Dollar drops as Fed projects just 2 more hikes in 2018

US stock indices ended choppy session lower on Wednesday after Fed hiked rates. The S&P 500 slipped 0.2% to 2711.93, led by consumer staples shares. TheDow Jones Industrial Average slid 0.2% to 24682.31. NASDAQ Composite index lost 0.3% to 7345.29.The dollar turned weaker sharply: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.8% to 89.66. Stock indices futures point to lower openings today.

Federal Reserve raised rates 0.25 percentage points but policy makers’ forecasts of interest rates in the dot plots showed they expect only two more hikes this year. However they projected another three rate hikes in 2019 instead of the previous two which should bring Fed’s benchmark funds rate to 2.9% instead of 2.7% by the end of 2019. The statement was not as hawkish as some expected and caused the decline in the dollar index. Economic data also contributed to dollar weakness: the current account deficit for the fourth quarter rose by 26% over quarter, widening to $128.2 billion from a revised $101.5 billion in the third quarter.

European stocks pull back

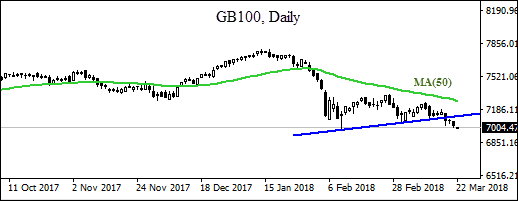

European stocks pulled back on Wednesday ahead of Fed decision. Both the euro and British Pound turned higher against the dollar. The Stoxx Europe 600 fell 0.2%. However Germany’s DAX 30 rose 0.01% settling at 12309.15. France’s CAC 40 lost 0.2% and UK’s FTSE 100 fell 0.3% to 7038.97. Indices opened 0.6% - 1% lower today.

Traders were cautious ahead of the Federal Reserve decision announcement. The Bank of England holds its policy meeting today and the decision will be announced at 14:00 CET. No change in policy is expected.

Asian indices retreat

Asian stocks are mostly lower today after Fed hiked rates. Nikkei ended 0.9% higher at 21578.50 as traders returned after holiday and yen continued strengthening against the dollar. China’s stocks are lower after the central bank lifted its short term interest rates, by 0.05 percentage point to 2.55%, and market participants await President Trump’s China tariff announcement today: the Shanghai Composite Index is 0.5% lower and Hong Kong’s Hang Seng Index is down 0.9%. Australia’s ASX All Ordinaries is down 0.2% as fewer than expected jobs were created in February, Australian dollar is little changed against the greenback

Brent down

Brent futures prices are retreating today on rising US crude output which climbed to a fresh record of 10.4 million barrels per day last week. Prices jumped yesterday on bigger than expected US supply drop: the US Energy Information Administration reported Wednesday that domestic crude supplies fell by 2.6 million barrels last week. May Brent crude rose 3% to $69.47 a barrel on Wednesday.