by Eli Wright

Markets are trying to digest President Trump’s memorandum of withdrawal from the TPP trade agreement, which—though clearly and frequently signaled during the election campaign—still shifts the US squarely into protectionist territory on the new Commander-in-Chief's first working day. And the UK's Supreme Court ruled earlier this morning that Article 50 cannot be triggered until after a Parliamentary vote.

In the aftermath, the dollar has edged higher while sterling has moved lower. Global markets are mixed, and US indices are still in a holding pattern. Oil is up, but gold and silver have pulled back slightly from yesterday’s highs.

Overnight in Asia, the Nikkei dropped 0.55% to 18,787.99, while the Shanghai Composite and Hang Seng both gained approximately 0.21%, to 3,142.55 and 22,949.86, respectively.

In Europe this morning, the FTSE has edged 0.05% higher, to 7,153.95; the DAX has gained 0.12%, to 11,560; and the Stoxx 50 is up 0.09%, to 3,274.50.

On Wall Street, indices finished yesterday lower, but remain tightly range-bound. The Dow fell 0.14% to 19,799.85; the S&P 500 lost 0.27% 2,265.20; and the NASDAQ inched down 0.04% to 5,552.94.

US equities are little changed in pre-market trading. The Dow is up 0.03%; the NASDAQ is 0.04% higher; and the S&P is down 0.01%.

Of interest in light of rangebound major equity markets, yesterday, the iShares MSCI Emerging Markets ETF (NYSE:EEM) rose 1.48%.

US Treasury yields are higher this morning and technicals point to possible additional upward moves. The 2-year yield is 1.164%; the 10-year yield is 2.417%; and the 30-year yield is 3.005%.

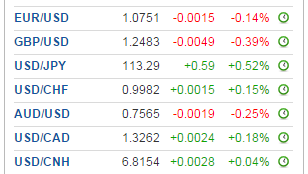

Forex

The US Dollar Index fell 0.6% in yesterday's trading, but this morning it's up 0.05% to 100.22; right now the greenback is trading higher against all the currency majors.

Though the US withdrawal from the TPP agreement dismantles a key Obama legacy, when asked yesterday about his intentions toward NAFTA, Trump said he would approach it “at the appropriate time.” It’s one thing to pull out of a not-yet-ratified agreement such as TPP but an entirely different endeavor to renegotiate a longstanding trade deal. If the new President delays tackling NAFTA, the dollar could get some breathing room.

On the economic calendar today:

- German manufacturing PMI came in at 56.5, beating expectations of 55.4

- US Existing Home Sales for December will be released later today; a 1.1% decline, to 5.52M units is expected

- Australian Q4 CPI will be announced this evening. It is expected to remain steady at 0.7%

Commodities

Gold opened at a two-month high of $1,217 yesterday to start the trading week. However, this morning’s stronger dollar has weighed on the precious metal, which has fallen 0.19% to $1,213.

Silver is also trading lower today, down 0.13%, to $17.163.

Oil prices continue to fluctuate as traders focus on either the thus-far successful OPEC production cuts or alternately the increase in US shale drilling.

Today markets are focusing on the seemingly strong start made by OPEC and non-OPEC countries in their efforts to reduce output by 1.8 million barrels. Prices for crude and Brent are both up 0.8% to $53.18, and $55.68, respectively.

Stocks

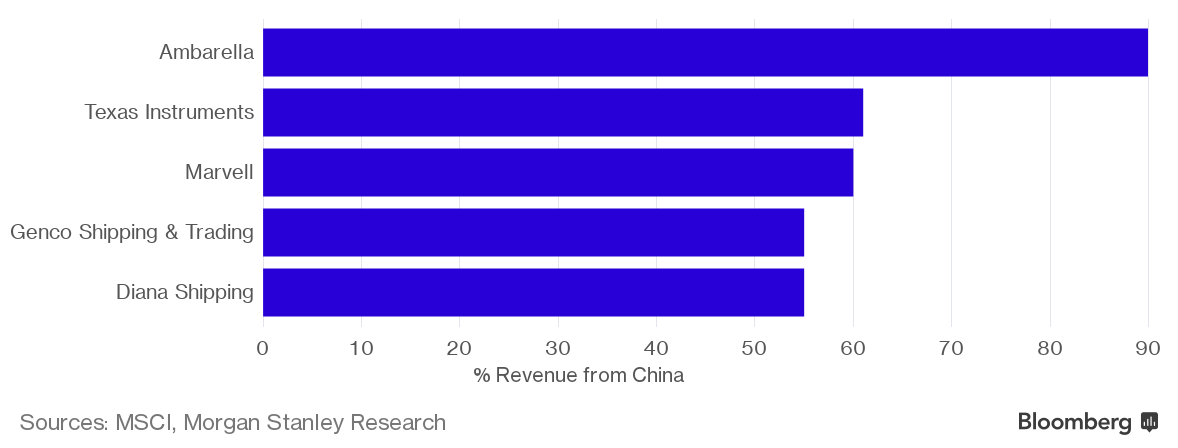

According to Morgan Stanley, US equities have more to lose than their Chinese counterparts in the event that the new US administration stokes a trade war. While almost 10% of companies listed on the MSCI US Index derive at least 10% of their sales from China, less than two percent of Chinese corporates benefit from a similar level of US sales.

US companies with the strongest presence in China include the three semiconductor companies: Ambarella (NASDAQ:AMBA), Texas Instruments (NASDAQ:TXN), and Marvell Technology Group (NASDAQ:MRVL), as well as two shippers, Genco (NYSE:GNK) and Diana (NYSE:DSX).

Sports apparel giant Nike (NYSE:NKE), which produces approximately 40% of its shoes in TPP member nation Vietnam, could also stand to lose if the USA implements an import tax. Faltering US-China relations could impact the company as well, since China currently accounts for more than 12% of Nike's sales.

Q4 2016 earnings reports today include:

- Johnson & Johnson (NYSE:JNJ), a consumer healthcare and medical device company, is expected to report EPS of $1.56 on revenue of $18.42 billion

- Verizon Communications (NYSE:VZ) is expected to report EPS of $0.89 on revenue of $32.36 billion

- Software company SAP (NYSE:SAP) is expected to report EPS of $1.53 on $6.66 billion in revenue

- Manufacturing conglomerate 3M (NYSE:MMM) is expected to report EPS of $1.87 on revenue of $7.36 billion

- Aerospace and defense company Lockheed Martin (NYSE:LMT) is expected to report EPS of $3.06 on revenue of $13.04 billion

- Texas Instruments, one of the companies mentioned above which could be heavily impacted by a trade war with China, is expected to report EPS of $0.82 on $3.31 billion in revenue

- Alibaba (NYSE:BABA) is expected to report Q3 2017 EPS of $1.13 on $33.16 billion in revenue