Geo-political risk is set to dominate capital markets this week; it will be supported by a handful of central bank monetary policy decisions.

In the Gulf, the Saudi’s, Bahrain, the United Arab Emirates and Egypt said they are suspending all travel to and from Qatar, citing Qatar’s support of “terrorist groups aiming to destabilize the region.”

In the U.K, citizens are dealing with the outcome of the weekend’s terrorist acts as the political parties enter the final three-days of the nation’s election campaign. The British snap election will be held on Thursday, June 8. In France, the French election will take place in two-rounds beginning on June 11.

In the U.S, fired FBI Director James Comey is set to testify before the Senate Intelligence Committee on Thursday about his conversations with President Trump regarding suspicion of Russian interference in the 2016 election. His testimony is expected to drive further moves in equities and the dollar in a recurrence of market swings last month.

The RBA, RBI and the ECB announce their respective monetary policy decisions on June 6, 7 and 8 – all three central banks are expected to leave their policies unchanged, however, the market is looking for guidance on QE reduction from Draghi.

Germany will release its April data for both manufacturing orders and output, while Canada will report its labor force survey and key housing starts, both for May.

1. Global equities questioning growth

Friday’s underwhelming non-farm payroll (NFP) is testing market bets on improving global growth that’s helped drive the value of global equities this year.

In Japan, the Nikkei’s share average barely changed overnight, keeping close to a 22-month high scaled last week as the yen’s rise stalls (¥110.48), while the broader Topix index fell -0.1%. The gauge closed Friday at the highest point in two-years.

In Hong Kong, the Hang Seng fell -0.4%, while the Shanghai Composite Index slipped -0.5%.

Elsewhere in the region, the Malaysia’s benchmark gained +0.6% and Indonesian stocks climbed +0.2%, while Taiwan’s Taiex increased +0.7%.

With the Saudi-led alliance cutting diplomatic ties with Qatar, Doha’s QE Index dropped -7.7%, the most in three-years. While in Dubai, the DFM General Index fell -1.3%.

Note: Germany, Switzerland and France all have a bank holiday.

In Europe, indices are trading slightly lower in light trade due to bank holidays. The market reaction to this weekends terror attacks in London is having little impact, although travel and leisure names seeing some downside pressure on the FTSE 100.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 -0.3% at 3579, FTSE -0.2% at 7530, DAX Closed, CAC 40 -0.6% at 5312, IBEX 35 -0.5% at 10850, FTSE MIB -1.0% at 20724, SMI Closed, S&P 500 Futures -0.1%

2. Oil prices gain as Saudi Arabia cuts ties with Qatar

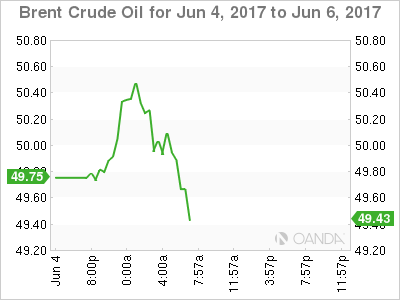

Ahead of the U.S open, oil prices are better bid after top crude exporter Saudi Arabia and other neighbouring Arab states cut ties with Qatar – the market is worried that increased tension in the Middle East will disrupt supplies.

Saudi Arabia, the United Arab Emirates, Egypt and Bahrain closed all transport links with top ‘liquefied natural gas and condensate shipper’ Qatar, accusing it of “supporting extremism and undermining regional stability.”

Brent crude prices are up +35c, or +0.7%, to +$50.30 a barrel, while U.S West Texas Intermediate (WTI) is at +$48.03 a barrel, up +37c.

Note: With a production capacity of about +600k bpd, Qatar’s crude oil output is one of OPEC’s smallest.

However, the market is focusing on tensions within OPEC, which could potentially impact any agreement to cut production in order to support global prices. Brent crude prices are still down about -7% from their open on May 25, when OPEC opted to extend last November’s production cuts into 2018.

The market outlier that is having an impact on OPEC product cuts supporting prices is U.S oil production. The rise in production has been driven by a record 20th straight weekly climb in oil drilling, with the rig count climbing by 11 in the week to June 2, to 733, the most since April 2015.

