VIX had a key reversal on Friday, making a new low, then closing higher than the previous weekly close. A rally above mid-Cycle resistance at 15.19 implies that VIX may challenge its Ending Diagonal at 17.50 in the next move. The news stories are still behind the curve on this one.

The low volatility plaguing the market looks here to stay, after traders hoping for a spike this week got the opposite.

The CBOE Volatility Index, considered the best gauge of fear in the market, dropped Friday to 9.37, its lowest since Dec. 27, 1993.

SPX makes a weekly key reversal.

SPX made a weekly key reversal that may not get any attention until next week. The throw-over has reversed beneath the trendline. The reversal has been made on an important 8.6-year Cyclical interval that suggests a potential Super Cycle turn may be at hand.

U.S. stock indexes reversed lower at midday Friday, erasing early gains as the chip sector came under fire.

The NASDAQ was down 0.6% after being up 0.3%, while S&P 500 dog-paddled to a 0.2% gain. The blue chip Dow Jones industrial average was up 0.3% and the small-cap Russell 2000 led with a 1.1% pop. Volume in the stock market today was down on the NYSE and up on the NASDAQ.

Britain's Conservative Party unexpectedly lost its majority in Parliament, which could complicate talks on Britain's exit from the European Union. This came a day after former FBI chief James Comey ripped President Trump, but the testimony seemed more about honesty than illegality. The stock market gauged both pieces of news and tossed them into the so-what file.

NDX reverses from an all-time high

NDX had the largest key reversal among the stock indices on Friday.The next move to look for is a challenge of the supports beneath it. A decline beneath the Cycle Top support and the trendline at 5551.55 may suggest a deepercorrection is in order.

Update: FANG Stocks are getting hammered today.

The fascination with the influence of a handful of giant tech stocks on the overall markets continued overnight, when one day after Bank of America found that the tech sector is now the "most overweight it has ever been", surpassing even the record clustering into tech during the dot com bubble, Goldman issued a report looking at the outsized influence of the five tech stocks in question which it dubs FAAMG – Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL), which have collectively added a total of $600 bn of market cap this year, "or the equivalent GDP of Hong Kong and South Africa combined."

The sudden rotation out of growth/momentum stocks, highlighted earlier, sure escalated quickly.

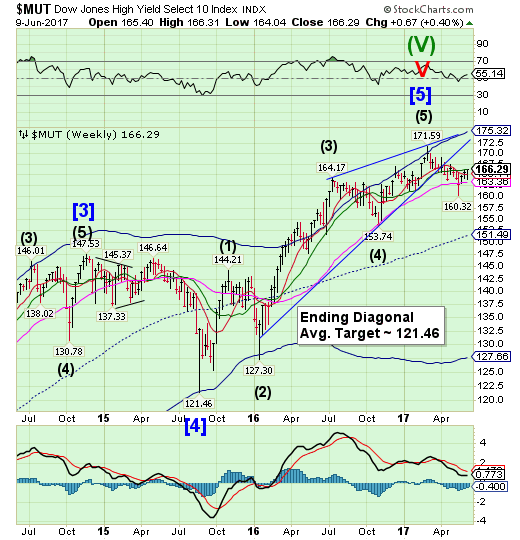

High Yield Bond Index tests Intermediate-term resistance.

The High Yield Bond Index challenged Intermediate-term resistance at 166.29 again.It remains on a sell signal, but must decline back beneath Long-term support at 163.36 to confirm it. The Cycles Model suggests weakness may resume next week.

If investors are worried about the Federal Reserve's monetary tightening plans, you wouldn't know it judging by the performance of high-yield bonds.

This asset class -- also known as junk bonds because they are rated below investment grade by credit rating agencies -- sparked fears of widespread defaults in 2015, when the Fed began raising rates for the first time in almost a decade.

