resistance turned to support, the price fell below its uptrend line since September, opening the potential for a further fall toward the downtrend line since June.

While Bitcoin is said to have found a bottom, it’s still very much within a downtrend. Nevertheless, it’s surprising that specifically during a time of market turmoil, the most volatile asset has become a “bastion of stability.” Currently, the rebound from $6,000 is struggling over its current February 10, $9,074.3 resistance, compounded by a downtrend line since January 6. A successful breakthrough would test the $10,000 round psychological number, whose resistance is reinforced by the January 16-31 supported, now presumed resistance.

Up Ahead

Market Moves

Stocks

Currencies

Bonds

Commodities