by Eli Wright

This morning the dollar regained its momentum, global indices are mixed, the Turkish lira continues its downward spiral and markets await US President-elect Donald Trump’s speech later this morning for some indication of how his administration will proceed and what that will mean for US and global economies.

In Asia overnight, the Nikkei rose 0.33% to 19,364.67 and the Hang Seng climbed 0.84% to 22,935.35. The Shanghai Composite dropped 0.76%, to 3,137.63.

In Europe this morning, the FTSE continues to scale new highs, currently up 0.14%, to 7,286. The DAX is flat at 11,584.50, and the Stoxx 50 has lost 0.05%; it's down to 3,306.50.

On Wall Street yesterday, the NASDAQ closed at yet another record-high, 5,551.82. The Dow dropped 0.16% to 19,855.53. And the S&P, at 2,268.90, closed flat.

In pre-market trading, the NASDAQ is up a modest 0.02%; the Dow is up 0.05%; and the S&P is down 0.03%.

Yields are mixed as well: the US 2-year Treasury note has fallen to 1.19%, but 10- and 30-year yields are up: 2.389% and 2.976%, respectively.

Forex

With very little in the way of important US economic data on the calendar over the past two days, it’s been difficult for traders to maintain their dollar exuberance.

Yesterday’s JOLTs Job Openings report, which which came in lower than expected, showed 5.5522M open positions. Nevertheless it was better than last month’s 5.451M. The Dollar Index inched 0.03% higher on the news, to 102.04.

Traders will pay close attention to the President-elect’s press conference this morning in the hopes of gaining some clarity as to how Trump intends to carry out his campaign promises. A lack of specificity could disappoint markets, but it’s equally possible that some form of feel-good rhetoric propels markets blindly higher.

The euro is down slightly since yesterday, falling below the $1.06 level, to $1.0553. However, technical charts could be signalling a corrective wave higher over the next few weeks. The pound is slightly lower, but continues to find strong support at $1.21. The yen has retreated 0.26% today, to 116.07. The dollar is higher versus the Swiss franc and loonie, but lower vs the Australian dollar. Bitcoin is in a freefall thus far today, down 11.4%, to $802.

Most emerging market currencies continue to struggle versus the dollar—none more than the Turkish lira and Mexican peso.

The lira has plummeted more than 26% since this past summer’s failed coup. With Turkey still in a heightened state of emergency, the lira continues to reach new record lows; it’s currently down to 3.8439 vs the USD. President Erdogan has refused to raise interest rates to buoy the currency thus far, but the FX market might soon force his central bank’s hand; a large one-off rate hike could precipitate a sharp reversal in Turkey’s fortunes. The next bank meeting is on January 24.

As William Jackson, a senior emerging-market economist at Capital Economics said:

“The latest fall in the lira has prompted the Turkish central bank to announce small tweaks to its policy framework to provide support to the currency. Past form suggests that these will have little lasting impact. Instead, it looks increasingly likely that the [monetary policy committee] will need to raise official interest rates at its next meeting.”

Trump’s continued threats of revamping NAFTA and building a wall that he will try and force Mexico to pay for, have weighed on the peso throughout the US election campaign. Since Election Day it has fallen 15%; it's now trading at 21.7724 vs the USD – just off a new record low.

One more emerging market currency that Kathleen Brooks, Research Director of City Index, recommends closely watching the Czech koruna. The koruna has been capped at 27 vs the euro since 2013, but with upside inflation raising prices 2% in the Czech Republic, there’s a real possibility the peg will be removed in the first half of this year. Brooks points to the havoc wreaked on markets via the Swiss franc, when that country's central bank broke the peg tying the currency to the euro in 2015 without prior warning.

Commodities

Oil fell approximately half-a-percent yesterday as production questions about OPEC and non-OPEC production arose.

Thus far, Saudi Arabia, Kuwait, Venezuela, and the UAE appear to be in compliance with their agreement to curtail production. However, a hurdle has emerged via Iraq and its relationship to the autonomous Kurdish region, which pumped an average of 587,646 bpd to Turkey in November. The region is allocated 250,00 bpd by Iraq, but clearly Kurdish production has gone way beyond Baghdad's control. Some are speculating that this could be the first fissure.

In the week ending January 8, Russia reduced output by about 100,000. However, that cut is just a third of what they initially pledged.

In the US, the API weekly crude stock report showed stores of 1.500M – significantly more than the expected 0.900M. The EIA crude oil inventory numbers are due out today.