Fast forward a couple years and the picture looks much brighter. High-yield debt funds have seen positive inflows of capital for six consecutive weeks, according to data from Bank of America Merrill Lynch (NYSE:BAC). Last week, they even recorded a significant improvement: inflows swelled from $4 million in the week before to $668 million.

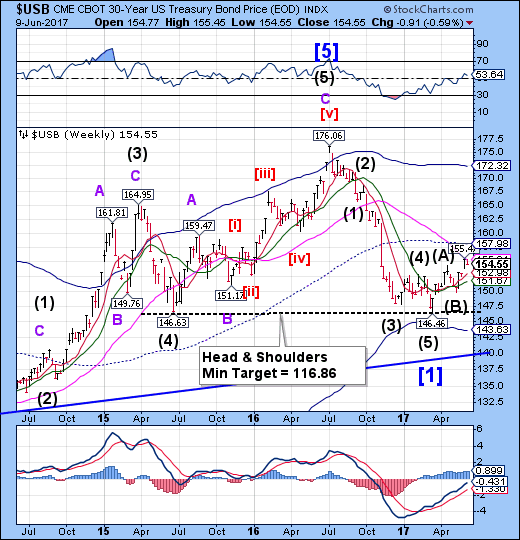

USB consolidates.

The Long Bond consolidated at Long-term resistance at 155.31. The Cycles Model allows for a potentially larger pullback before resuming its rally.

The “Bond Bears” just can’t seem to catch a break.

Beginning in mid-2013, there have been numerous calls the 30-year bond bull market was dead. The reasoning was simplistic enough – economic growth was set to return pushing inflation, and ultimately interest rates, higher. Unfortunately, as each year has come and gone, economic growth has failed to return with real economic growth averaging just 1.9% since the turn of the century.

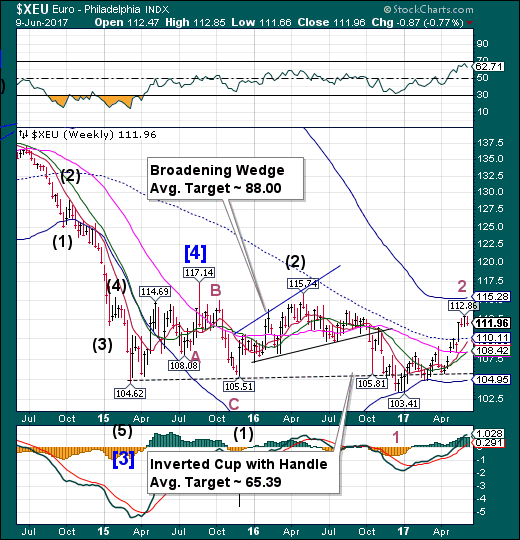

The euro reverses.

The euro reversed from Cycle Top resistance this week, but hasn’t yet produced a sell signal, which may be triggered at the crossing beneath mid-Cycle support at 110.11. The reversal from the high may be unusually strong and fast, since it must make a Master Cycle low in the next week.

It’s 2007 all over again.

The euro is on a tear, U.S. investors are snapping up European stocks -- and traditional theories to justify the shared currency’s spirited advance have broken down, as investors luxuriate in a climate of low volatility.

That’s the market landscape as painted by Deutsche Bank AG (DE:DBKGn) strategist George Saravelos. Given the parallels, he suggests caution after the euro’s 7 percent rally against the dollar this year.

Saravelos wrote in a client note Wednesday:

Something strange has happened to the euro in recent months. Almost all traditional drivers that usually ‘explain’ the price action have broken down.

Euro Stoxx hover at the trendline.

The Euro Stoxx 50 Indextested the Ending Diagonal trendline and weekly Short-term support at 3558.41 this week, closing above it.Stoxx are overdue for a breakdown, which may occur this week.

European stocks were choppy on Friday after Britain's election delivered no clear winner on the eve of Brexit talks, though a slump in sterling gave an edge to shares in UK exporters.

