by Eli Wright

The US dollar continues to struggle, but all three major Wall Street indices notched new record highs yesterday. Consequently, global equities continue to advance. Though safe-haven commodities including gold and silver have been shunted aside in favor of stocks, oil is slightly higher this morning.

Overnight in Asia the Nikkei jumped 1.81% to 19,402.39; the Hang Seng gained 1.41% to 23,374.17; and the Shanghai Composite closed up 0.31%, at 3,159.17.

In Europe, the FTSE is up 0.2%, to 7,178.75; the DAX is 0.5% higher, at 11,864.75; and the Stoxx 50 has ticked up 0.09%, to 3,327.

Though the Dow, which finally broke through the 20K benchmark at the open was the star yesterday, the S&P 500 and NASDAQ both reached all-time highs as well; the S&P rose 0.8% to 2,298.37, while the NASDAQ jumped 0.99% to 5,656.34. After its record-breaker open, the Dow, drove even higher to close up 0.78% at 20,068.51.

Yesterday's spirit of optimism—and perhaps even a bit of eurphoria—continued this morning in pre-market trading. The S&P is up 0.1%; the Dow is up 0.21%; and the NASDAQ is up 0.27%.

US Treasury yields continue to pop higher. The 2-year yield is 1.252%; the 10-year yield is 2.549%; and the 30-year yield is 3.128%.

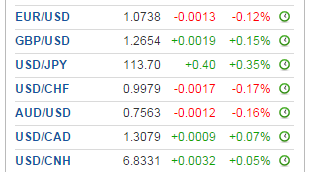

Forex

The Dollar Index has edged up 0.08% this morning, to 100.11, but it’s still hovering near the 100-99.5 tipping point in mixed trading against global major currencies.

Although Trump’s signals on increased infrastructure spending and his statements about lowering corporate and middle class taxes should be net positives for the US dollar, it's equities which have broken out over the past two days.

Kathy Lien offers two explanations on why the dollar hasn’t yet pushed higher. In short her view is:

- Trump is doing everything he can to talk the dollar down and keep it low in an effort to make American products more affordable overseas.

- FX traders worry that China could lash out at the new US administration and sell off their US Treasurys.

Sterling was the best-performing major currency yesterday, rising almost one percent. It's up an additional 0.15% today, driven by this morning’s better-than-expected Q4 GDP results. British PM Theresa May meets with President Trump tomorrow—the first world leader to do so since he's taken office—and traders are hoping the two will set the framework for a new US-UK trade agreement. Despite Trump’s protectionist agenda and the UK’s Brexit course, both countries stand to gain by working together and showing the world that they are not turning completely inward.

The Mexican peso gained two percent yesterday despite Trump's announcement that “the Secretary of Homeland Security, working with myself and my staff, will begin immediate construction of a border wall.” However, Mexican President Enrique Pena Nieto pushed back, issuing his own statement saying he regrets and rejects the US decision and that “Mexico will not pay for any wall.” The peso is currently trading at 21.1067.

Commodities

Oil prices have shrugged off yesterday’s EIA report, which showed that US stockpiles increased by 2.84M. Instead, traders today are focusing on the relatively low greenback, which drives up demand for the dollar-denominated commodity. Crude is up 0.7% this morning to $53.12 while Brent is up 0.96% to $55.61.

Demand for precious metals is slowing today; gold has fallen 0.1% to a two-week low of $1,196.65.

Gold miner ETFs have dipped as well: Direxion Daily Gold Miners Bull 3X (NYSE:NUGT) dropped 2.47% yesterday. It's down yet more, 3.46%, in pre-market trading; Direxion Daily Junior Gold Miners Bull 3X (NYSE:JNUG) is down 4.52%, but has climbed 0.2% in pre-market trading.

Silver is down 0.2%, at $16.947.

Copper is up 0.7% to $2.712, propelled by hopes of an infrastructure spending boom in the US.

