The markets “reflationary” trend remains in vogue, with the dollar continuing to make strong gains following last week’s U.S election, on expectations of hefty public spending will raise inflation, boost the U.S economy and cause higher interest rates.

Fed Chair Yellen yesterday was at her opaque best, by saying a rate increase could come “relatively soon” and this was on the back of some of the best U.S data in decades on housing, jobless claims and inflation.

The Fed chief said the results of the U.S. presidential election hadn’t changed officials’ view following their last policy meeting that the case for a rate increase had strengthened.

The market event risk now is that the Fed does “not” hike rates in December. Fed funds futures odds are at +96%.

1. Global equities have a bumper week

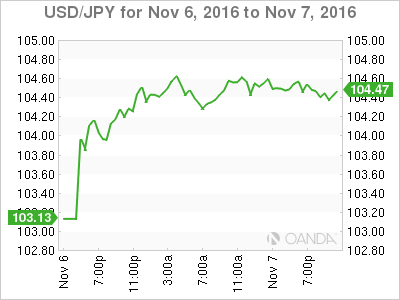

Overnight, Japan’s Nikkei share average rose to an 11-month high (+0.6%) as the yen weakened further against the surging dollar (¥110.65), raising prospects for better-than-expected exporters’ earnings. For the week, the index gained +3.4%, the biggest weekly gain since early September.

Elsewhere in Asia the week closed out with a mixed bag of results. Consumer stocks drove the Aussie S&P/ASX 200 Index up +0.4%, while South Korea’s KOSPI index slipped -0.3%. In Hong Kong, the Hang Seng Index advanced +0.2%, while the Shanghai Composite Index dropped -0.5%.

In Europe it’s a different story with indexes under pressure after initially trading higher. Banking shares are leading the losses ahead of the U.S open in the EURO STOXX 600, while commodity and mining sector are leading the losses seen in the FTSE 100.

S&P futures are set to open down -0.2%.

Indices: Stoxx50 -0.5% at 3,024, FTSE 100 -0.6% at 6,757, DAX -0.1% at 10,673, CAC 40 -0.4% at 4,510, IBEX 35 -1.2% at 8,615, FTSE MIB -1.8% at 16,261, SMI -0.2% at 7,946, S&P 500 Futures -0.2%

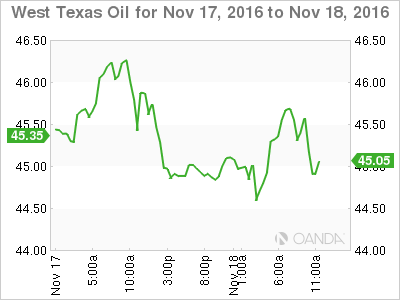

2. Crude Oil prices fall as strong dollar wipes out OPEC cut optimism

With the dollar rallying to a new 14-year high is beating back-renewed hope that OPEC might finally agree to production cuts in Vienna on Nov 30.

Brent crude futures are trading down -32c, or -0.69%, to +$46.17 per barrel, while West Texas Intermediate (WTI) oil futures are down -47c, or -1.06%, at +$44.95 a barrel ahead of the U.S open.

Despite oil prices falling the last three-days, crude is still up +6% from its three-month low print last Friday.

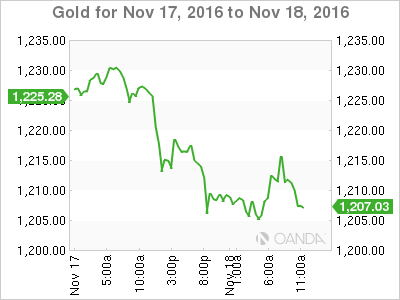

Other commodities are also feeling the pressure from a stronger dollar, higher rates and some aggressive speculation.

Gold has tumbled to the lowest print in more than five-months, falling -1.1% to +$1,202.96 an ounce. Nickel has lost another -1.4% to lead declines in industrial metals, while copper has retreated -0.8% and is heading for a weekly loss after entering a bull market last week.

3. Treasury curve continues to steepen

Trump’s policy mix of infrastructure spending and tax cuts has fuelled expectations of stronger growth and rising inflation. That has sparked a rash of selling in sovereign government bonds, especially in the U.S long-end, since the election.

The yield on U.S. 10-Year's settled at +2.278% yesterday, its highest close in 11-month, wiping out this year’s U.S yield tumble. Overnight they have backed up an additional +6bps to +2.33%

The aggressive back up in yields is causing some concerns, especially for Japan, who cannot afford higher yields.

The BoJ’s Governor Kuroda said overnight that the recent rise in 2's and 5-Year JGB yields has been quite fast, pledging to continue to use new “fixed rate operations” as needed with unlimited capacity for purchases and that they are prepared to conduct the operation even at below market yields. It’s another shot across the bow for JGB fixed income dealers, be prepared to keep the JGB curve flat!

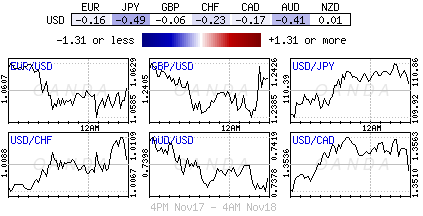

4. Dollar straddles its 14-year highs

The ‘mighty’ dollar maintains its firm tone after Fed Chair Yellen reinforced the message that the Fed was close to raising rates, while emerging market currencies have dealers testing their central banks resolve.

Ahead of the U.S open, the EUR/USD slid to its lowest level in 11-months at €1.0582, with the market beginning to talk once again about “parity.” USD/JPY has rallied to to a five-and-a-half month high of ¥110.92.

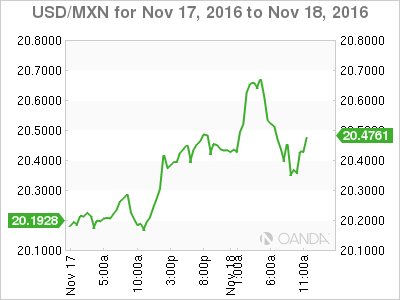

In emerging markets, the MXN ($20.66) has plummeted despite Mexico’s Central Bank’s +50bps point rate hike yesterday afternoon. Turkey’s TRY ($3.3990) continues to print new record lows as the government has hinted that no FX intervention would occur. Malaysia Central Bank (BNM) Assistant Governor Adnan confirmed that they were intervening in FX market again overnight.

5. EU remains reliant on stimulus

ECB’s Draghi sent a strong signal this morning that the ECB would extend its bond-purchase program on Dec 8, by warning that the eurozone’s weak economy remains “clouded by risks and heavily reliant on the ECB’s stimulus.”

Speaking at the 26th European Banking Congress, he said “the ECB will continue to act, as warranted, by using all the instruments available” until inflation picks up sustainably. Draghi basically reiterated comments from other board members this week regarding a cautious approach to exiting the central bank’s stimulus measures.

The market consensus is leaning towards the ECB to announce a six-month extension of the bond purchases program (€1.7T) next month.

It was not all doom and gloom, Draghi pointed to some encouraging signs, including a rebound in employment and a reduced dependence on exports, which makes the region less vulnerable to external shocks.

But similar to other central bankers, he mentioned geopolitical uncertainty and weak bank profits are a concern.