Monday May 29: Five things the markets are talking about

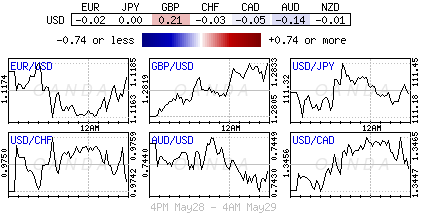

Overnight, global stocks were mixed amid low trading volume while the dollar held to a narrow range as investors continue to weigh the latest comments from the Fed on interest rates and the U.S economy.

Note: Markets are closed in the U.S., the U.K. and China.

On the weekend, the G7 concluded it’s meeting in Italy with a vague commitment to existing exchange rate arrangements, pledge to “fight protectionism” and reduce global imbalances to support growth.

However, climate change friction was among the more noteworthy developments, as leaders failed to bridge differences on the issue. The focus now turns to China-EU investment agreement taking place next weekend.

It’s a busy week on the data front; final May manufacturing PMI’s will be released globally.

In Asia, Japan posts key data for April industrial production, household spending, retail sales and unemployment.

North America, Canada releases its Q1 GDP and its trade balance numbers. Stateside, there is April personal spending and international trade data to shift through before Friday’s May employment situation report.

1. Global equities mixed in thin holiday trade

In Japan, the Nikkei was flat overnight as investors wait for key U.S data this week to provide clues on how soon U.S interest rates might rise. The broader TOPIX index advanced less than +0.1%.

In Australia, the S&P/ASX 200 Index fell -0.8%, pressured by weakness in energy and mining sector.

In Hong Kong, the Hang Seng increased +0.3% and the Hang Seng China Enterprises Index rose +0.4%.

Note: China markets are closed for the Dragon boat festival.

In South Korea, the KOSPI fell -0.1% after jumping +0.7% earlier in the session. The index closed last week at an all-time high. Overnight, North Korea conducted another ballistic missile test, despite being warned repeatedly by world leaders.

In Europe, regional bourses are broadly flat on low volumes due to holidays in the U.K and U.S. Energy stocks are somewhat depressed following lower crude prices.

Indices: Stoxx50 -0.2% at 3,576, FTSE closed, DAX flat at 12,602, CAC 40 -0.1% at 5,330, IBEX 35 -0.1% at 10,889, FTSE MIB -1.1% at 20,982, SMI -0.4% at 9,008

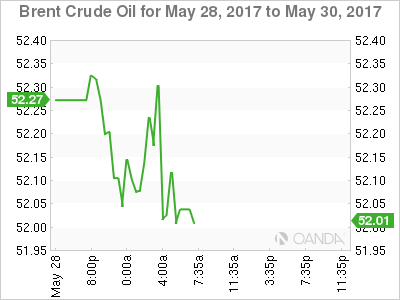

2. Oil dips as U.S drilling weakens drive to tighten markets

Oil prices are trading on the back foot, pressured by the rise in U.S drilling which continues to weaker OPEC led attempts to tighten global supplies.

Brent crude futures are trading down -6c at +$52.09 per barrel, while U.S West Texas Intermediate (WTI) crude futures are down -8c at +$49.72 per barrel.

OPEC and some non-OPEC producers agreed last week to extend a pledge to cut production by around -1.8m bpd until the end of the Q1 2018.

However, the price action since the May 25 decision would suggest that the market was expecting much deeper cuts and a longer deal. Despite the ongoing cuts, oil prices have not been able to rally much beyond +$50 per barrel.

Much of OPEC’s success will depend on output in the U.S, which is not participating in the cuts and where production has soared +10% in two-years to over +9.3m bpd.

Note: According to Baker Hughes’s report, data on Friday showed that U.S drillers have now added rigs for 19 consecutive weeks, to 722, the highest amount in two-years.

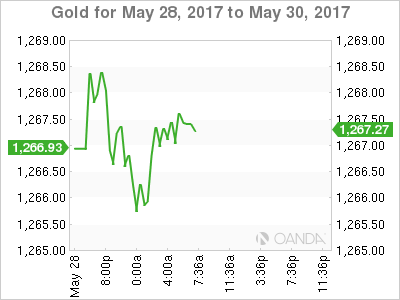

Gold is holding steady near its four-week highs after rising almost +1% in Friday’s session, supported mostly by geopolitical tensions boosting its safe-haven appeal. Spot gold is almost flat at +$1,267.01 per ounce, after it climbed +0.9% to touch its strongest print since May 1 at +$1,269.50.

3. Global yields confined to tight ranges

U.S government bonds retraced early gains Friday, ending the day little changed amid signs that investors have grown comfortable with current prices. The yield on U.S 10’s closed out the week at +2.25% after early climbing in the week as the market was flooded with new debt supply from both the Treasury and the private sector.

However, last week’s Fed minutes which suggested U.S policy makers would continue to take a cautious approach to tightening monetary policy had the curve flatten again.

To date, the Fed has strongly signalled that it will raise interest rates next month, but officials have promised to keep a close watch on inflation, and their preferred gauge – personal-consumption expenditures price index or PCE – will be in the spotlight tomorrow.

4. Dollar temporarily contained

The USD is trading little changed in holiday thin trading. The greenback found some support from Fed Williams stating that the U.S medium-term trends “remains pretty favorable despite some recent soft consumer price data.”

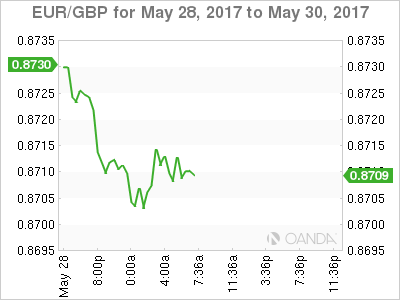

Sterling is a tad firmer by +0.2% at £1.2842 despite some weekend polls continuing to point that the upcoming Jun 8th U.K Parliamentary election race was tightening.

PM May’s Conservative Party still holds a sizeable lead, but the initial “blowout scenario” has been deflated in recent sessions.

Note: Conservative Party’s lead continues to erode (Opinium Poll: Con: +45% (-1); Labour +35% (+2); ComRes Poll: Con: +46% (-2); Labour +34% (+4); ORB/Telegraph Poll: Con: +44% (-2); Labour +38% (+4).

The EUR (€1.1182) continues to trade within touching distance of the psychological €1.1200 handle.

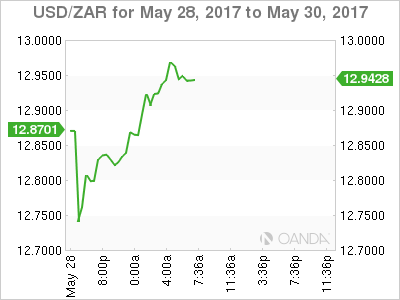

Elsewhere, the ZAR was weaker by -0.7% at $12.9500 after South Africa President Zuma survived a no-confidence motion. The President has faced mounting pressure from ANC members and opposition parties since he fired respected finance minister Gordhan in March, triggering a credit rating downgrade.

5. Data point to little SNB FX intervention

This morning’s sight deposit data (a proxy for intervention) from the Swiss National Bank (SNB) suggests that have not been intervening much in markets to weaken the franc in recent weeks.

The latest SNB figures showed sight deposits were flat last week at +576B francs and were broadly stable for May as a whole. They had risen sharply in early 2017 as the SNB stepped up its efforts to fight the strong franc.

EUR/CHF at €1.0891 is marginally firmer compared with Friday’s close.