Market Brief

The last ADP report fell short of expectation as the private-sector added 169K jobs in April while analysts were looking for 200K (prior read was revised down to 175K); the report indicates that manufacturing sectors lost 10K jobs while all the other sectors added jobs. In addition, companies with more than 500 employees have the slowest growth. The greenback took the hit, the dollar index reached 93.89, the lowest level since February 29th.

EUR/USD jumped 1.10% following the news’ release before moving sideways around 1.1350 overnight, printing a new 2-month high at 1.1370. Fresh boost will be needed to break the next resistance at 1.1380, the release of the US jobless claims will therefore be monitored. US equities also reacted to Janet Yellen comments. The Federal Reserve chairwomen declared that equity valuations are “quite high” and that long-term US sovereign bond yields could be subject to “sharp jump” when the Fed will raise interest rates. S&P 500 lost -0.45%, Nasdaq Composite -0.40% and Dow Jones -0.48%.

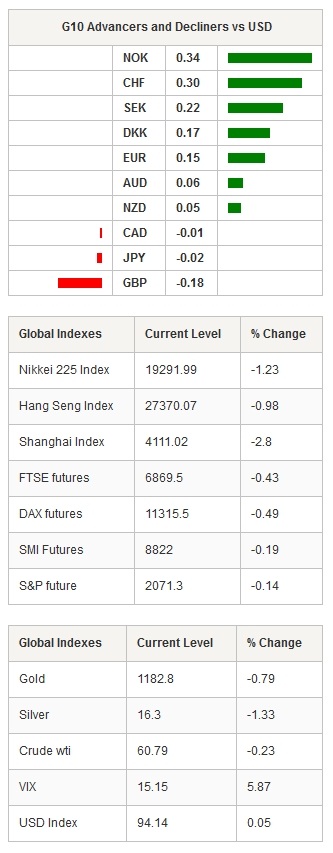

Chinese equities are on sell, again, amid bond sell-off. Shanghai Composite retreats by -2.8%, Hang Seng lost almost 1%. Japan is open and the Nikkei is down by -1.23% while Australian shares lost 0.80%. German sovereign 10-year yield keeps rising and reaches 0.65%, the 5-year one is trading above 0.10%, 25bps higher than 3 weeks ago. USD/JPY edged down to 119.46. A strong support stands at 118.50 (multi lows).

In Europe, equities were broadly flat yesterday, except in Switzerland where the SMI lost 1.50% and the SPI -1.41%. However, futures are blinking red this morning with Euro Stoxx 50 down 0.48%, Footsie down -0.30%, DAX and CAC down 0.45%.

Crude oil erased European gains in Tokyo with the Brent down to $67.68 a barrel and WTI sliding to $60.79. Brent tested the $70 level and printed a 5-month high.

In UK, markets are consolidating as voters are heading to polls today. The uncertainty is weighing on the GBP as traders clean their books and brace for the impact. GBP/USD is slightly lower this morning after a quiet session in Tokyo. On the downside, a support stands at 1.5120 and further at 1.4922 (Fib 61.8% on April rally). EUR/GBP is on the rise and is printed a 3-month high at 0.7465. The next resistance can be found at 0.7592 (high from February 3rd).

USD/BRL is grinding lower to 3.03 amid poor US jobs report. The greenback presents a negative bias since last Monday when the pair reached 3.0951. Yesterday, March industrial production figures was released and indicated a contraction of -3.5%y/y verse -3% (prior read revised down to -9.4% verse -9.1%). Brazil April PMI was also a disappointment, the Composite came in at 44.2 verse 47 prior while Service PMI was released at 44.6 verse 47.9 prior.

Today will be a relative light data, Norges Bank will release its rate decision. In the US, buildings permits, initial jobless claims and Bloomberg consumer comfort index are due. In the UK, exit polls should be available later this morning with final results tomorrow. Finally, in Brazil April FGV Inflation is due this afternoon as well as the release of the previous COPOM meeting minutes.

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1355

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.5498

R 1: 1.5287

CURRENT: 1.5214

S 1: 1.5156

S 2: 1.5051

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.47

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9138

S 1: 0.8936

S 2: 0.8823