by Eli Wright

The big headlines yesterday were about oil—specifically, after weeks of hemming and hawing, an OPEC deal to cut output was finally reached. Prices surged more than 9% on the news. Now, as the market week comes to a close attention will turn to tomorrow's US Nonfarm Payroll release after which all eyes will move to Europe, where Italy's key senate reform referendum is scheduled to occur on Sunday.

For equities, the response to the OPEC deal was varied – energy stocks performed very well, but the overall market reaction was muted with ongoing selling into the US close and a quiet open in the Asian morning.

In Asia overnight, the Nikkei rose 1.12%, to close at 18,513.12; the Shanghai Composite finished 0.74% higher, at 3,273.31; the Hang Seng gained 0.39%, up to 22,878.23.

European markets opened lower. The FTSE is currently down 1.19% to 6,705; the DAX is down 0.79% to 10,556.25 and the Stoxx 50 is also down, 0.78% at 3,028.

US markets couldn’t sustain yesterday’s higher open: the S&P 500 ended the day 0.27% lower, to close at 2,198.81 while the NASDAQ Composite lost 1.05%, to close at 5,323.68. The Dow finished flat, at 19,123.58. Profit-takers also kept pressure on the small-cap Russell 2000, which fell for a third straight day, down 0.46% to 1,323.08.

Pre-market trading is relatively flat: the Dow is down 0.03%, the S&P is down 0.14% and the NASDAQ is down 0.18%.

Tepid stock market reactions yesterday did nothing to slow the exodus from bonds: the 2-year Treasury yield rose to 1.123%; the 10-year yield is up to 2.388%; the 30-year yield is back above 3%.

The bond selloff has been global. The Bloomberg Barclays Global Aggregate Total Return Index of bonds fell 4% in November, the index’s largest-ever decline. It looks like the bond bull market may be over.

Forex

The US dollar continued to strengthen yesterday, on the back of positive economic data. The ADP Nonfarm report showed a 216K employment increase, well ahead of the expected 165K. With US Manufacturing PMI later today and the NFP tomorrow, the USD could reach even higher.

USD/JPY reached an eight-month high, breaking above 114. It may extend to 115 on the back of a good NFP release. Cable remains in a mini uptrend against the USD, and has just broken above 1.25 for the first time in two weeks.

Higher oil prices lifted the Canadian dollar and Russian ruble.

Commodities

OPEC surprised yesterday, by actually agreeing to a deal after months of whipsawing on the subject. Specifics call for reduced production by 1.2 million bp day, to 32.5 million – the first such cuts in eight years.

Markets now hold out the hope that the deal will revive sagging oil prices, which would provide a boost to US shale drillers and to struggling developed world, non-OPEC oil economies such Russia, Venezuela and Libya. To a lesser extent, Canada could benefit as well.

Brent is currently trading at $52.47 while crude is at $49.94.

Nevertheless, for all the revelry, skepticism over the deal remains. The newly agreed-upon production levels still leave production levels at the high end of daily output for the past ten-year period. “In other words, the meeting is highly unlikely to substantially affect the oil market balance,” concluded Michael Cohen, an analyst at Barclays.

In a note following the agreement, Goldman Sachs said it expected oil prices to average just $55 per barrel in the first half of next year.

Gold is down 0.46% right now, to $1,168.65. The overall downtrend continues. Gold fell approximately 10% in November and has so far failed to climb back over its new. $1,200 resistance. Silver lost more than 10% in November as well, currently trading at $16.362, a loss of 0.66%.

Stocks

Energy stocks trended higher as markets opened yesterday and over the course of the day the price action didn't disappoint.

Whiting Petroleum (NYSE:WLL) skyrocketed more than 30% higher: Devon Energy (NYSE:DVN) soared over 14%; Chesapeake (NYSE:CHK) and Petrobras (NYSE:PBR) shares jumped close to 10%; Royal Dutch Shell) B shares (NYSE:RDSb) climbed 4.5%; Exxon (NYSE:XOM) and Chevron (NYSE:CVX) each gained around 2%.

Financial shares have also been trending higher, likely on news from the US and Europe.

First, more former and current Goldman Sachs (NYSE:GS) executives are poised to join Trump’s administration. Newly picked Treasury Secretary Steven Mnuchin spent 17 years at Goldman; chief strategist Steve Bannon spent some time there as well; and Goldman’s current president Gary Cohn could soon be up for a government posting as well. Their combined anti-Dodd-Frank sentiments, which echo Trump's own stated reservations, could give banks a further boost.

Royal Bank of Scotland's (LON:RBS) failure to pass the BoE stress test, as well as Sunday’s referendum vote in Italy also raised interest in—and anxiety about—the banking sector. Markets are nervous that a referendum to reduce the Italian senate’s power and streamline legislation will not pass. If that happens, Italian Prime Minister Renzi has hinted he may resign which worries markets for two main reasons:

- Early elections could give rise to the Five Start Movement, a populist party in favor of Italy leaving the EU. Such an eventuality might initially shock markets, but as Brexit has shown, it takes a while to initiate an exit and markets can withstand the interim pressure.

- The political uncertainty surrounding a “no” vote would have a domino effect on Italy’s banks, which would struggle to raise needed capital. Italy is the eurozone’s third-largest economy, but the banking industry there is on precarious footing, currently grappling with over €200 billion in non-performing debt (from approximately 10 times as many unpaid loans compared to US institutions). So far this year, Italian banks have underperformed their European peers by 40%. For Italian bank shares the price of a “no” vote may already be priced in. However there’s a risk that as many as eight Italian banks could fail, which could become a contagion for other European banks. Unicredit (MI:CRDI), Italy’s largest bank, Spain’s Banco Popular (MC:POP), Portugal’s Caixa Geral de Depósitos and even Germany's Deutsche Bank (DE:DBKGn) may end up seeing their shares battered.

Within the UK, markets over the past few days have focused on the by now well-publicized results of the BoE's stress test: Royal Bank of Scotland (LON:RBS) failed and needs a further £2 billion buffer in case of a future financial crises. Barclays (LON:BARC) and Standard Chartered (LON:STAN) missed some key metrics, but did not require a revised plan to raise capital; HSBC Holdings (LON:HSBA), Lloyds (LON:LLOY) and Banco Santander (LON:SANq) all passed.

And because Europe’s financial activity is largely concentrated in London, at least for now, any shock to Italy’s banking institutions would impact British banks as well.

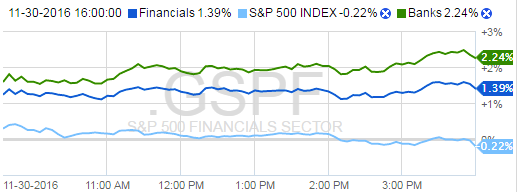

US bank shares increased approximately 33% since July. Just yesterday, banks outperformed both the overall S&P and the S&P Financial Index.

Source: Fidelity.com

Among the biggest gainers were Bank of America (NYSE:BAC) which rose 4.65%; Goldman Sachs (NYSE:GS) moved up 3.82% to hit an eight-year high, closing at $219.84. Citizens (NYSE:CFG) finished the day 3.46% higher.

Still, anxiety surrounding the Italian vote in conjunction with the uncertain status of too many European financials, could spur some profit-taking in this sector prior to the weekend.