The pan-European STOXX 600 index ended the session 0.3 percent higher, having moved in and out positive territory throughout the day, while the UK's internationally-facing blue chip FTSE 100 .FTSE index outperformed with a gain of 1 percent.

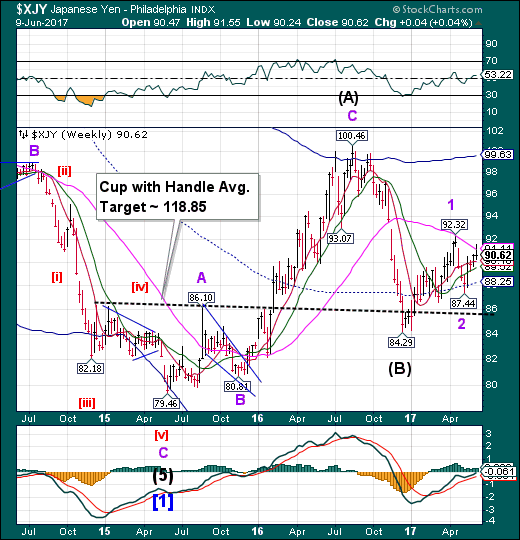

The yen pulls back from Long-term resistance.

The yen challenged Long-term resistance before pulling back. The Cycles Model suggests that Cyclical strength may resume for another week before a significant pullback. A breakout may alter the pace of the rally.

Corporate Japan's earnings prospects for fiscal 2017 have softened because of the yen's appreciation but are still seen notching double-digit growth, according to brokerage projections.

The nation's four leading securities companies review earnings projections for listed companies every three months. Nomura Securities has downgraded its pretax profit growth projection for major nonfinancial firms by 3.5 percentage points to 11.1%. Daiwa Securities and SMBC Nikko Securities have lowered theirs by 1.2 points and 5.4 points.

The Nikkei reverses, remains above 20000.

The Nikkei had a reversal week, but remained above the 20000 level. The Cycles Model suggests a probable continuation of the decline. A sell signal may be generated beneath 20000 with confirmation of the correction beneath support at 19449.12. The decline may not be long, but threatens to be deep.

Japanese Prime Minister Shinzo Abe suddenly seems to have a divine wind at his back. A resurgent stock market is an unexpected bit of good news for Abe, whose signature policy of ultra-loose monetary expansion and economic reforms has delivered mixed results in recent years.

The benchmark Nikkei 225 Stock Average has spiked up 11 percent from an April 14 low, and it broke through the 20,000 mark on June 2 for the first time since December 2015. The rally came as the nation’s corporate profits climbed to a record and attracted foreign investors, who snapped up more than $13 billion in Japanese stocks in eight straight weeks through May 26 after being net sellers earlier in the year.

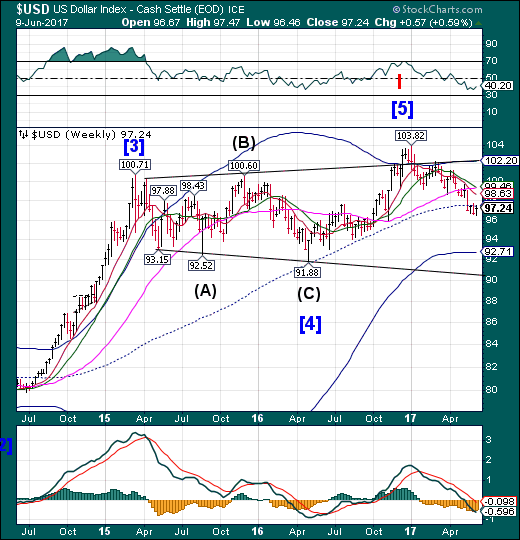

U.S. dollar consolidates below mid-Cycle resistance

USD appears to have failed the test at mid-Cycle resistance a second time, possibly completing its consolidation. The Cycles Model suggests a possible 6-week decline in USD.

Net long positions on the U.S. dollar increased in the latest week after two straight weeks of declines, according to calculations by Reuters and Commodity Futures Trading Commission data released on Friday.

