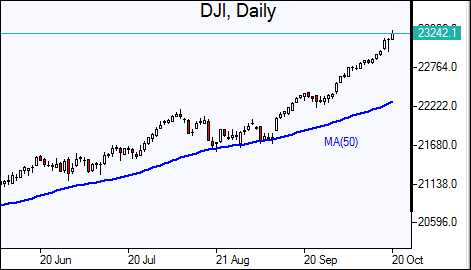

S&P 500, Dow Close At Record Highs

US stock indices managed to close higher on Thursday as the Senate approved a $4 trillion budget blueprint for 2018 that will pave the way for Republicans to pursue a tax-cut overhaul without Democratic support. The dollar weakening accelerated on the report that President Trump is leaning toward a dovish candidate Jerome Powell as the next chairman of the Federal Reserve: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.158. Dow Jones Industrial Average pared earlier losses and ended up less than 0.1% at all-time high 23163.04. The S&P 500 added 0.84 points settling at new record 2562.10 as gains in health care and utility shares outweighed losses in consumer staples and technology shares. The NASDAQ index extended losses 0.3% closing at 6605.07.

European Stocks Retreat As Political Tensions Rise In Spain

European stocks fell on Thursday as investors confidence was undermined by rising concerns about continued deadlock over Catalonia’s independence referendum in Spain and lackluster Chinese growth report. The euro extended gains against the dollar while British Pound resumed the slide. The Stoxx Europe 600 index closed 0.6% lower led by consumer goods shares against the background of disappointing earnings reports. Germany’s DAX 30 fell 0.4% to 12990.10. France’s CAC 40 lost 0.3% and UK’s FTSE 100 ended 0.3% lower at 7523.04. Indices opened 0.4%-0.5% higher today.

Asian Markets Advance

Asian stock indices are higher today with market sentiment buoyed by advances on Wall Street overnight. Nikkei ended 0.4% higher at 21457.64 as yen weakness resumed against the dollar. Chinese stocks are rising after previous day’s slump following a report China’s GDP rose 6.8% in third quarter, below the 6.9% growth in the second quarter: the Shanghai Composite Index is 0.3% higher and Hong Kong’sHang Seng Index is up 1%. Australia’s ASX All Ordinaries is up 0.2% as the Australian dollar reversed most of previous session’s gains against the greenback.

Oil Edges Higher

Oil futures prices are recovering today on signs of tightening global supplies and more balanced market. Prices fell yesterday on profit-taking after four days of straight gains. Brent for December settlement lost 1.6% to end the session at $57.23 a barrel on ICE Futures Europe on Thursday.