Tuesday January 24: Five things the markets are talking about

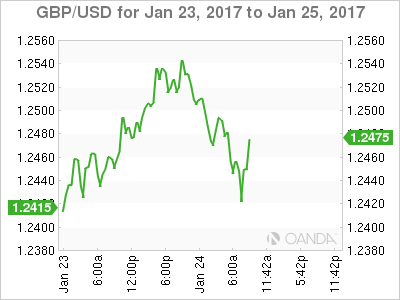

Earlier this morning, the U.K’s Supreme Court made public their ruling on PM Theresa May’s government’s appeal over Article 50 and the Brexit process.

The nation’s highest court ruled that PM May must seek the permission of U.K Parliament to trigger the two-year countdown to Brexit. This basically hands lawmakers a slim outside chance to soften the government’s current plan.

The ruling was not unanimous, the court ruled against the government by an 8-3 vote. A key part of their decisions was that legislatures in Scotland and Northern Ireland do not get to vote on the Article 50 process.

PM Theresa May believed that she alone had the power to begin the country’s withdrawal from the European Union – the need to now win the approval of lawmakers will most likely threaten the March 31 deadline for starting E.U separation talks.

1. Global equities see mixed results

Asian shares were broadly higher overnight, as the decision by the U.S. to pull out of TPP, coupled with the Trump administrations protectionist rhetoric were already priced in by investors.

Australia’s S&P/ASX 200 ended up +0.7%, while Hong Kong’s Hang Seng Index added +0.2%. Markets in Shanghai, Singapore, Taiwan and Malaysia were in higher as well. The Nikkei Stock Average seesawed but closed down -0.6%, and Korea’s Kospi fell -0.1%.

In China, the Shanghai Composite Index ended up +0.2% amidst thin volumes ahead of the weeklong Chinese New Year holidays, set to begin on Saturday.

In Europe, equity indices are trading highe,r with the banking sector leading the gains across the board. Energy, commodity and mining stocks are trading notably higher in the FTSE 100 as oil and copper prices rally intraday.

U.S. futures are set to open little changed.

Indices: Stoxx50 +0.3% at 3,280, FTSE +0.3% at 7,172, DAX +0.3% at 11,577, CAC-40 +0.2% at 4,831, IBEX-35 +0.5% at 9,352, FTSE MIB +1.1% at 19,539, Semiconductor Manufacturing (NYSE:SMI) +0.5% at 8,269, S&P 500 Futures flat

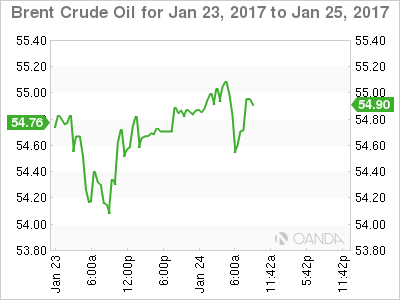

2. Oil prices find traction, gold eases

Oil prices have found short-term support on evidence that the global market was tightening as lower production by OPEC and other exporters drain stocks. However, an uptick in new drilling in the U.S is expected to cap medium term prices.

Brent crude futures are up +40c at +$55.63 a barrel, while West Texas Intermediate (WTI) also trades +40c higher at +$53.15.

So far OPEC members appear to be sticking to the deal. On the weekend, OPEC and non-OPEC producers stated that of the -1.8m bpd that they had agreed to remove from the market starting on Jan. 1, already -1.5m had been cut.

Nevertheless, it seems that the reduction in supply is being offset by an increase in U.S. production as prices rise.

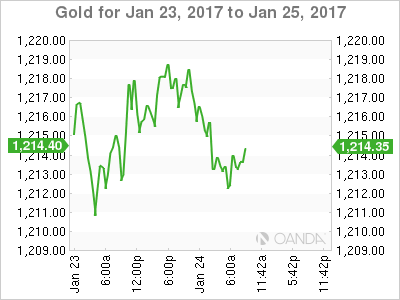

Gold prices (+$1,213.16) are easing ahead of the U.S. open, pressured by the dollars recovery from its seven-week lows overnight. The yellow metal printed a two-month high earlier (+$1,219.63) amid signs that U.S. would adopt a protectionist stance on trade.

Note: Due to a weaker dollar and investors' appetite for a hedge against inflation, Exchange-traded funds (ETF’s) that invest in gold attracted inflows of +$65.4m last week, the most money in four-months.

ETF’s also saw a record inflow of cash into products betting against commodity sensitive currencies – in particular, AUD and NOK on concerns about the potential for an economic slowdown in China and a reversal in oil prices.

3. Fixed Income yields little changed

There’s a big showdown looming in the U.S. Treasury market.

According to last week’s CFTC data, speculators have upped their U.S. 5-Year notes “bearish” bets to new records this month, while institutional buyers have done the opposite and added to their “bullish” positions.

Over the past six-months U.S. 5-year debt yields have almost doubled to today’s +1.94% – much of the selloff has occurred since November, where Trump’s surprise victory supports the “reflation” trade.

Ahead of the U.S. open, the 10-Year Treasury yield has fallen to +2.435%, after having risen briefly on Friday to +2.513%, its highest print this year. It’s equivalent 10-Year German Bund yield is little changed at +0.333%.

In Europe, the weekly net purchases of covered bonds by the ECB set a new record low of +€240m last week. Dealers are putting the blame on scheduled maturities.

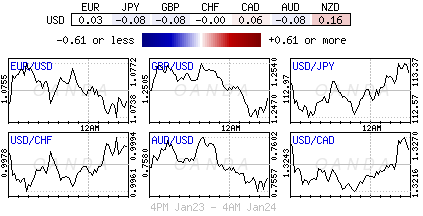

4. Dollar rallies from its seven-week lows

Ahead of the U.S. open, the ‘mighty dollar has advanced against G10 currency pairs, reversing some of the declines sparked by Treasury Secretary nominee Steven Mnuchin, who indicated yesterday that a strong dollar “could have a negative short-term effect on the economy.”

Europe’s single unit has fallen for the first time in four sessions below the psychological €1.0750 in the aftermath of this morning’s mixed PMI data (see below).

Despite the U.K Supreme Court ruling that parliament should have the power to trigger the Brexit process and not the government alone, GBP is trading under pressure (£1.2450) as the overall timeline of the Brexit remained unphased and the ruling was largely priced in. The Supreme Court noted that their decision was not about stopping the Brexit process.

5. Eurozone composite PMI’s disappoints, Turkey’s CB raises rates

Euro data this morning showed that the composite PMI’s for the eurozone came in weaker than expected this month, which may suggest that regions end-of-year revival may already be losing traction.

The headline print fell to 54.3 from 54.4 in December – market consensus expected a rise to 54.5.

Despite the miss, the robust rate of growth was enough to raise the pace of new hiring to its highest level in nearly a decade. From an inflation perspective, President Draghi and his fellow ECB members should also be happy, as businesses raised their prices at the fastest pace in nearly six-years.

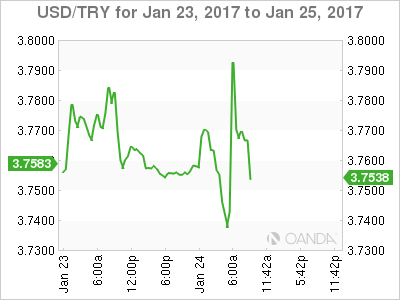

TRY has come under pressure ($3.8204 vs. $3.7482) after Turkey’s central bank (CBRT) has left its benchmark rate unchanged at +8% (unexpected), but raised its overnight lending rate to +9.25% from +8.5% (as expected).