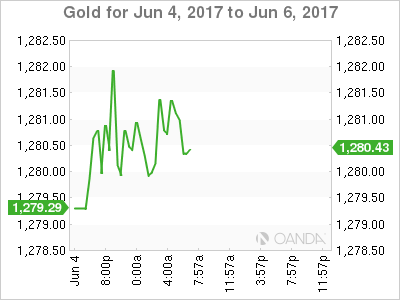

Gold is holding steady (+0.1% to +$1,280.90 per ounce) after hitting its highest in over six-weeks overnight, supported by Friday’s disappointing U.S jobs data that appeared to dilute the prospects for an aggressive string of Fed interest rate hikes.

3. Yield curves remain flatter

U.S Treasury yields remain near the lowest level in seven months with last Friday’s data on wage growth and hiring in the U.S labor market came in below expectations.

The report is unlikely to keep the Fed from raising rates in June (13-14), but the slow wage growth reinforces the view that stubbornly weak inflation could keep the Fed from raising rates again later in the year.

The yield on U.S 10-Year Treasury notes has rallied less than +1 bps to +2.17%, after dropping -5 bps on Friday.

Elsewhere, the yield on Aussie 10-year government bonds have lost -2 bps to +2.39%. In the U.K, 10-year Gilt yields have climbed +2 bps to +1.06%.

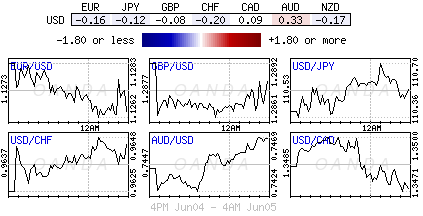

4. Dollar seeks out direction

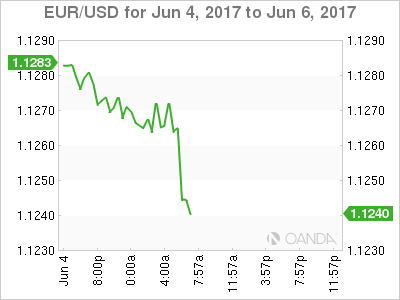

The ‘mighty’ USD has consolidated some of its recent losses after its declines following Friday’s U.S jobs data. On Friday, the USD tested its lowest level across the board since November after non-farm payrolls underwhelmed – the markets seemed content to ignore that U.S unemployment rate (+4.3% vs. +4.4%) was its lowest level in 16-years.

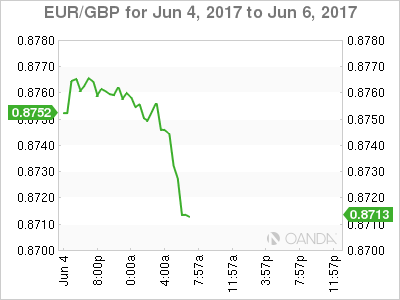

The EUR (€1.1264) and GBP (£1.2888) trade slightly lower outright due to caution ahead of Thursday’s ECB meeting and the U.K’s general election. The single unit could gain again if the ECB speaks of plans to scale back monetary stimulus, but policymakers may be cautious of doing so given subdued core inflation.

In the U.K, sterling continues to be held captive by ‘opinion polls’ which point to waning support for the ruling Conservative party. Currently, the impact of weekend’s terror attacks has been “limited.”

Note: U.K election uncertainties have risen with some opinion polls seeing the Conservatives lead narrowing to only around +1-4% points ahead of Labour.

5. U.K May Services PMI Weaker Than Expected

Data this morning showed that the U.K’s PMI for the dominant services sector came in weaker than expected in May, having hit a four-month high in April.

The measure fell to 53.8 from 55.8 the previous month and well below the expected 54.9 reading.

Digging deeper, IHS Markit said new orders grew more slowly, partly in response to a squeeze on household incomes as a result of a jump in inflation, and partly because some businesses have delayed making decisions ahead of the June 8 general election.

Despite the May dip, purchasing managers surveys more broadly point to a possible pickup in growth during Q2, to +0.5% from +0.2% in Q1.