Stocks

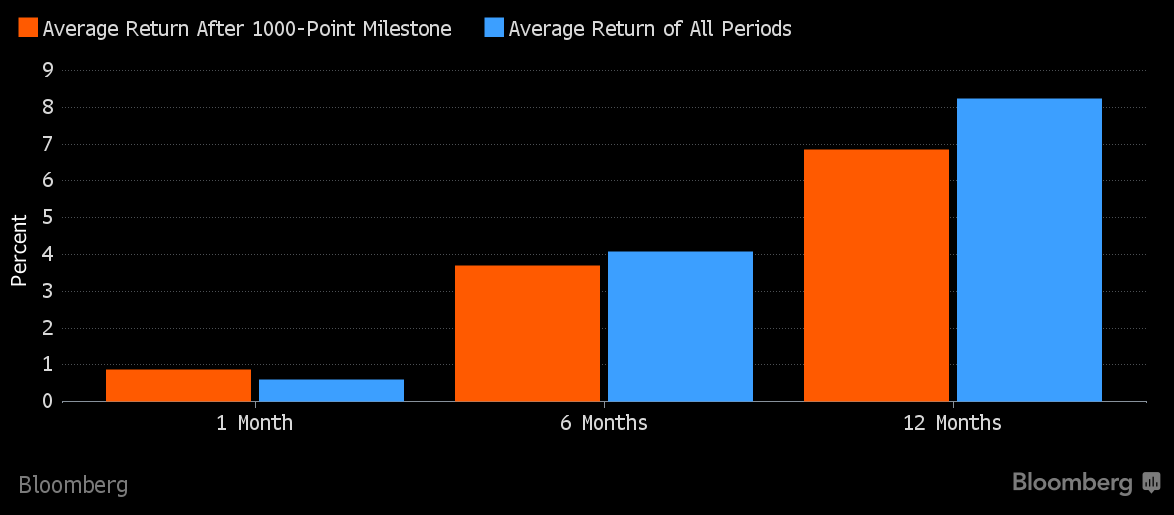

Yesterday's Dow record-breaker was the second-fastest 1,000-point move on record for the index. It only took 42 trading sessions for the Dow to travel from 19-20K. The quickest 1,000 jump happened shortly before the end of the dot-com bubble in 1999, when the Dow went from 10 to 11-thousand in just 24 sessions.

Source: MarketWatch

Though the Dow seems to have finally broken out of its seven-week range of consolidation, investors should be cautious about jumping on this new version of the Trump Rally hype train. Aside from concerns over inflated stock valuations, a study by Bloomberg showed that historically, the benefits to those chasing momentum after major 1,000 breakthroughs is only short term; after a month, performance starts to lag.

President Trump issued two executive orders yesterday to put into motion construction of a US-Mexico border wall, which he said would:

“save thousands of lives, millions of jobs and billions and billions of dollars.”

With cost estimates of said wall at approximately $15 billion, traders immediately began speculating about which stocks might win contracts and gain from the massive infrastructure project. Companies specializing in building materials—especially cement—all saw gains.

Among the strongest gainers: US Concrete (NASDAQ:USCR) jumped 4.39%; Martin Marietta Materials (NYSE:MLM) gained 3.2%; Vulcan Materials (NYSE:VMC) rose 2.21%; CRH (NYSE:CRH) finished the day 2.26% higher; and Forterra (NASDAQ:FRTA) edged up 1.19%.

Ironically, two Mexican-based cement manufactures also saw big gains. Cemex (NYSE:CX) rose 3.72% while Grupo Cementos De Chihuahua (MX:GCC) soared an incredible 30.43%.

Today is a very busy day on the earnings calendar. Companies reporting include:

- Tech titans Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), and Intel (NASDAQ:INTC)

- Biotech giants Celgene (NASDAQ:CELG) and Biogen (NASDAQ:BIIB), as well as pharmaceutical manufacturer Bristol-Myers Squibb (NYSE:BMY)

- Telecom conglomerates Comcast (NASDAQ:CMCSA) and Rogers Communications (NYSE:RCI)

- Luxury fashion brand Louis Vuitton (OTC:LVMUY)

- Coffee retail outlet Starbucks (NASDAQ:SBUX)

- Industrial equipment manufacturer Caterpillar (NYSE:CAT)

- Defense contractor Raytheon (NYSE:RTN)

- Automakers Ford (NYSE:F) and Fiat Chrysler (NYSE:FCAU)

- US based airlines Southwest (NYSE:LUV) and JetBlue (NASDAQ:JBLU)

- Oil and gas services company, Baker Hughes (NYSE:BHI)