by Eli Wright

Oil takes center stage today after news that Royal Bank of Scotland (NYSE:RBS) failed the Bank of England's annual stress test dominated the European open. The much anticipated OPEC meeting in Vienna wraps-up today as members once again attempt to hammer out at least a nominal agreement to cut output.

RBS (LON:RBS) will need to raise additional capital of approximately £2 billion in order to buffer against any future financial crises. Other UK based banks also struggled. However, Barclays (NYSE:BCS) and Standard Chartered (LON:STAN) were able to hit key targets by cutting dividends.

Beyond banks and oil, markets also internalized yesterday's positive Q3 US GDP report, which showed Q3 growth improving at the fastest pace in more than two years as well as record-breaking Cyber Monday sales.

Overnight in Asia, oil anxiety gripped the markets. Reactions were mixed: the Nikkei closed flat, at 18,308.48; the Hang Seng closed 0.19% higher, at 22,781; the Shanghai Composite lost 1.01% to close down at 3,249.64.

European equity markets opened higher: the FTSE is up 0.65% to 6,816; the DAX is up 0.13% to 10, 634.5 and the Stoxx 50 is higher 0.33% to 3,048.

Wall Street ended yesterday slightly higher: the Dow closed up 0.12%, at 19,121.6; the S&P 500 finished up 0.13% at 2,204.66; and the NASDAQ gained 0.21%, to close at 5,379.92. In pre-market trading the Dow is up 0.11%, the S&P is up 0.14% and the NASDAQ is up 0.03%.

US Treasurys sold off in response: the 2-year yield is up at 1.103%; the 10-year is higher at 2.311%; and the 30-year is up to 2.962%.

Forex

The USD sold off earlier this week, but the decline appears to have been nothing more than profit taking; the uptrend has now resumed. Today's ADP Nonfarm Employment Change later this morning should shed some light on the dollar’s future direction. The US Dollar Index is currently at 101.07.

The euro fell yesterday as investors priced in concern that a defeat for Italian Prime Minister Matteo Renzi in Sunday’s referendum would undermine the country’s future in the EU. The EUR/USD pair continues to trade lower, currently at $1.064.

Sterling, on the other hand, rose to $1.2485 yesterday following better than expected results in the monthly UK Money Supply and Mortgage Approval reports. It's now at similar levels.

The Japanese yen has been heading lower on dollar and global equity market strength and the pair seems to be on a continuing uptrend. However, analysts at JP Morgan and UBS Wealth Management believe the yen could appreciate to trade at ¥98-99 by the end of 2017.

There is range between 111 and 114.8 where the USD/JPY could consolidate before deciding which way to move next.

Commodities

After falling over 4% yesterday, oil prices have jumped 5% higher this morning in advance of news from today's OPEC meeting in Vienna, as markets await the most recent iteration of whether production cuts will—or won't—actually occur. Russia is not a part of these talks, but there remains a shred of hope that OPEC members could at least find some common ground on who should cut and by how much. Iran and Iraq both want exemptions, meaning Saudi Arabia, Kuwait, Qatar, and the United Arab Emirates would need to absorb most of the over-one-million bpd oil production cut needed to drive up prices.

Asian buyers aren't happy with OPEC's attempt to artificially diminish oil supplies and have threatened to purchase oil from outside OPEC, which would only exacerbate OPEC’s problems. In a related development, Canadian Prime Minister Justin Trudeau yesterday approved two new pipeline projects, which would improve Canada’s ability to deliver Alberta crude to the Pacific coast and from there to China. It's expected to increase delivery by an additional 1.1 million bp daily.

A press conference by the President and Secretary General of OPEC is tentatively scheduled for 10 AM ET.

Analysts at Barclays and Goldman Sachs said that a deal could quickly push prices above $50, but that a 'no deal' outcome would foster expectations of oil prices averaging $45 through the first half of 2017.

If Brent prices start to fall, $44 could quickly be breached, followed by a move to $41, and then to $38.

Crude’s decision points are more compact than Brent’s but the demarcations are similar: $43 to $41 to $39 in the event of a fall; up to $49 and possibly further in the event of a rise.

The stronger dollar continued to weigh on precious metals yesterday. Gold fell 0.78%, silver dropped 1% and platinum was 0.5% lower. If markets see undue volatility today because of oil, however, there may be a rush to safe-havens.

Stocks

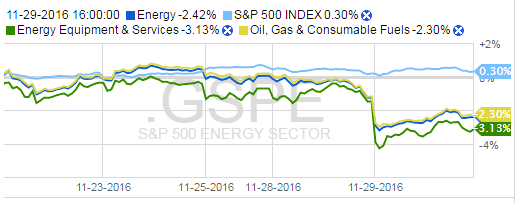

Since oil appears to be today's theme, we'll focus on the S&P 500 Energy Index. Over the past five days the sector has been hit hard. Though profit-taking has weighed on the entire S&P 500, which has barely eked out a 0.3% gain, energy has slipped 2.42%.

Source: Fidelity.com

Of the 35 energy companies listed on the S&P 500, 30 ended the day yesterday down: Hess (NYSE:HES) and Marathon Oil (NYSE:MRO) shares lost nearly 4%; Anadarko Petroleum (NYSE:APC) and ConocoPhillips (NYSE:COP) shed approximately 3%; Halliburton (NYSE:HAL) fell 2.05%. Baker Hughes (NYSE:BHI), Occidental (NYSE:OXY), Devon Energy (NYSE:DVN), Chevron (NYSE:CVX), and Apache (NYSE:APA) all dropped around 1%. Exxon (NYSE:XOM) and Noble Energy (NYSE:NBL) fell 0.6%.

Still, this could all change later today if OPEC delivers positive production freeze news.

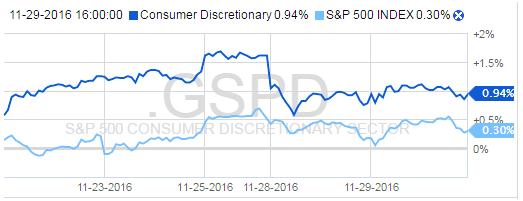

Separately, the Consumer Discretionary Index has outperformed the general S&P over the last five days, rising 0.94%.

Source: Fidelity.com

Among the big gainers yesterday were luxury and travel companies along with, toy, and retail shares. Tiffany & Co (NYSE:TIF) rose 3.15%, Hasbro (NASDAQ:HAS) is up 1.37% while Mattel (NASDAQ:MAT)) was up 0.22%; Best Buy (NYSE:BBY) is up 0.64%; Target (NYSE:TGT) is up 0.89%; Nordstrom (NYSE:JWN) is up 0.5%. Shares of Carnival (NYSE:CCL) rose 2.23%, Royal Caribbean Cruises (NYSE:RCL) gained 1.74%, and Marriott (NASDAQ:MAR) was up 1.33%.

Final Cyber Monday data provided reason for retailer optimism: record online sales of $3.45 billion in the US, a 12% jump YoY. The holiday shopping season, which began on November 1, has so far brought in nearly $40 billion in online revenue. Surprisingly, these figures did little to affect the price of Amazon (NASDAQ:AMZN), which actually ended the day 0.55% lower.