by Clement Thibault

There's a commonly held belief among traders and investors that December might just be the most wonderful time of the market year. Perhaps it's because in addition to the general holiday merriment, one of the most popular beliefs market participants ritually resurrect right now is the anticipation—indeed for many, the expectation—of an annual Santa Rally, a period of time around the Christmas holiday when markets will surely gift investors and traders gains they might have missed during the rest of the year.

What exactly is a Santa Rally? The exact definition varies.

Some define the period when this might happen as the trading days between Christmas and New Year's Eve while others extend the timing to include a few additional days into the new year. Others believe the entire month of December is a positive time for markets.

There are a number of rationalizations for the phenomenon. Among the more plausible reasons a rally might occur: an influx of end-of-year bonus money invested in the market, general optimism surrounding the holiday season and even anticipation of the January Effect (another market hypothesis which attributes a strong rise in prices to buying at the beginning of the year in order to off-set capital gains related selling at the end of the previous year).

Of course, in opposition to the notion of a guaranteed, calendar-pegged rally is the Efficient Market Hypothesis, which says that asset valuations fully reflect all available information, and since a timed rally is known in advance, a rally relying on a known event at a known time is impossible. So we decided to see if the idea of a Santa Rally actually had any validity.

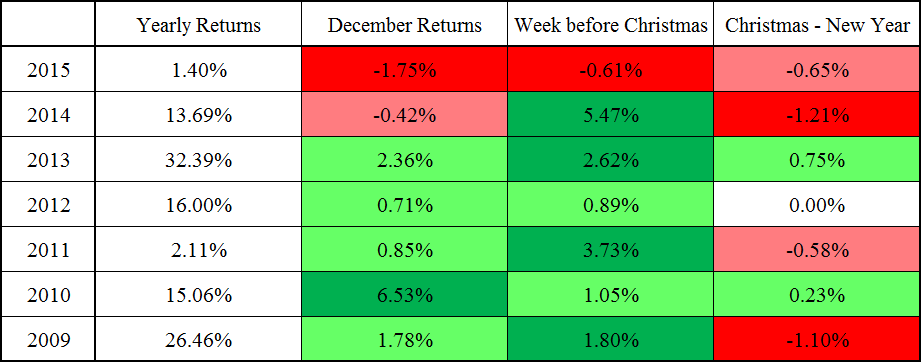

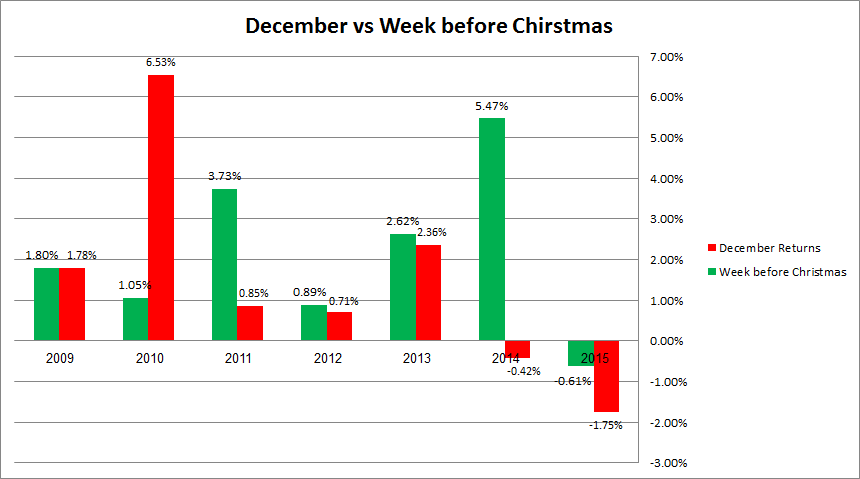

Here's a look at S&P 500 data for the past seven years of this aging bull market:

First thing to note: there is no rally pattern of any kind during the whole month of December. The years 2010 and 2015 are positive and negative outliers respectively, nothing more. Our conclusion? If there is such a thing as a 'Santa Rally' it's certainly not occurring over the course of the entire month.

For that matter, data doesn’t show anything special happening at the height of the holiday season either, between Christmas and New Year's Day. Only two of the seven sample weeks were positive, four were negative, and one was flat. The average return for that specific period was a dismal -0.37%. Disappointing results for any week, let alone one where expectations were high for better-than-average returns.

However, in recent years, there appears to be an unexpected rally period in town.

Surprisingly, the week right before Christmas, between the 17th and 24th of December, has been extremely good to investors over the time-frame we examined.

Discounting last year's results—which were brought about by market turmoil related to crude oil hitting multi-year lows ($33.9 during that specific week) even as China's Shanghai Composite and Shenzen exchanges both showed worrying signs of an impending crash—this particular week has consistently outperformed the full month of December. Indeed, in 2011 it even set the S&P up for a positive close on the year.

With an average return of 2.14% for that weekly period, compared to 1.44% for the full month, and the even more disappointing negative yield for the holiday week, it's fair to say that Santa does indeed come to town in December, but he arrives earlier than expected and his visit is brief—albeit potentially profitable for those who are paying attention.