Oil is up almost 1% in early trading today. Crude is trading at $51.23, while Brent is at $54.14.

Natural gas reversed its fortunes yesterday. After falling 5% on Monday, gas regained all losses, rising 5% to $3,278, as colder US weather patterns were predicted for the latter half of January. Natural gas is slightly lower this morning, down to $3.219.

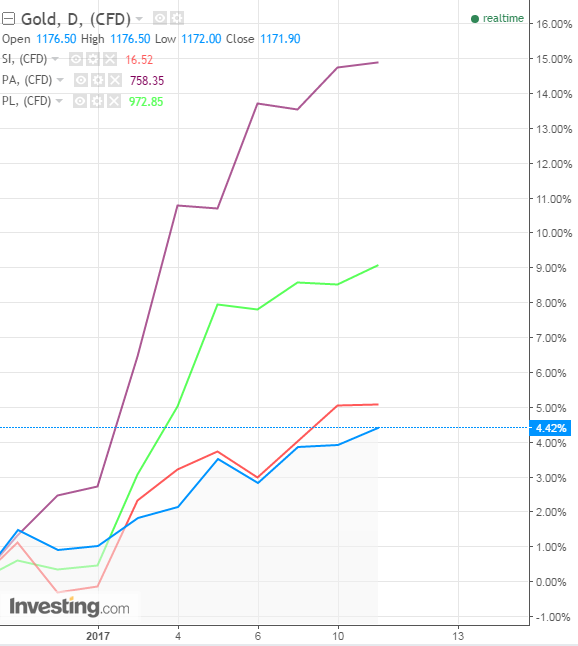

Precious metals have been performing well recently. Since the New Year, gold is up approximately 3.5%; silver is up more than 5%; platinum is up more than 8%; and palladium is up 12%.

Stocks

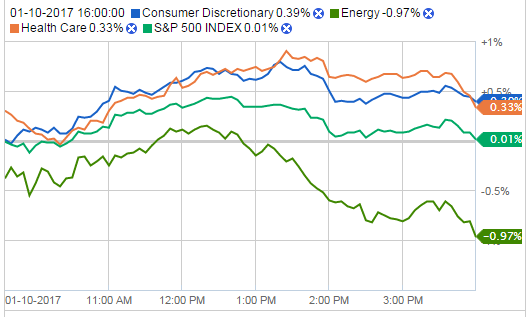

The S&P 500 closed flat yesterday. Consumer discretionary stocks were the best performers; the Consumer Discretionary Index rose 0.39%. For a second straight day the energy sector struggled; the Energy Index was down 0.97%.

Source: Fidelity.com

Chipotle (NYSE:CMG) was the biggest gainer on the Consumer Discretionary sector, with shares climbing 5% after the burrito chain reported smaller same-store sales declines in the fourth quarter. Chipotle saw sales decline more than 20% in the third quarter, but in Q4, according to a recent company release, they fell only 4.8%. The company is set to report full Q4 2016 earnings on February 2.

Carmaker General Motors (NYSE:GM), and auto parts manufacturer Delphi (NYSE:DLPH) each rose more than 3.5%.

In fashion, Michael Kors (NYSE:KORS) and Urban Outfitters (NASDAQ:URBN) gained 3.19 and 2.57%, respectively.

Despite the rise in natural gas prices yesterday, Williams (NYSE:WMB) was the biggest loser on the S&P, down 10.75%, while ONEOK (NYSE:OKE) and Spectra Energy Corp (NYSE:SE) declined 2.45% and 1.51%, respectively.

Due to lower oil prices, Newfield (NYSE:NFX), Baker Hughes (NYSE:BHI), Exxon Mobil (NYSE:XOM) and Noble (NYSE:NBL) also continued to slide.

The biggest gainer on the S&P was biotech company Illumina (NASDAQ:ILMN), which soared 16% after raising its Q4 sales expectations and unveiling new genetic sequencing technology at the JP Morgan Healthcare Conference in San Francisco.

The biggest gainer on the NASDAQ was Signal Genetics (NASDAQ:SGNL), another genetics company. Shares of the oncological diagnostic services provider skyrocketed 264.93% in unusually heavy trading.

Other genetic diagnostic/therapeutic companies gained as well: Biocept (NASDAQ:BIOC) rose 77.45%, while GenVec (NASDAQ:GNVC) marched 76.86% higher.