The value of the dollar's net long position rose to $8.00 billion in the week ended June 6, from $7.53 billion the previous week.

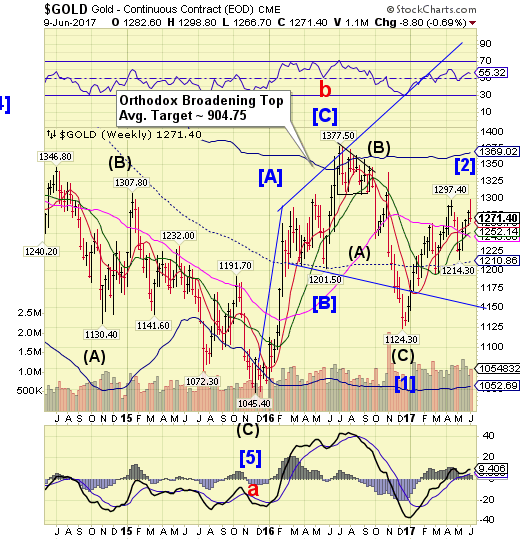

Gold makes a new retracement high.

Gold extended its rally tomake a new retracement high on Tuesday, then made a reversal. The Cycles Model suggests another 2 weeks of probable decline ahead.

Gold is back to a currency play, with prices surging only for British investors, as the pound headed for the biggest drop in almost eight months.

Bullion priced in sterling rose as much as 2.2 percent to 1,007.52 pounds an ounce, a seven-week high, after Prime Minister Theresa May failed to win an overall majority. In dollar terms, gold futures fell, posting its first weekly loss in more than a month, as market attention for the rest of the world refocuses on the prospect of U.S. interest rates rising next week.

Crude crosses mid-Cycle support.

Crude declined through mid-Cycle support at 46.78 on Wednesday, closing beneath it.It may now threaten the Head & Shoulders neckline at 44.00 in the next week. There are now three formations indicating the probable target for the coming decline this summer.

Oil prices rose on Friday after a pipeline stoppage in Nigeria, but crude still ended the week down nearly 4 percent on persistent worries about global oversupply.

Brent crude oil LCOc1 settled up 29 cents at $48.15 a barrel. U.S. crude CLc1 futures rose 19 cents to $45.83 a barrel. Both benchmarks posted weekly declines of nearly 4 percent, pressured by big U.S. inventories and heavy worldwide flows.

"I don't think it's anything more than a temporary stabilization," said Gene McGillian, manager of market research at Tradition Energy in Stamford, Connecticut, adding that traders were short-covering ahead of the weekend.

"The increases in production will still drag us lower," he said.

Shanghai Index challenges Long-term resistance.

The Shanghai Index again challenged Long-term support/resistance at 3146.73, closing above it. However, the Shanghai Index is due for a fall next week. Attempts to limit the decline may have succeeded so far, but may have reached their limit.

Just when we thought there were no surprises left in the world's foremost incubator of "financial engineering" that is China, we got a stark lesson in never underestimating China's market manipulating ingenuity.

According to Caixin, around two dozen Chinese companies recently offered their employees a deal: buy company shares while guaranteeing that any losses would be covered.

While employees think they may be getting an unbeatable deal - who can say no when your employer promises you all the upside and no downside - the reality is that any participants in such scheme are merely locking in their fates with that of their soon to be insolvent employer, who desperately needs to raise the price of their stock to fend off collateral calls on stock-backed loans usually made by founders and other major sharehholders.

