Here's the regular 5 macro technical charts (going as far as individual commodities, currencies, bonds, and sectors, as well as the rest of the major indexes and benchmarks). No comments on anything except the technical/price developments (albeit we will typically cover the broader case in the Weekly Macro Themes where the technical and fundamental set up produce a compelling investment idea). Even if you're not technical analysis minded it's a useful way to keep on top of trends in some of the main financial markets and as a prompt for further investigation...

In this edition we look at a bull flag that points to further upside for bond yields, some critical levels for the US dollar index, a potential confirmation of a new uptrend in gold, some clues from the options markets for the short-term direction of the S&P 500, and see why a long bias may be warranted for the Australian dollar.

1. US 10 Year Treasury Yield - Bull Flag

- Bull flag spotted on the US 10-year Treasury yield chart; this is a bullish continuation pattern.

- Measure rule for a bull flag is that the flag (which slopes against the trend) appears "half way up the flag pole" thus if you say the move started at 1.35% and you get a breakout at say 2.50% that would imply a target move of 115bps to a target yield of 3.65%.

- Yield is currently trading around its 50-day moving average and RSI has reset to below 50 from extreme overbought levels. Risk management point is 2.30% - a clean break down through the 50 day moving average and through 2.30% will quickly switch the bias from rising to falling yields. Again, 2.60% is the critical level on the upside and will provide confirmation to any upside break from the bull flag.

Overall technical view: Bias is to expect rising yields, watch for an upside break of the bull flag continuation pattern.

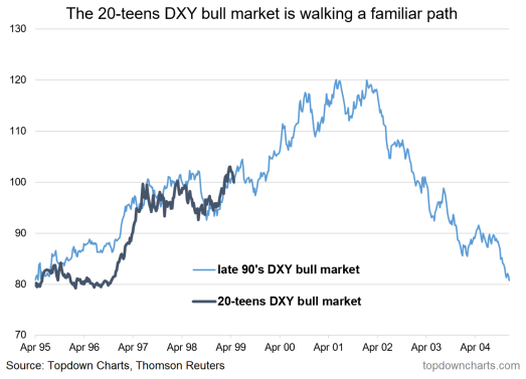

2. US Dollar Index - 100 reasons to buy and sell

- For DXY, 100 is the critical level; this support line, if broken, will probably open up a move back to the bottom of the range around 95.

- Looking at the analog chart (which appeared here) one key takeaway is that it's not uncommon for the DXY to undergo big-league corrections in the order of 7 points during a bull market.

- One thing to watch for will be a possible head and shoulders top as we already have a left shoulder, a head, and a clearly defined and meaningful neckline.

Overall technical view: Cautious; break of the 100 point will see an extension of the correction

3. Gold - Another key line in the sand

- -Gold has put in higher lows and now faces a test in the form of a resistance line.

- -Speculative futures positioning bottomed out at levels usually seen during an uptrend (it usually bottoms at a lower level during a downtrend).

- -The v-shaped recovery has also seen gold clear its 50-day moving average

Overall technical view: Bullish bias, confirmation/trigger is a clean break above resistance

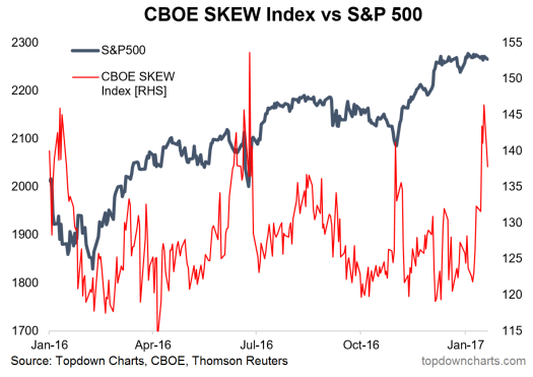

4. S&P500 - Ex-SKEW-sme

- SKEW is a measure of tail risk hedging demand. Present levels indicate high demand for tail risk hedges and high implied probability of long-tail outcomes.

- The chart shows that SKEW has spiked into the major market bottoms of the past year; so it was not smart money as such (in hindsight); thus if we assumed the same were to happen again you'd be calling for a move higher. This time however there is no real event risk unless you count the inauguration...

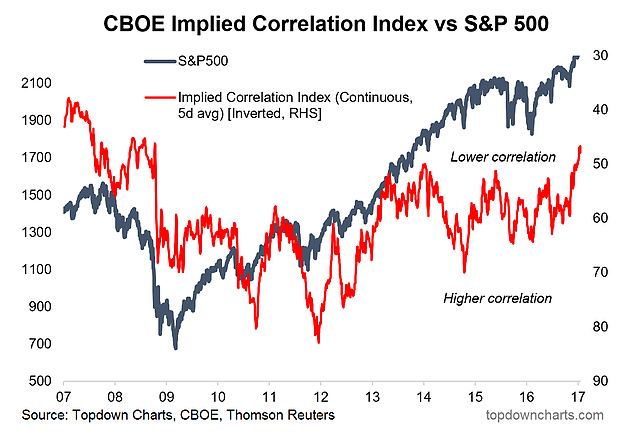

- On the other hand, a somewhat similar index, the CBOE option implied correlation index shows falling correlations which have actually been a bad sign historically. I talked about the implied correlation index here).

Overall technical view: Mixed signals from these alternative CBOE options driven indexes, but somewhat cautionary on balance

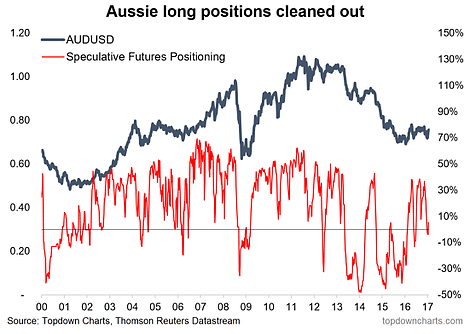

5. AUDUSD - Trading the range

- The Aussie is currently pushing up against resistance of 0.76 and a break will be a trigger to get long with an upside target of just 0.7750 (the top end of the range).

- Failure to break 0.76 should see a drop back towards the bottom end of the range of 0.7150

- Speculative futures positioning shows a clearing out of the longs; it also shows bullish divergence in that higher lows were made; thus a bullish bias can be justified.

Overall technical view: Bullish bias; trigger is a break of 0.76, add on a break of 0.7750

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.