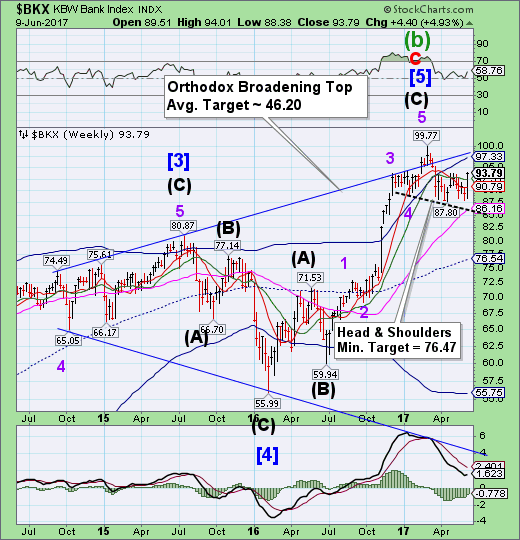

The Banking index completes its correction.

BKX rallied this week to complete its correction. The sell signal has been temporarily neutralized as BKX rose above its Intermediate-term resistance at 92.51. This action served to give pain to the shorts while offering a short-term reprieve for the longs. It may not last as an important low is due this week.

Bank stocks are on pace for their best week of 2017, as the group rises by nearly 5 percent to turn from negative to positive on the year.

The strong performance is due in large part to investors pricing in efforts across the Trump administration to kill the Dodd-Frank Wall Street Reform and Consumer Protection Act, said Chantico Global CEO Gina Sanchez. Republicans in the U.S. House of Representatives voted Thursday to replace the 2010 legislation, enacted under President Barack Obama, which more stringently regulated the financial services industry.

Goldman Sachs (NYSE:GS) faced a looming deadline in July. Under new federal rules, the storied Wall Street bank was required to rid itself of about $6 billion in risky investments, such as stakes in hedge funds, that regulators fear could hamper it during an economic downturn.

But by late last year, Goldman had yet to find a buyer and appealed to the Federal Reserve for a reprieve. The agency gave Goldman and several other banks five more years to comply with the rules put in place in response to the 2008 financial crisis.

Now, it appears, Goldman may be able to keep those investments after all.

One month ago, when observing the record low vol coupled with record high stock prices, we reported a stunning statistic: central banks have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record" according to Bank of America. Today BofA's Michael Hartnett provides an update on this number: he writes that central bank balance sheets have now grown to a record $15.1 trillion, up from $14.6 trillion in late April, and says that "central banks have bought a record $1.5 trillion in assets YTD."

The latest data means that contrary to previous calculations, central banks are now injecting a record $300 billion in liquidity per month, above the $200 billion which Deutsche Bank recently warned is a "red-line" indicator for risk assets.

In late April, after some disturbing monthly charge-off reports from major credit card vendors, we reported that according to the latest data from the S&P/Experian Bankcard Default Index, as of March 2017, the default rate on US credit cards had jumped to 3.31%, an increase of 13% from a year ago, and the highest default rate since June 2013.

The troubling deterioration prompted Moody's to pen its own report yesterday titled "Spike in Charge-off Rates Indicates a Slide in Underwriting Standards" and as Moody's analyst Warren Kornfelf writes, the steep increase in credit card charge-off rates in 1Q’17 and 4Q’16 was the largest since 2009, and indicates that "strong underwriting standards in place since the financial crisis have deteriorated, potentially rapidly."

Here’s the perfect example of how insane our financial system has become.

It was announced yesterday that, after a 24-hour white-knuckled ride, Spanish banking giant Banco Popular had been sold to Banco Santander (MC:SAN) for the price of just 1 euro.

Note- that’s 1 euro in TOTAL. Not 1 euro per share.

Banco Popular had once been one of Spain’s largest banks.

But just as certain banks tend to do from time to time, Popular sacrificed responsibility and good conduct for quick profits.

They spent years gambling their depositors’ savings away on idiotic, dangerous, pitiful loans. And those bad loans eventually came back to bite them.

The modern business of banking is all about pooling customer deposits together and making various loans and investments with those funds.

Safe, responsible banks make sensible investments.

They maintain extremely high loan standards. And they keep a SUBSTANTIAL rainy day fund set aside in case those loans and investments go bad.

Banco Popular did none of those things.